Bestinvest has expelled Fundsmith Equity and Lindsell Train UK Equity from its Best Funds list, shortly after they appeared in its ‘Spot the Dog’ report for the first time.

The investment platform has introduced a new policy of kicking dog funds out of its Best Funds list to avoid confusing non-advised investors, said managing director Jason Hollands. “Being suspended from the list does not mean we advocate selling or switching these funds and is effectively a pause.”

This new policy led to the ejection of several well-known funds in the latest Best Funds report, including Baillie Gifford Global Discovery, Ninety One Global Environment, CT Responsible Global Equity, Liontrust UK Ethical and Premier Miton UK Growth.

Fundsmith Equity and Lindsell Train UK Equity’s investment processes “have delivered strong long-term returns”, Hollands conceded. They “remain unchanged but have lagged markets over the past few years for style reasons”.

If either fund escapes this summer’s Spot the Dog list, “we will likely reintroduce them to the Best Funds list if our research team continues to have confidence in the funds,” he added.

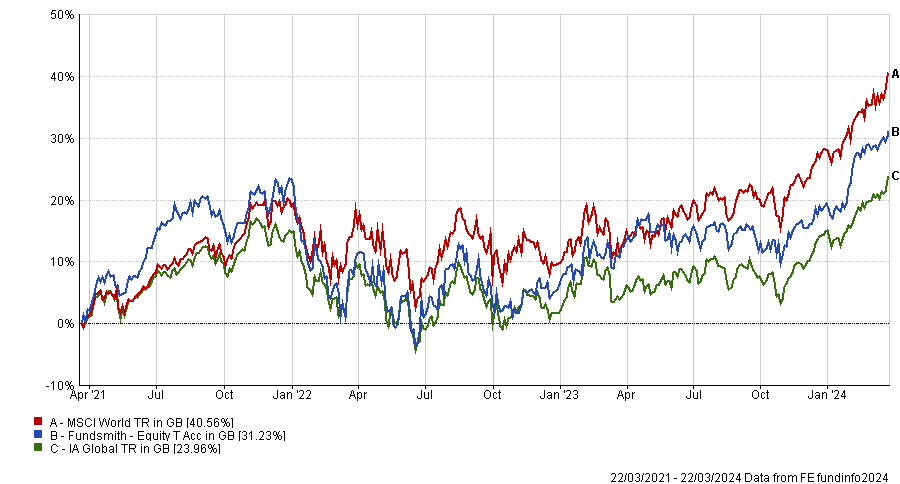

Terry Smith’s £25.6bn Fundsmith Equity flagship is not managed with reference to any benchmark but it has fallen behind the MSCI World index over three years, as the chart below shows, and has underperformed the index in each of the past three calendar years – the criteria required to become a ‘dog’ fund. However, it remains well ahead of its peers in the IA Global sector.

Performance of fund vs MSCI World and sector over 3yrs

Source: FE Analytics

Fundsmith’s quality-growth style struggled in 2022 as interest rates shot up. Then in 2023, when the ‘Magnificent Seven’ mega-cap technology stocks dominated US and global equity markets, Fundsmith Equity failed to keep up.

It currently holds two of the Magnificent Seven within its top 10 – Microsoft and Meta Platforms. Other large holdings are Novo Nordisk, L’Oreal and medical technology company Stryker.

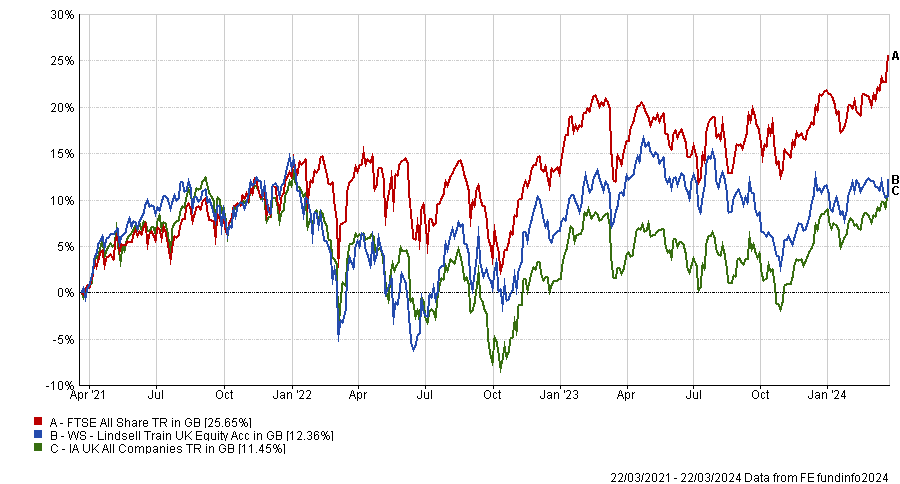

Meanwhile, Nick Train has apologised for poor performance and expressed his disappointment. The £3.8bn Lindsell Train UK Equity fund’s relative performance was hampered by a lack of exposure to oil and mining companies, while top 10 holdings Burberry and Diageo disappointed last year.

