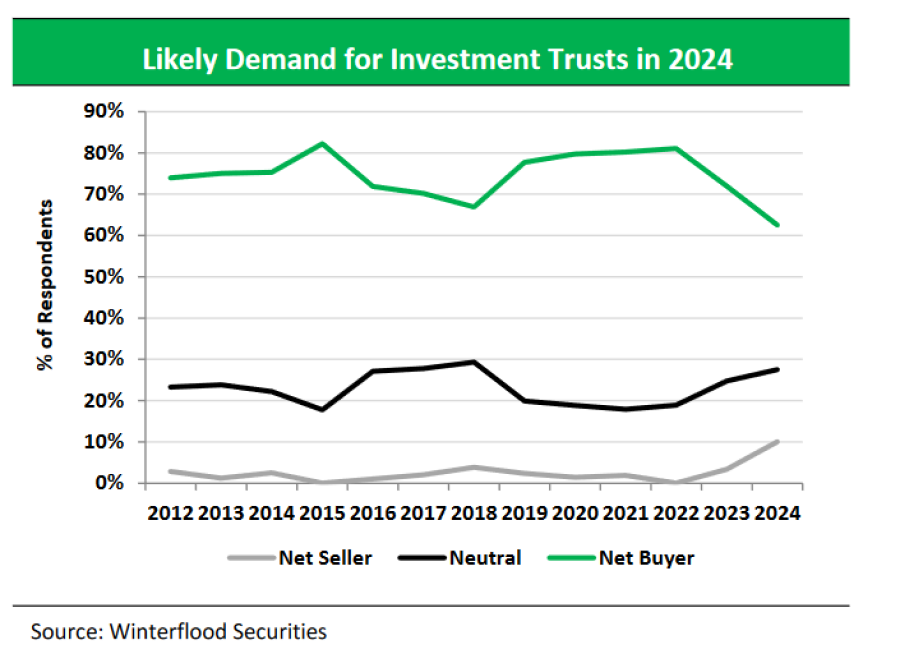

This may turn out to be a difficult year for the investment trust industry, as the number of investors who expect to be net sellers of investment trusts has increased to 10% from 3% in 2023, according to Winterflood.

In fact, this is the highest level on record since Winterflood launched its annual industry survey in 2012.

The majority of wealth managers and investors participating in the survey expect to be net buyers of investment trusts this year but even so, the proportion of buyers has fallen significantly. Only 63% of respondents will channel more money into investment companies during 2024, compared to 72% in 2023 and circa 80% in the 2020 to 2022 period.

Many investment trusts are trading at wide discounts to their net asset values, which sellers cited as a source of concern, but buyers perceive as an opportunity. One buyer also said that a fall in interest rates could drive a positive re-rating for the investment trust sector.

On the other hand, the state of the UK equity market is troubling investors (given that investment trusts are UK-listed vehicles).

An investment trust director responding to the survey stated: “The UK equity sector remains unloved, and unless and until the attempts by the Investment Association and others to re-energise it works, I anticipate continuing to see net selling of such assets.”

However, several investors who were net sellers in 2023 said an improvement in performance and liquidity could change their mind.

Small is not beautiful

Winterflood’s survey also revealed that fewer investors are willing to put money in trusts with market caps below £200m. While 99% were ready to do so in 2013, the figure has fallen to 62% this year.

The minimum size of trusts in which wealth managers can invest is often decided centrally, with a market cap of £200-£300m being an internal rule or a decision from their research department.

Emma Bird, head of investment trusts research at Winterflood Securities, stated: “A fund’s size is a blunt proxy for how it might trade in the secondary market. However, the general trend is a preference for bigger funds, which is driven, in our opinion, by the growth in the largest wealth managers and consolidation within this industry, exemplified by last year’s merger between Rathbones and Investec Wealth & Investment UK.”

She also highlighted that a larger market cap is beneficial in terms of lower costs, tighter spreads and a higher profile, which in turn can attract a greater retail following.

