For investors who are comfortable taking some risk and thinking beyond core asset classes, emerging market debt offers compelling returns as well as diversification.

As such, fund managers outlined six reasons why financial advisers and investors should consider investing in the asset class this year.

Reason 1: Strong performance is expected this year

The first reason to consider investing in emerging market debt is performance. Marcelo Assalin, head of emerging market debt at William Blair, forecasts the asset class to return about 8-10% this year. He expects 2024 to be less volatile than 2023, with a more benign global macro backdrop and solid emerging market credit fundamentals.

Ed Harrold, fixed income investment director at Capital Group, said with the benefit of an 8% yield, returns of around 10% would not be an unrealistic expectation.

Reason 2. Valuations look attractive

Broadly speaking, emerging market debt valuations look compelling from a risk/reward perspective, Assalin said. “We believe valuations continue to overcompensate investors for credit risks, currency and local rate risks, and volatility,” he explained.

“Emerging market debt credit spreads appear compelling on both an absolute and relative basis, with current levels remaining wider than their historical levels. While emerging market sovereign high-grade credit spreads appear unattractive, high yield credit spreads appear compelling, particularly relative to US corporate high yield.

“In the distressed credit space, we believe current prices continue to overestimate the probability of credit default and underestimate potential restructuring and recovery values.”

Reason 3: Emerging markets are further along in the monetary cycle

Central banks in many emerging market countries were proactive in late 2021 and 2022 about raising rates to control inflation, which started to fall sooner and faster than in the US and Europe.

This enabled them to start cutting rates earlier to support economic growth. Brazil, for instance, announced its first rate cut in three years on 2 August 2023.

Reason 4: Local currency debt should benefit from dollar weakness

Mary Thérèse Barton, head of fixed income at Pictet Asset Management, expects local currency emerging market debt to return in the high single to low double digits this year depending on dollar weakness, with currency delivering an “added kicker”. Pictet is overweight emerging market currencies versus the dollar, which she described as overvalued.

Reason 5: Diversification

Emerging market debt is a powerful diversifier because of the different rate cycles, economies and investor bases, Harrold argued.

The local currency bond markets in China and Indonesia have strong domestic institutional investor bases, including pension funds, banks and insurers, who own a significant percentage of their domestic bond markets meaning that these markets are less driven by global flows.

This stickier domestic investor base gives the asset class a degree of insulation from broader market sentiment, he explained.

That being said, Assalin warned that most asset classes are highly correlated to risk sentiment at the moment. By way of example, the US Federal Reserve’s pivot at the end of last year drove a rally for equity and bond markets, including emerging market debt.

Reason 6: Emerging market credit is a compelling alternative to US corporate bonds

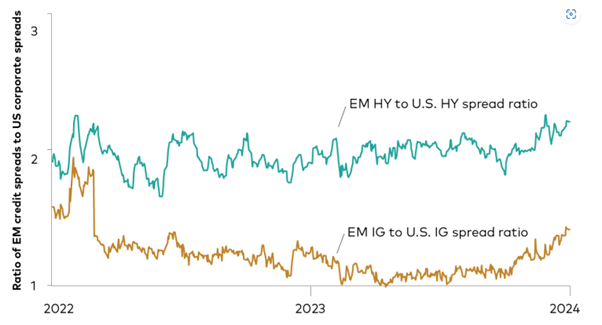

Daniel Shaykevich, senior portfolio manager, emerging markets at Vanguard, believes that emerging market credit is more attractively valued than US investment grade and high yield bonds, as the chart below shows.

Sources: Vanguard, Bloomberg, JPMorgan, data as of 30 Jan 2024.

“In addition, emerging market debt benefits from a unique combination of wide spreads and long duration, something that neither US investment grade nor high yield can offer,” Shaykevich continued.

Ratio of emerging market spreads to US corporate spreads

Sources: Vanguard, Bloomberg, JPMorgan, data as of 30 Jan 2024.

This leaves emerging market debt well positioned to benefit from a rally as central banks cut rates, risk appetite returns and growth normalizes. With strong investor demand for fixed income assets and historically expensive valuations in US corporate bonds, emerging market debt is likely to benefit from inflows, he concluded.

Dimity Griko, chief investment officer of Arkaim Advisors, said that high yield credit in emerging markets is less volatile over the long term than developed market high yield bonds and has a lower default rate.

Over 10 years, cumulative average defaults are almost two times lower than developed markets, especially the US, while recovery rates are about the same. Emerging market corporations have a 30% lower average debt burden than companies in developed markets, he added.