Veteran fund managers Nick Train and Terry Smith have appeared in Bestinvest’s ‘Spot the Dog’ report, which highlights funds that have underperformed a relevant benchmark by more than 5% for the past three years – as well as in each of the three years individually.

WS Lindsell Train UK Equity and Fundsmith Equity weren’t the only active funds that struggled, as the number of dog funds spotted this year has tripled since the last issue of the bi-annual report, going from 56 to 151.

This is attributed, among other things, to the rise of the ‘Magnificent Seven’ stocks which drove markets in the past year, making the fortune of passive funds and hindering active managers who don’t own them in bulk.

Lindsell Train’s is “a notable addition”, the report read. “Nick Train is arguably one of the best investors of his generation, but even he has been caught up in a market that hasn’t favoured his style of investing, which is focused on quality companies with strong brands.

“The fund has a strong skew to areas such as beverages, personal goods and financial services and has no exposure to energy [which soared in the period in analysis].”

Fundsmith Equity has been struggling with the unpopularity of its quality-growth style, but it also doesn’t own shares in companies that are highly sensitive to the ups and downs of the economic cycle, has no exposure to energy and isn’t heavily invested in technology companies, the report explained. Making up about a quarter of the portfolio, consumer staples and healthcare also had a tough year.

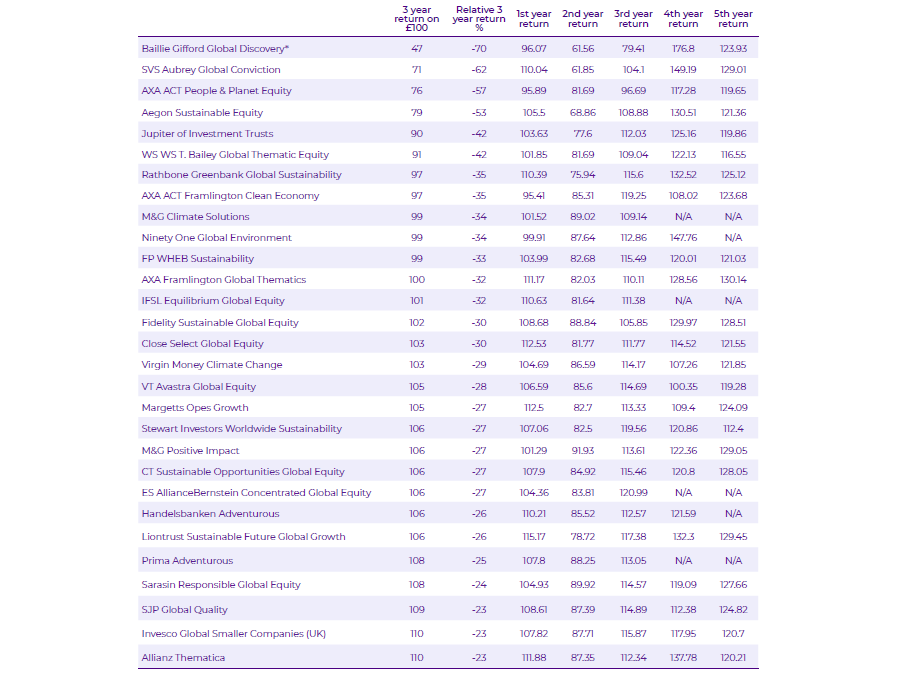

Very few of Smith’s IA Global fellow active managers have been successful at navigating the challenges of the harsher market environment, with an “astonishing” 49 funds making the dog list, representing £61.0bn (30%) of assets, compared to the previous 25 funds and £31bn in August 2023.

Suffering the most were those with a quality or sustainable focus. Funds investing in on smaller companies have also been left behind and the list is led by small-cap specialist Baillie Gifford Global Discovery.

IA Global funds in the Bestinvest dog house

Source: Evelyn Partners Investment Management Services Limited

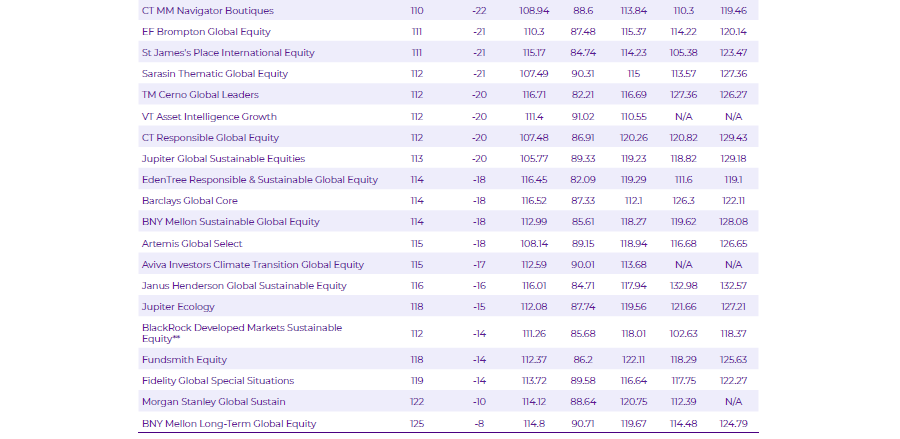

While Smith and Train are newcomers to the Bestinvest kennel other funds are becoming regulars. Columbia Threadneedle’s Sustainable Opportunities Global Equity, Responsible Global Equity and UK Sustainable Equity kept their place in the dog house from last year as sustainable funds suffered across the board.