Performance of fund vs benchmark and sector over 3yrs

Source: FE Analytics

Style factors have hurt several of the other dog funds, with growth strategies in particular struggling in a rising rate environment.

Baillie Gifford Global Discovery focuses on smaller companies, which have trailed their larger brethren during the past couple of years.

It has also been a difficult period for sustainable investing, especially for renewable energy-related stocks. “Share prices in this part of the market soared during the pandemic and have had to make a painful adjustment ever since. At the same time, renewable energy companies have struggled with rising costs, which have forced them to shelve key projects,” Hollands said.

The Best Funds list is published twice a year and this time Bestinvest expelled 17 funds including Rathbone Ethical Bond, Aubrey Global Emerging Markets Opportunities, Findlay Park American, AXA Framlington UK Mid Cap, JPM Japan, Barings Europe Select Trust, iShares FTSE 250 ETF, HICL Infrastructure and SDCL Energy Efficiency Income.

Although Bestinvest has now established a clear link between its name-and-shame Spot the Dog list and its Best Funds universe, the criteria are very different.

Bestinvest chooses its favourite funds by looking for characteristics beyond performance, such as concentrated portfolios, long-term horizons, capacity constraints and clear objectives. Bestinvest prefers managers with long-term track records and skin in the game who pay attention to environmental, social and governance (ESG) criteria. They must not hug their benchmarks and should instead focus on growing wealth. Nowhere does it state performance is a factor for inclusion.

Using this checklist, Bestinvest has whittled the investment universe down to 122 funds, ETFs and investment trusts that it believes should beat their peers and benchmarks. The list includes 30 investment trusts, 30 passive strategies for cost-conscious investors and 16 sustainable investment strategies.

In today’s rebalance, Bestinvest added four actively-managed funds: JPM Global Macro Sustainable, Brown Advisory Global Leaders Sustainable, GQG Partners US Equity and NB Private Equity Partners.

Hollands described JPM Global Macro Sustainable Hedged as “an absolute return strategy that might suit investors wanting an ESG-tilted portfolio”. It is a rare find, given that sustainable absolute return funds are “relatively thin on the ground”.

The fund aims to deliver positive returns over cash in varying market environments through investments in sustainable equities and bonds, as well as currencies and gold, with derivatives also used where appropriate. It currently has 50% in fixed income, 37% in equities, 12% in cash and cash for margin calls and 1% in gold.

The $659m Brown Advisory Global Leaders Sustainable strategy joins its larger sibling, the $3bn Brown Advisory Global Leaders fund, in the Best Funds list. Co-managers Mick Dillon and Bertie Thomson look for high-quality companies that are leaders within their industry or country.

“It’s a fairly concentrated portfolio of 30-40 companies that the managers feel combine exceptional outcomes for their customers with strong leadership, so they can generate high and sustainable returns on invested capital. These are companies with strong economic moats and high free cash flow generation,” Hollands said. “The portfolio is very similar to the sister fund, but with negative screens applied to meet sustainability criteria.”

The $1.4bn GQG Partners US Equity fund is managed by three FE fundinfo Alpha Managers: Brain Kersmanc, Rajiv Jain and Sudarshan Murthy. GQG stands for global quality growth, which sums up their investment style, Hollands said.

“The aim of the fund is to outperform the S&P 500 across the cycle, but with lower volatility. The portfolio is focused on high-quality, large-cap US companies with durable earnings growth. It’s a fairly concentrated, high conviction portfolio, with no constraints on sector exposure,” Hollands explained.

NB Private Equity Partners, managed by Neuberger Berman (NB), focuses on companies that should benefit from long-term secular growth trends. Key sector exposures are technology, finance, business services, consumer and e-commerce. The private equity trust is tilted towards North America and is trading at a 25% discount to its net asset value.

“Long-term performance has been excellent,” Hollands said. “The underlying portfolio is relatively mature with the average holding having been backed for five years. The current portfolio consists of 87 companies, with NB typically co-investing alongside other private equity managers.”

Bestinvest also introduced four passive strategies to its best buy list: SPDR MSCI World Technology ETF, SPDR S&P 500 ETF, UBS FTSE RAFI Developed 1000 Index and Vanguard UK Short-Term Investment Grade Bond Index.