After years of equities being the main game in town, bonds now offer a compelling source of income and have returned as a core allocation in many investors’ portfolios. Given the renewed interest in their asset class, Trustnet asked fixed income managers where they are finding the most compelling investment opportunities.

Pictet expects strong returns from local currency emerging market debt

Mary-Thérèse Barton, Pictet Asset Management’s chief investment officer for fixed income, expects local currency emerging market debt to deliver returns in the high single digits to double digits this year.

Many emerging market central banks have displayed more policy credibility than their developed market counterparts. They hiked rates earlier and have managed to bring down inflation faster.

Emerging market growth has held up well, which creates “a strong platform for emerging market outperformance”, she said. The currency component will be an “added kicker” if the dollar continues to weaken. Pictet is overweight a basket of emerging market currencies versus the dollar in its emerging market debt portfolios.

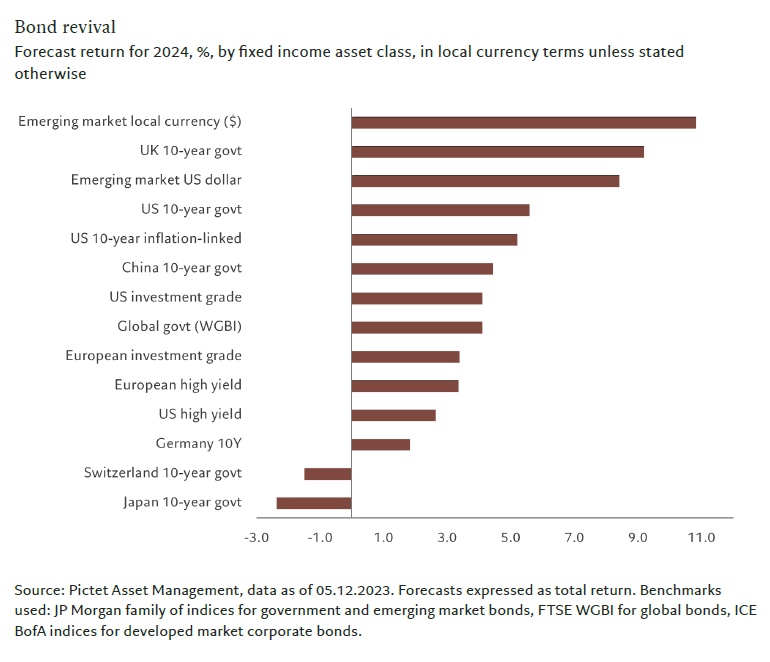

Indeed, Pictet forecasts that local currency emerging market debt will be the best performing of the major bond sectors this year, as the chart below shows.

For emerging market debt, the main lesson of 2023 was to look outside of China, Barton continued. “Mexico is a darling” while India and Indonesia also look attractive.

Elsewhere, Barton and her colleagues have a “constructive” outlook for investment grade credit. “We like the short end and the mid part of the curve but we are being very selective,” she said.

“Higher rates for longer are leading to more differentiation, both in the corporates space and also in the emerging market sovereign space, so for me that’s the best of all worlds. We’ve got the income aspect and then there’s the added value from active management, really differentiating between names. You need to take advantage of the volatility in the rates curves to be able to generate alpha above the income level.”

Subordinated tier one and tier two bank debt has been performing well so far this year and offers equity-like returns with bond-like risk, providing attractive carry. It has been a theme in Pictet’s corporate bond portfolios since the fourth quarter of last year.

Barton’s final lesson from the “rollercoaster” of 2023, which ended with “the largest core rates rally in 40 years”, is this: “Expect the unexpected – you’ve got to be in for the ride.”

TwentyFour Asset Management expects collateralised loan obligations to top the charts

George Curtis, a portfolio manager in TwentyFour Asset Management’s multi-sector bond team, thinks that collateralised loan obligations (CLOs) could be the best performing bond sector in 2024, continuing last year’s strong showing.

