Two of the £674m Temple Bar Investment Trust’s portfolio companies have been subject to takeover bids in the past two weeks. This is symptomatic of the UK stock market’s “ludicrous valuations”, according to Ian Lance, who runs the trust and is a fund manager in Redwheel’s value and income team.

Redwheel owns 15% of Currys, which last week received an unsolicited £760m bid from Elliott Advisors that Lance believes “woefully undervalues” the company. Then on Wednesday 28 February, Direct Line announced a £3.1bn takeover bid from Belgian insurer Ageas, representing a 43% premium. Both boards rejected the offers.

Here Lance tells Trustnet which other companies might be the next targets of a bidding frenzy, how he was “lucky” with the timing of taking over the trust and how he recently bought one of the cheapest stocks of his career.

What is your investment process?

We are value investors so we compare the intrinsic value – what we think a business is worth – to the share price. If the share price is about half of the intrinsic value then it’s an attractive stock to us. But corporate buyers can see the undervaluation too and come in and take it off us.

Richard Oldfield (founder of value manager Oldfield Partners) wrote a book on value investing called ‘Simple but not easy’. You only get to buy something cheaply when there is controversy, when management has been fired or if it’s a cyclical business during a recession. That’s the part that’s not easy. It requires a contrarian bent.

It’s even harder when you’re running other people’s money – when you go in and put your top 10 stocks in front of them and they say, ‘are you mad?’

Why is there so much interest from overseas buyers in British companies?

The UK stock market is lowly valued and the pound is cheap so if you’re an overseas buyer, you’re buying a cheap company in a cheap currency. The UK is trading at a 40% discount to global equities.

Do you expect any other companies in your portfolio to get approached?

ITV is an obvious takeover target. It runs the second largest studios business in the world and more than 50% of its profits come from outside the UK.

Netflix spends more than $15bn a year on programming whereas ITV’s market capitalisation is only £2bn so Netflix could have ITV’s entire back catalogue for a fraction of what they spend on programming.

Standard Chartered is often subject to bid rumours. If a big US bank wanted to have a footprint across Asian markets, they could buy Standard Chartered and even its chief executive officer (CEO) admits that its share price has been crap.

Another obvious target is Royal Mail, which has changed its name to International Distributions Services (IDS). It has two businesses, the first involves delivering letters in the UK and the second is its European parcels business, GLS. This is a growing business benefitting from online shopping and it’s worth £3.50 per share on its own. The share price for the whole of IDS is £2.43 which means that the UK letters business is negatively valued.

IDS has a consolidated shareholder list which means a potential buyer would only have to negotiate with a handful of people. Daniel Kretinsky, a billionaire known as the ‘Czech Sphinx’, owns 25% of IDS through his family office Vesa Equity Investment. We own 10% and Schroders owns it too.

What has been your best performing stock recently?

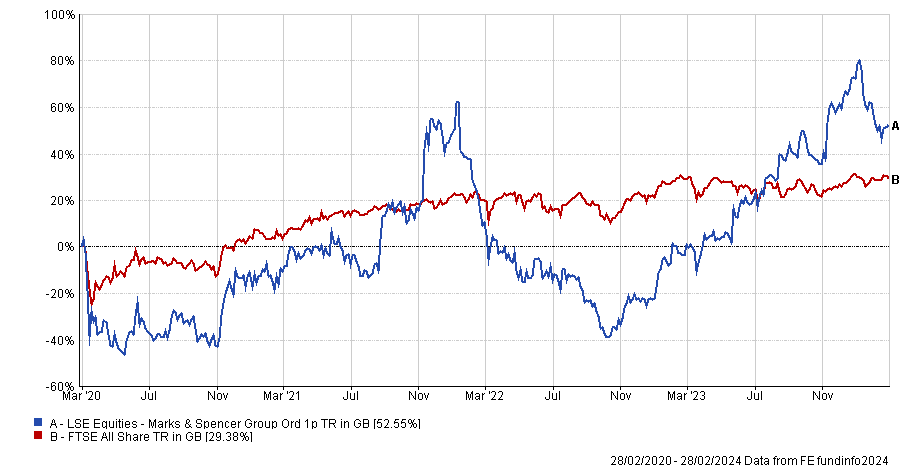

Marks & Spencer, which went up 121.8% last year. Chairman Archie Norman is extremely capable. He identified problems such as a lack of online presence and fixed them. M&S has revamped its store portfolio so the old-fashioned décor has gone.