There has been a drought of initial public offerings (IPOs) in the investment trust sector in recent years. For instance, Ashoka WhiteOak Emerging Markets was the only investment trust to list in 2023, while there were no listings at all in 2022.

However, investment trust investors seem content with the current offerings, as only 5% of respondents said they were ‘very likely’ to support investment trust IPOs this year, while 64% stated they were ‘not very likely’ to do so.

Those who were ‘not very likely’ to support issuance this year attributed their reluctance to the wide discounts across the investment trust universe, as they would prefer to buy existing trusts at a discount, rather than investing an IPO.

Other respondents prefer to be selective about which IPOs they support. For example, one manager would not invest in a new listing unless there were clear disclosures on factors such as discounts and continuation.

A smaller manager that typically deals in secondaries said they would consider a trust at IPO if there was a “carrot”, while another stressed they were never very keen as new launches “always move to a discount”.

Cost disclosures

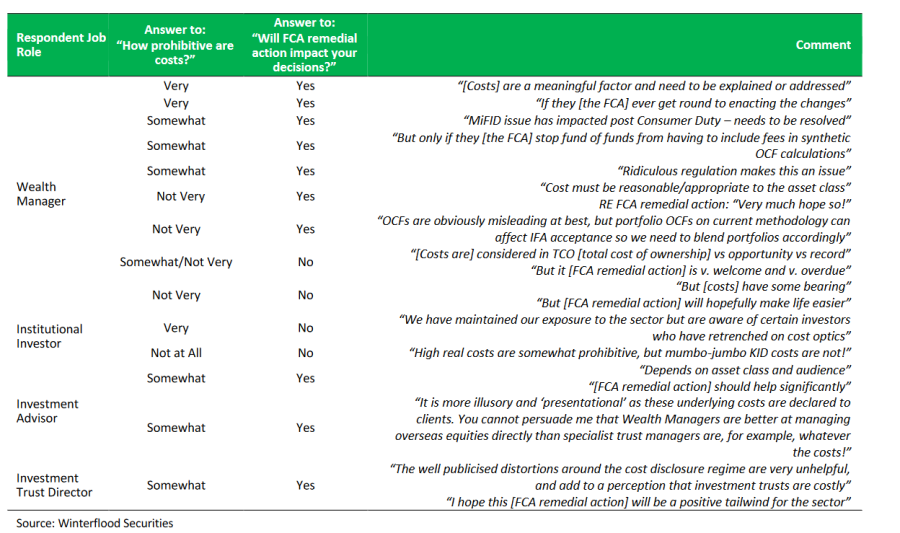

Winterflood was surprised to discover that over half of respondents find the costs of investment trusts ‘not very’ or ‘not at all’ prohibitive, while 36% opted for ‘somewhat’ and 13% for ‘very prohibitive’.

On the question of whether the remedial action on cost disclosure rules proposed by the Financial Conduct Authority would impact their investment decisions, 48% said yes, while 52% answered negatively. The regulator introduced those temporary measures late last year to enable investment companies to explain their costs and charges to help consumers make better informed investment decisions.

Bird added: “Despite this reasonably balanced result suggesting that costs may not be as much of an issue as we thought, this question prompted a significant number of comments, implying that it is a key area of focus.”

One wealth manager caveated their net buyer stance with “possibly – if we see better board/shareholder disclosure and removal from cost disclosure”.

Board games

Finally, the number of respondents who believe that independent boards provide a ‘considerable’ benefit fell from 60% in 2023 to 49% this year, while 12% see the benefit of boards as ‘limited’. No respondents saw zero benefit in independent boards.

Almost all of those surveyed (88%) concluded that independent boards bring either ‘some’ or ‘considerable’ benefit to the trusts they oversee, which is in line with the 89% figure from last year.

A former non-executive director stated that investors “buy for the manager, not the board” and that the role of the board is to “limit activity, primarily, to ensuring no style shift”.

A range of comments accompanying this question emphasised the need for directors to have relevant experience, but others stressed that the quality of boards varies.

Some respondents highlighted the importance of independent boards in difficult situations, while one individual believes investment trusts would be “uninvestable as a listed company” without independent boards.