Investment trust buyers are bullish about global stock markets, even as US and Japanese equities hit new highs, according to a survey by Winterflood.

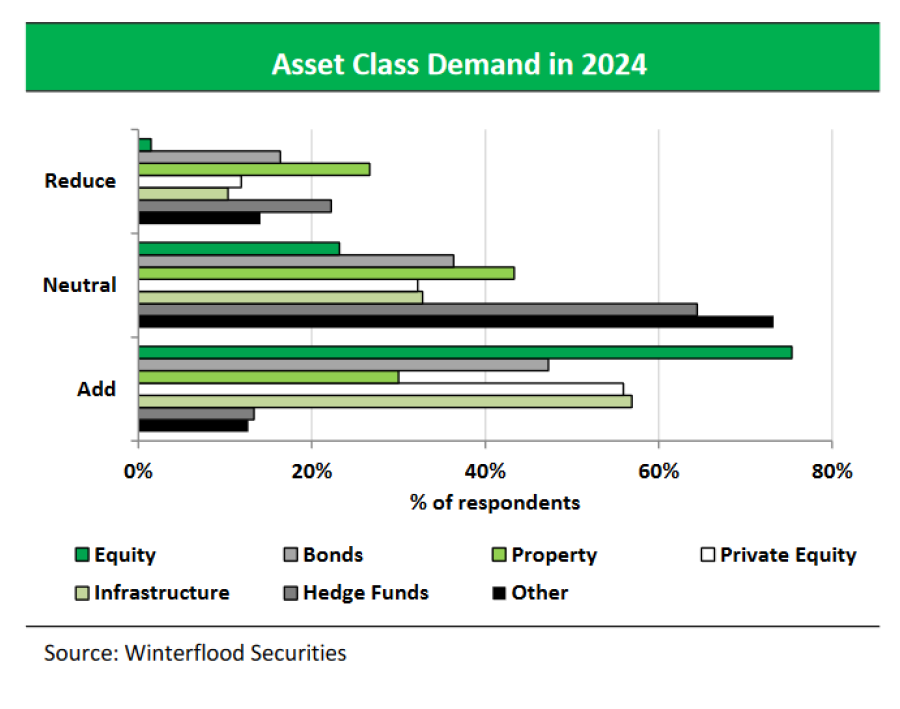

Three quarters of the respondents – which include wealth managers, investment trust directors and institutional investors – indicated their intention to top up their equity exposure this year.

This is, however, slightly below last year’s figure, when 82% of investors were positive on the asset class, but in line with trends observed in 2022, 2021 and 2020. More investors are also ‘neutral’ on equities this year than at the beginning of 2023, but only 1% are looking to reduce their exposure.

Half of the respondents intend to increase their fixed income allocations, but investors are slightly less bullish on bonds than they were this time last year, with 47% planning to add to their exposure compared to 53% in 2023.

Moreover, the number of investors looking to reduce their bond exposure also increased year-on-year with 16% highlighting their intention to do so compared to 7% in 2023.

To put this into context, appetite for bonds is significantly higher than in 2022, when yields were much lower and only 5% of investment trust investors were intending to top up their exposure.

One investment advisor who intends to reduce their bond exposure explained that “we may have to wait longer for interest rate cuts, but they will happen eventually as the economy slows”.

Instead, this advisor is looking to increase exposure to private equity and infrastructure, in addition to equities.

Private equity and infrastructure are popular this year with investors, as 56% of the respondents expect to add to private equity and 57% to infrastructure, with one wealth manager specifically mentioning renewable energy infrastructure.

On the contrary, property has fallen out of favour, with only 30% of the respondents indicating an interest in adding to the asset class, while 43% are neutral and 27% are planning to reduce their allocation.