During the pandemic, M&S’ share price fell to £1 because people were worried about short-term news and store closures. We thought it could get back to earnings per share (EPS) of 25p which on 12x earnings equates to a share price of £3. We were big buyers of M&S in the pandemic.

We still own it. We think it could do 30p EPS quite easily and the share price might be worth £3.50-£3.60 so it’s still cheap (it was £2.37 on 29 February 2024). We have taken profits because it became a big position in the portfolio.

Performance of M&S versus FTSE All Share over 4yrs

Source: FE Analytics

Another successful investment is Stellantis, an automotive company headquartered in Amsterdam that owns a range of car brands including Chrysler and Maserati (30% of the trust’s portfolio can be invested outside the UK).

We bought it a year ago on a price to earnings (P/E) ratio of 3x. It was one of the cheapest companies we have ever bought. It had a lot of cash on its balance sheet and was paying a 9% dividend with a free cash flow yield of 23%. The management team plans to double revenues by 2030.

Why was it so cheap?

Parts of the stock market are completely ignored. People just put a line through autos, airlines, banks and energy companies because they have a yuck factor. With banks, people are still fighting the last war. Before the financial crisis, banks were too highly geared and had terrible loan books but banks have spent a decade getting their balance sheets in order and they are completely different businesses now.

The poor CEOs are sitting there with the heads in their hands. Business is going really well but the share price is at a 10-year low. We say to them ‘it’s not your fault, the market is at a 10-year low’. We encourage them to buy back their own stock.

We own Natwest, Barclays and Standard Chartered. Natwest and Barclays are both trading on 5x P/E and their 2023 dividend yields were 7.5% and 5.3%, respectively. Natwest is trading on half of its book value. It’s just extraordinary. These are some of the lowest valuations my co-manager Nick Purves and I have seen in our 30-year careers.

What has been your worst investment recently?

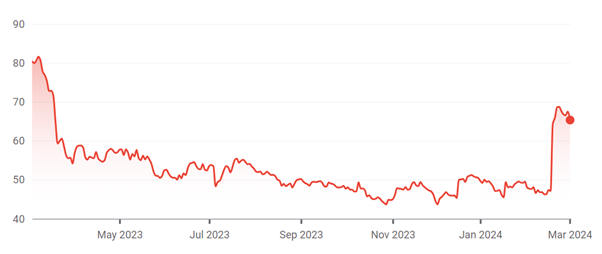

Currys was our worst performing stock until a week ago when it received an unsolicited bid from Elliott Advisors.

Currys is the leading electrical retailer in the Nordics but it is facing intense competition there and has lost market share so its share price has fallen. Of course, just as it starts to turn around, over the hill comes dear old Elliott.

Currys probably will get taken over. It has had other offers and it is trading on a low valuation.

Share price of Currys over 1yr

Source: Google Finance

How long have you been managing Temple Bar?

We won the Temple Bar mandate in 2020 and took over the trust that October after using a transition manager over the summer. We bought all the cyclical stocks the market hated. Then Pfizer made their vaccine announcement in November 2020 so from a timing perspective we were extraordinarily lucky.

Performance of trust vs sector and benchmark since 31 Oct 2020

Source: FE Analytics

What do you do outside of fund management?

I enjoy open water swimming and reading my collection of investment books, which is pretty extensive and runs into the hundreds.