St James’s Place(SJP), one of the UK’s largest wealth managers, is responsible for 63% of the total dog fund assets in the latest Bestinvest’s Spot the Dog report. Six funds from SJP fell into the dog fund category, twice as many as any other individual fund group.

Three of those funds – the £11.5bn SJP Global Quality, the £7.5bn SJP Global Growth and the £7.1bn SJP International Equity – are to be found in the global sector, which has 24 dog funds overall and accounts for three-quarters of the total dog funds by asset.

Performance of funds over 3yrs against benchmark

Source: FE Analytics

Jason Hollands, managing director of Bestinvest, said: “St James’s Place outsources the management of its funds to external fund managers and charges a premium for doing so. The annual costs on the two largest global funds are 1.88%. Only one fund in the sector has higher costs. One of the advantages of this approach is that the group should be able to swap out underperforming managers.

“The group rejigged the line-up on all three of the global funds in July last year to address underperformance. The switch has not yet had a discernible impact on these delinquent doggies.”

The three other dog funds from SJP are to the £1.9bn SJP Greater European Progressive, the £866m SJP Global Emerging Markets and the £541m SJP Continental European.

Performance of funds over 3yrs against benchmarks

Source: FE Analytics

SJP currently has £29.3bn across these six funds or 63% of the total dog fund assets in this edition of the Spot the Dog report.

To calculate dogs, Bestinvest looks at funds that have failed to beat an appropriate benchmark and have done so by 5 percentage points or more over the entire period, as well as failing to beat the index over the past three discrete 12-month periods.

The next largest contributor was Artemis, but the fund group only accounts for 5.8% of dog fund assets. This is due in particular to its two US funds – Artemis US Select and Artemis US Smaller Companies.

Hollands said: “The US team lost its talented long/short manager Stephen Moore in 2019 but has recently boosted its numbers with former Majedie US duo Adrian Brass and James Dudgeon.

“The problems appear idiosyncratic and down to a few difficult stock decisions – notably an underweight in Apple, Nvidia and Tesla, plus a holding in now defunct First Republic Bank.”

Performance of funds over 3yrs against sectors and benchmarks

Source: FE Analytics

The Artemis Global Select fund is also on the list. Simon Edelsten, who has managed the fund since 2011, will leave at the end of the year, while his co-manager Alex Illingworth has already left. Their successor Alex Stanic, who joined from JP Morgan in March, is already working on the portfolio.

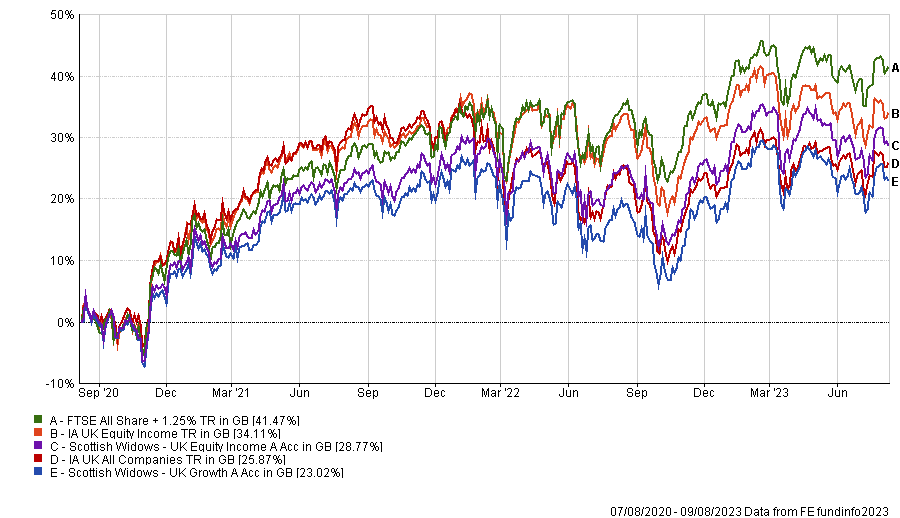

Scottish Widows contributed to £2.1bn of total dog fund assets, with two funds featuring on the list – Scottish Widows UK Growth and Scottish Widows UK Equity Income.

Hollands said: “Seasoned dog fans will have seen regular appearances from the HBOS and Scottish Widows funds, both of which are part of Lloyds Bank and now managed under contract by Schroders.

“However, in this latest report, there were just two funds from these brands on the list – the Scottish Widows UK Growth and UK Equity Income funds. While this still accounts for £2.1bn in assets, it feels like progress.”