Investing in illiquid assets is not the main draw

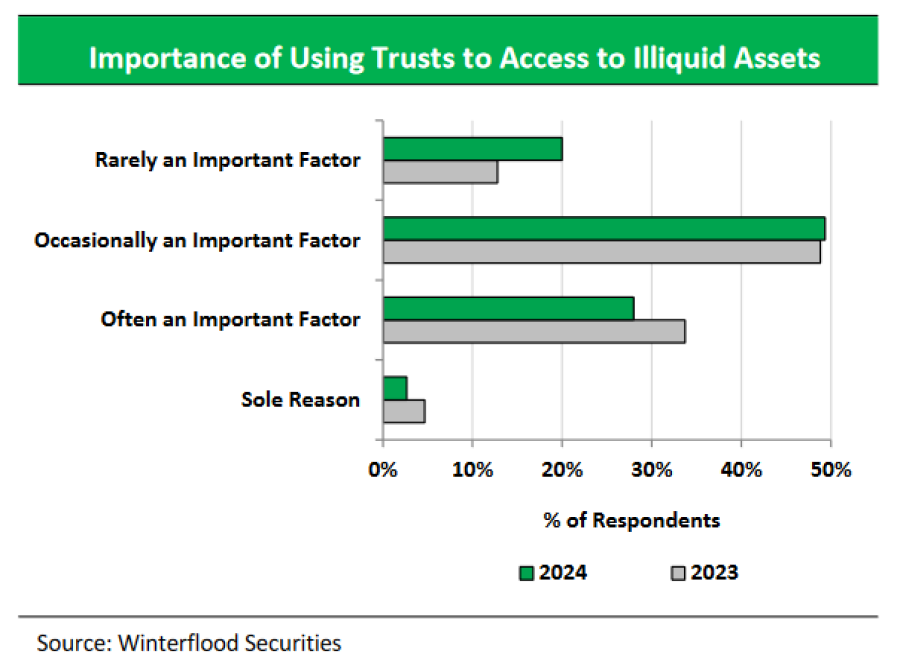

Surprisingly, the survey found that only 3% of respondents use investment trusts solely to access illiquid assets, with 20% of investors stating that it was rarely an important factor in their decision to use closed-ended funds.

For instance, a wealth manager said they decide whether to invest in a closed-end fund based on the question: “is an investment trust the best way to get access to that asset class and/or that manager and/or that portfolio in 2024?”.

Emma Bird, head of investment trusts research at Winterflood, said: “We have long stressed the importance of accessing illiquid assets via an appropriate fund structure. In our view, the closed-ended nature of investment companies is ideally suitable for these asset classes, as although discounts may widen during periods of market volatility, investors are always able to exit their holding if they wish.

“However, it is equally encouraging that investors appear to continue to recognise the other benefits of the investment trust structure.”

These findings come as the question of how retail investors should best access long-term, illiquid assets is under scrutiny. Several open-ended property funds have announced suspensions or intentions to close, acknowledging the mismatch between offering investors daily liquidity whilst holding illiquid buildings. Meanwhile, the Financial Conduct Authority launched the the Long-Term Asset Fund (LTAFs) category last year to simplify access to illiquid assets.