The £1.5bn TwentyFour Dynamic Bond fund’s CLO bucket returned more than 25% last year, with two-thirds of that return coming from the large carry that CLOs offer (given floating rate coupons) and one-third coming from spread compression.

By contrast, the TwentyFour Dynamic Bond fund is underweight high yield relatively its history. Euro BB-rated high yield bonds are yielding approximately 5.4% at the moment relative to almost 11% in BB CLOs, pointing to a spread pick up from high yield to CLOs of approximately 400bps.

The CLO market is less liquid than high yield bonds because CLO tranches are smaller so investors have to size accordingly, but the potential for strong risk-adjusted returns remains likely in Curtis’ view.

Curtis and his colleagues are also looking at additional tier 1 (AT1) bonds. These are bank bonds that can be converted to equity if the bank’s capital levels fall below a threshold, although Credit Suisse’s AT1 bondholders were wiped out during its forced merger with UBS in March 2023.

AT1 bonds issued by western European financial institutions had “the highest credit upgrade to downgrade ratios of any credit market in the world” in 2023, Curtis said. Banks are very conservatively financed in Europe, where they are subject to stringent regulations. Banks have been building up their capital reserves since the financial crisis and have seen strong improvements in their credit ratings as a result, he explained.

BlueBay has high conviction in euro-denominated credit

Marc Stacey, senior portfolio manager, investment grade at RBC BlueBay Asset Management and an FE fundinfo Alpha Manager, favours euro-denominated bonds over dollar-denominated credit because the former are still trading cheaply.

Spreads between euro and dollar bonds are about 35 basis points apart, with euro denominated bonds wider than dollar bonds. Prior to 2022 euro denominated bonds used to trade tighter than dollars in spread terms and that relationship has been flipped, providing an opportunity in euros.

Dollar and euro credit spreads have a very high historical correlation and over the last five years, euro spreads have only been wider than their current levels for 29% of the time, so from a spread perspective, European corporate credit is cheap.

From a yield perspective, this is “an amazing entry point that we haven’t seen for a number of years”, Stacey said. As a result, he believes total return prospects are high. BlueBay is overweight European credit in its global credit fund.

In terms of sectors, BlueBay is bullish on financials. For banks in particular, higher interest rates have provided a “huge tailwind from a profitability standpoint” and at the same time, valuations are cheaper than for corporate bonds in most other sectors “which makes no sense to us”, Stacey said.

“That strikes us as a compelling investment case,” he added.

From a trading angle, cash bonds are currently cheap compared to credit default swaps (CDS) so BlueBay has been buying cash bonds and then hedging its credit risk using the iTraxx (a group of international credit derivatives indices providing exposure to the credit markets in Europe, Japan, Asia and Australia).

Candriam prefers European high-yield bonds to the US

Jamie Niven, senior fixed income fund manager at Candriam, has two strong convictions for global credit.

First, within high yield, he favours European over US credits.

“Valuations are tight in both markets, but relatively more so in the US, while we also don’t believe the better quality of credits in the European market is fully reflected,” he explained.

“Additionally, expectations for European growth are already very depressed while the market expects a soft landing in the US. We agree that US growth will be stronger than in Europe in 2024, however we believe the propensity to surprise on this front is more on the downside for US growth in relative terms.”

Second, Niven expects dispersion to increase, especially within high yield. “We strongly believe that in a post QE world, differentiation between credits will be realised and credit selection will be an extremely important aspect in returns,” he said.

Bank bonds present an attractive opportunity, according to Capital Group

Like Candriam and Pictet, Capital Group expects dispersion to increase, which will give fund managers the opportunity to pick up bonds at a wider spread relative to their market or sector. This is particularly apparent in the banking sector – one of the busiest in terms of new issuance – said Ed Harrold, fixed income investment director at Capital Group.

High quality banks with strong fundamentals were caught up in negative sentiment towards the whole sector last year following the US regional banking crisis. As a result, corporate bonds issued by banks are currently available at attractive relative valuations.