Performance of funds over 3yrs against sectors and benchmark

Source: FE Analytics

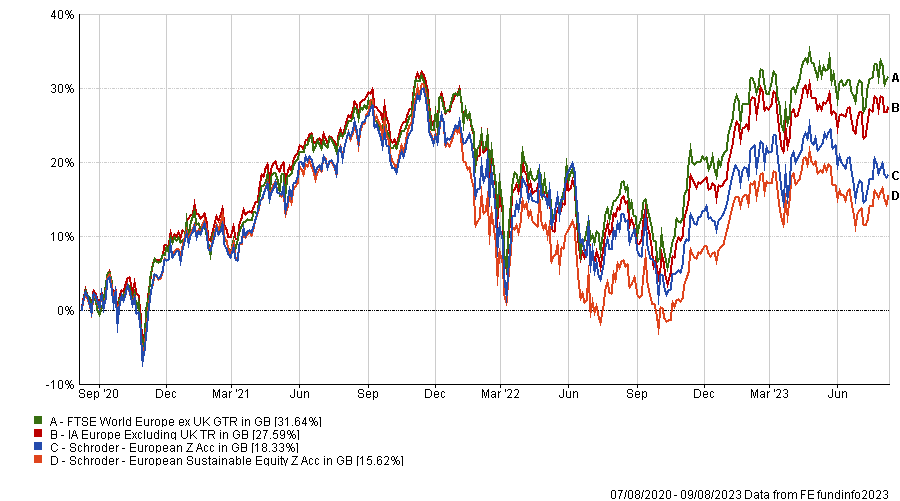

Schroders had some issues in its own-brand fund range with two dog funds in its European franchise – Schroder European and Schroder European Sustainable Equity. Yet, Schroder European Alpha Plus has fallen off the list this time around.

Performance of funds over 3yrs against sectors and benchmark

Source: FE Analytics

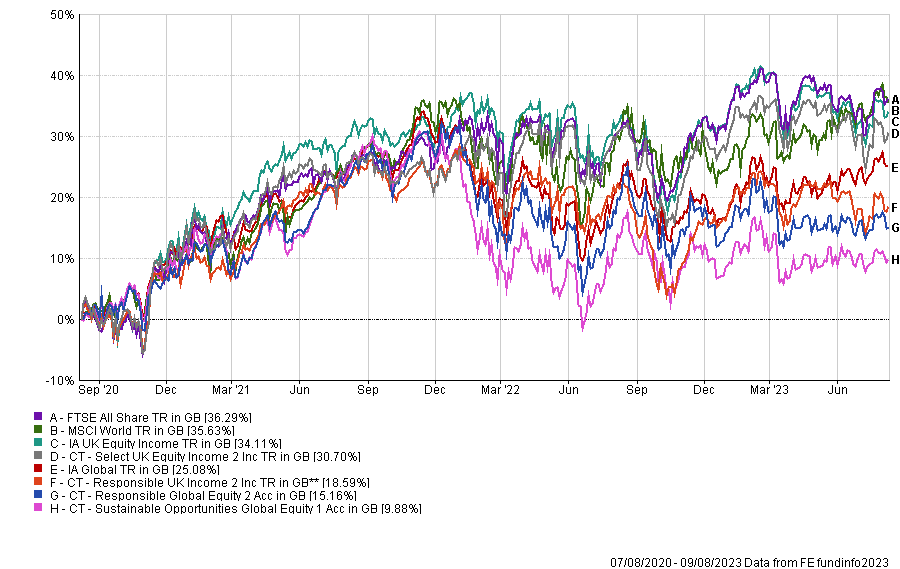

Columbia Threadneedle has four funds on this year’s list, worth £1.9bn – CT Responsible Global Equity, CT Responsible UK Income, CT Sustainable Opportunities Global Equity and CT Select UK Equity Income.

Those funds were inherited from BMO Global Asset Management (GAM) when Columbia Threadneedle took over its EMEA business in 2021.

Performance of funds over 3yrs against sectors and benchmark

Source: FE Analytics

Hollands said: “It is worth noting that responsible and sustainable strategies had a tougher time in 2022 as fossil fuel prices soared.”

Abrdn accounts for £1.7bn of total dog fund assets, but the number of its funds on the list went down from three to two since the previous survey.

One of them is the £1.1bn abrdn UK Smaller Companies fund, whose long-standing manager Harry Nimmo left at the end of December. The fund is now managed by FE fundinfo Alpha Manager Abby Glennie, while the process has remained unchanged.

Hollands said that the problem is more likely to be the group’s quality style, which has been out of favour. The other dog fund from the group is abrdn UK Income Equity.

Performance of funds over 3yrs against sectors and benchmarks

Source: FE Analytics

Boutique fund houses also had a difficult time in recent years. For instance, TM CRUX’s European and European Special Situations as well as Sarasin’s Responsible Global Equity and Thematic Global Equity are all on the dog fund list.

Other boutique dog funds this year include LF Lindsell Train North American Equity, MI Somerset Capital Global Emerging Markets, Trojan Income and Unicorn Outstanding British Companies.

Hollands said: “Investors turn to boutiques for specialist expertise and strong performance, so this will be disappointing. The arguments for boutiques still stand. They tend to live or die by their performance and may work that bit harder to put it right.

“However, the structure is not a panacea and investors need to ensure their boutique managers aren’t running the company to the detriment of the fund.”

In total, Bestinvest identified 56 dog funds, which is up from 44 in its January 2023 report. Notable exits from the list include Fidelity American and Invesco UK Equity High Income.

Hollands noted that BNY Mellon and M&G dodged the list entirely, while Baillie Gifford has just one fund on the list – Baillie Gifford Global Discovery – although its investing style has been out of favour.

Hollands also highlighted that some sectors have very few dog funds.

He said: “Japan, smaller companies and emerging markets have just one or two dogs, showing that active fund managers will often do best in the less-researched parts of the market.

“There were also no global equity income funds on the list this year, as dividend investing has revived. Pawfect.”