Fewer investors are willing to buy trusts trading on a premium

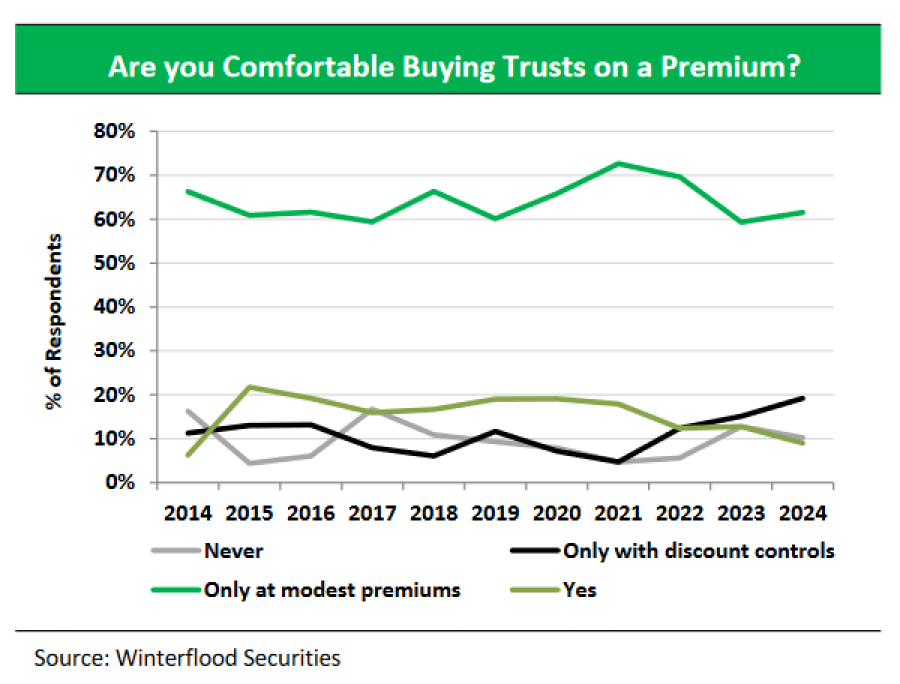

While almost all (91%) of investors were willing to buy shares in an investment company trading on a premium in 2021, this figure has fallen to 71% this year – in line with last year’s survey.

Moreover, 62% of those comfortable buying trusts on a premium would only do so if the premium was ‘modest’. One institutional investor said they would also need “active share buybacks at a price that is not too far from the net asset value”.

Other respondents said they would buy a trust at modest premium “in the right market environment”, while others would be happy to pay up “where justified by performance/outlook”.

However, 10% of respondents would never be comfortable buying trusts at a premium, with one investor believing that a “premium tends to be a better sell than buy signal”.

ESG is just one of many considerations

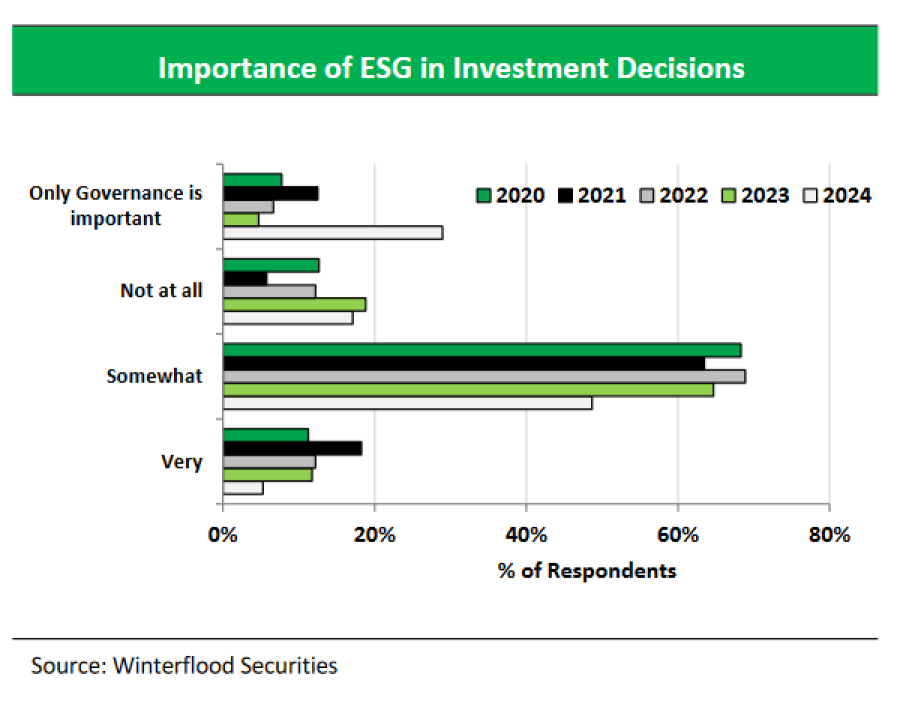

While environmental, social and governance (ESG) factors have become an increasingly popular conversation topic, they are just “one of many considerations in the investment process” for many investment trust investors. In fact, only 5% of respondents consider them as ‘very important’, which is down from 18% in 2021.

Fewer investors see ESG factors as ‘somewhat important’, with the number falling from 65% in 2023 to 49% this year.

However, the number of respondents for whom ESG factors are ‘not at all’ important fell slightly year-on-year, from 19% to 17%.