Liontrust Asset Management’s James de Uphaugh, who manages the £1.2bn Edinburgh Investment Trust and the £366m Liontrust UK Equity fund, is to retire in February bringing an end to a 36-year career.

The FE fundinfo Alpha Manager joined Liontrust in April 2022 when it acquired UK equity boutique Majedie Asset Management, which he co-founded with Chris Field, who is to retire next month.

Imran Sattar will replace de Uphaugh as head of the Liontrust global fundamental team and as lead manager of the Edinburgh Investment Trust when he leaves in February. Before that, Sattar will take over from Field as the trust’s deputy manager.

Sattar has been part of the Liontrust global fundamental team since 2018, first at Majedie and then at Liontrust. He was previously a fund manager at BlackRock, where he ran UK equity funds with more than £2bn in combined assets.

Sattar is already lead manager of the £19m Liontrust UK Focus fund and he will become the sole manager of Liontrust UK Equity on 10 November.

Field and de Uphaugh have managed the Edinburgh Investment Trust together since March 2020, when they took over from Invesco’s Mark Barnett after a period of underperformance.

At the time, the trust was trading on an 11% discount to net asset value (NAV) and its performance was trailing its benchmark and its peers.

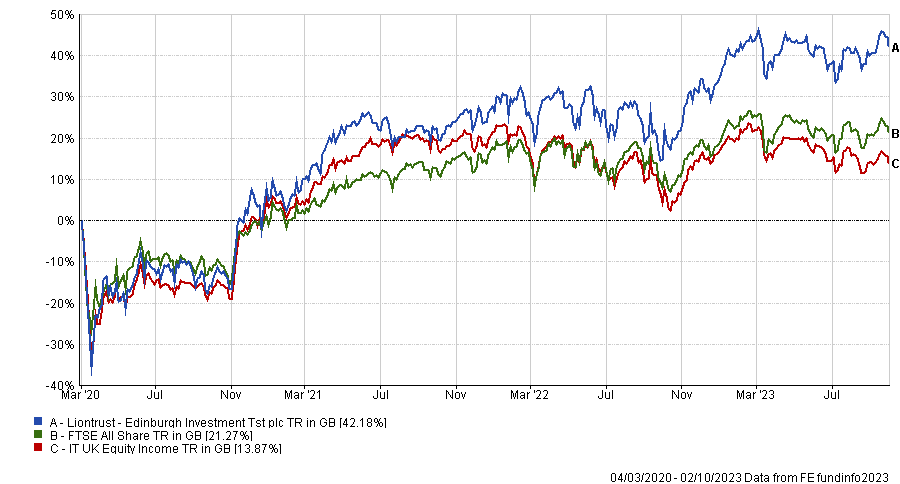

Since then, de Uphaugh has turned the trust’s fortunes around. It has made 42.2%, the second highest return in the IT UK Equity Income sector and more than double the FTSE All Share. Its discount has narrowed slightly to 10.1%.

Performance of fund vs sector and benchmark since manager start

Source: FE Analytics

Gavin Trodd and Ewan Lovett-Turner, research analysts at Numis Securities, said the news was “not a huge surprise” and said that incoming manager Sattar “has a much lower profile” than his predecessor. The investment policy and key features of the approach will remain the same, but they will wait to see “if there are any subtle changes” under the new management.

“The further change in manager a few years after appointment is further disruption that may not be welcomed by some investors and is unlikely to help the discount narrow, which is amongst the widest in the UK equity income peer group,” they added.

It is part of an ongoing trend in the investment trust world, with other high profile managers such as John Bennett (Henderson European Focus) and Bruce Stout (Murray International) also recently announcing they are hanging up their boots.