Many of these sustainable funds don’t hold the fossil fuel companies that led markets higher in 2021-22, with10 of the 34 UK equity funds on the dog list investing with an environmental, social and governance (ESG) tilt.

UK All Companies funds in the Bestinvest dog house

Source: Evelyn Partners Investment Management Services Limited

Columbia Threadneedle has a total of nine dog funds for a combined £3.3bn in assets, beaten by St James’s Place whopping £18.5bn, distributed among the SJP Global Quality, St James’s Place International Equity and St James’s Global Emerging Markets funds. That’s an improvement from last year’s six, however.

Underperforming funds were also spotted in areas that have been in favour.

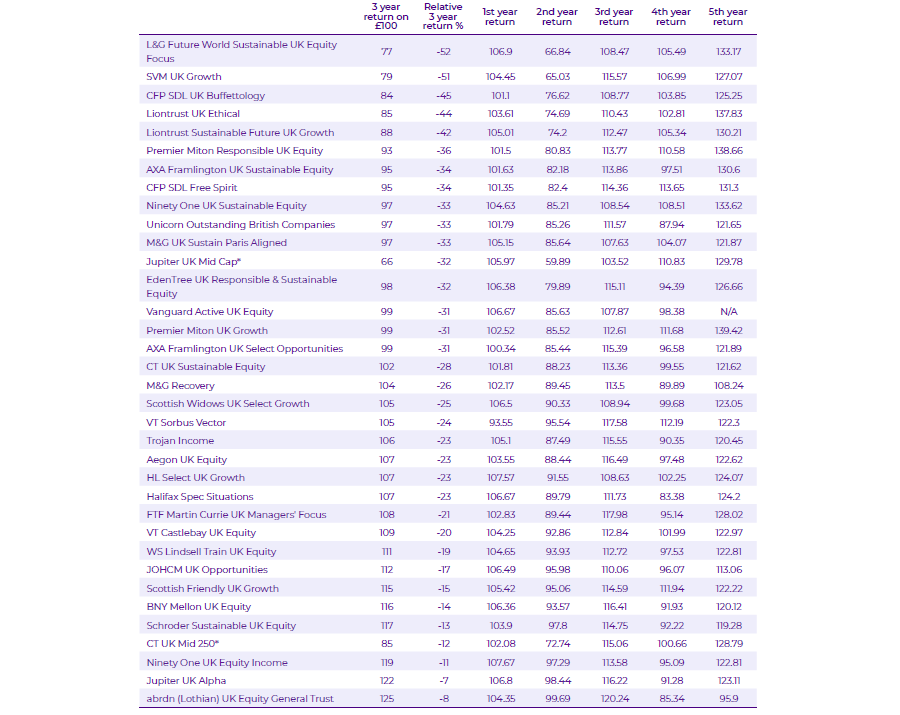

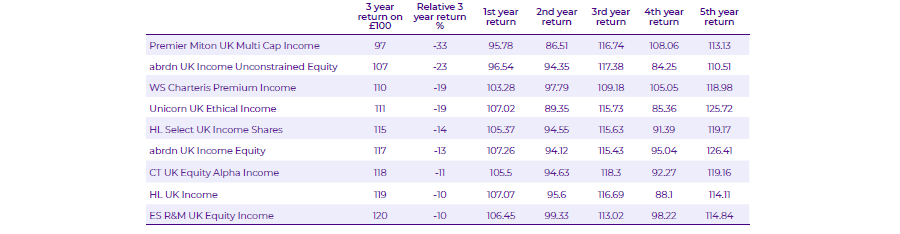

One of these was IA UK Equity Income, where higher inflation raised the appeal of owning a dividend-paying strategy. Only 13% of the whole sector is represented in the list below. Hargreaves Lansdown stands out with the with two funds listed: HL Select UK Income and HL UK Income.

UK Equity Income funds in the Bestinvest dog house

Source: Evelyn Partners Investment Management Services Limited

A few funds investing in North America disappointed as well, despite the market being hugely propped up by the Magnificent Seven. Five funds have been found barking, with VT Tyndall North American as the leader of the pack, but the largest dog with £878.8m in assets was CT American Select.

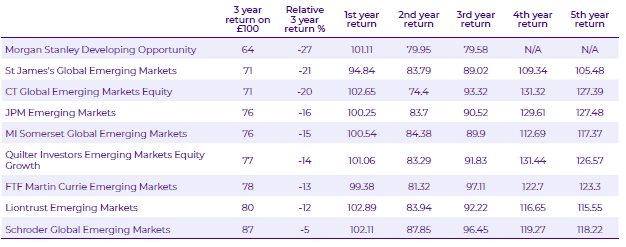

Emerging markets had relatively few dog funds. Last year, the sector only included MI Somerset Global Emerging Markets and St James’s Place Global Emerging Markets. While they still appear, the former is winding down and the latter changed manager. But the £2.1bn JP Morgan Emerging Markets fund was a notable addition, as it’s historically been one of the strongest in the sector.

Global Emerging Markets funds in the Bestinvest dog house

Source: Evelyn Partners Investment Management Services Limited

Finally, the IA UK Smaller Companies sector produced the fewest dogs – only two (WS Amati UK Listed Smaller Companies and Schroder UK Smaller Companies) out of the 43-strong universe.