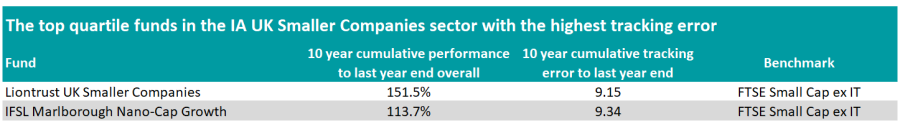

Two UK small-cap and three European smaller companies funds managed to deliver top quartile returns in the past 10 years by more or less ignoring their reference index and going their own way.

Research by Trustnet identified funds with a high tracking error that beat their benchmark and sit in the top quartile of either the IA UK Smaller Companies or the IA European Smaller Companies sectors. It should be noted that no fund in the IA North American Smaller Companies sector achieved this feat.

UK small-caps

In the UK, Liontrust UK Smaller Companies has been the best performing ‘rebel’ fund, returning 151.5% to investors over 10 years to 31 December 2023 and boasting a tracking error of 9.15.

The fund, managed by FE fundinfo Alpha Managers Anthony Cross and Julian Fosh, as well as Victoria Stevens, Matthew Tonge and Alex Wedge, follows a quality bias and typically holds between 50 and 60 stocks.

Analysts at Rayner Spencer Mills Research (RSMR) stressed that Liontrust UK Smaller Companies has a high active share and differentiates itself from its sector peers through its focus on intangible assets.

They added: “The fund tends to outperform in steady or falling markets and underperform in momentum-driven bullish markets, reflecting the make-up of the portfolio.

“The managers focus on businesses which they believe have distinct competitive advantages which will allow them to continue to grow. These are often structural growth stories in growing markets, however economic advantage can be found in both growth and value stocks.”

Source: FE Analytics

IFSL Marlborough Nano-Cap Growth is the other top quartile UK small-cap fund that deviated the most from its benchmark.

Managers Eustace Santa Barbara and Guy Feld invest in very small companies, with a market capitalisation of £200m or less at the time of the initial purchase. Investee companies should show either good long-term growth potential or appear undervalued relative to their future prospects.

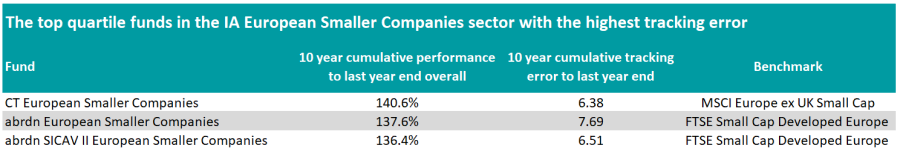

European small-caps

Two funds from abrdn – abrdn European Smaller Companies and abrdn SICAV II European Smaller Companies – match our criteria.

The former fund is managed by Andrew Paisley and Anjili Shah, who follow a quality, growth and momentum approach. They look for companies exhibiting a range of high quality characteristics that can deliver sustained long-term growth and positive earnings growth.

It is also the top quartile fund in the IA European Smaller Companies sector that has deviated the most from its benchmark over the past decade, with a tracking error of 7.69.

Source: FE Analytics

However, CT European Smaller Companies has been the best performer among the benchmark-agnostic funds, returning 136.1% to investors.

Manager Mine Tezgul typically holds fewer than 100 companies in the fund and also invests in businesses not included in the benchmark.

She seeks smaller companies that she believes have good prospects for share price growth across different sectors.

Tezgul aims to invest at least 50% of the fund in companies with strong environmental, social and governance (ESG) ratings. She also engages with investee companies to influence management teams to tackle material ESG risks and improve their ESG practices.