Investors should build balanced multi-asset portfolios around three central tenets this year: bonds look more attractive than equities; within equities there are selective opportunities to outperform; and alternative investments and gold should provide a hedge if geopolitical risks have a detrimental impact on stock markets.

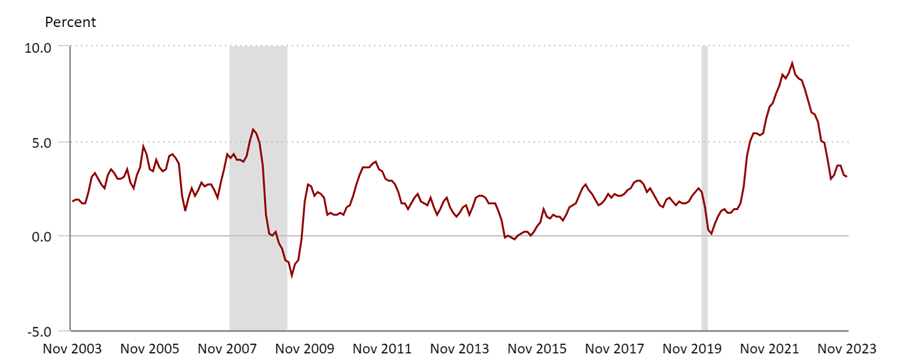

That’s the view of strategists at Candriam, who believe 2024 will be easier to read and forecast than 2023. Inflation is expected to fall below 3% in the US and the eurozone so the central question for investors has shifted to when – not whether – central banks will cut rates.

US CPI, 12-month percentage change

Source: US Bureau of Labor Statistics

Nadège Dufossé, global head of multi-asset at Candriam, does not anticipate large cuts, however. “The persistence of a higher-rate environment alters the balance of a diversified portfolio, as investors have a wider range of assets offering positive real returns,” she said.

Against that backdrop, bonds are offering attractive yields, as well as diversification against equities. Candriam favours longer duration bonds and is investing in government bonds, including dollar-denominated debt with currency hedging, as well as investment grade corporate credit in euros and dollars.

Additionally, Candriam believes that emerging market debt (both local currency and hard currency) offers attractive yields and should perform well as the dollar weakens, in an environment of slower growth.

Dufossé thinks investors should refrain from increasing the level of risk in their portfolios or adding to their equity allocations. “Based on the current level of the main [equity] indices, we expect a single-digit return, underpinned by low but positive earnings growth and dividend yields,” she explained.

“In our view, the expected returns on equity markets are insufficient to cover the risk of disappointing economic growth and geopolitical risks. After all, half the world's population will be going to the polls in 2024!”

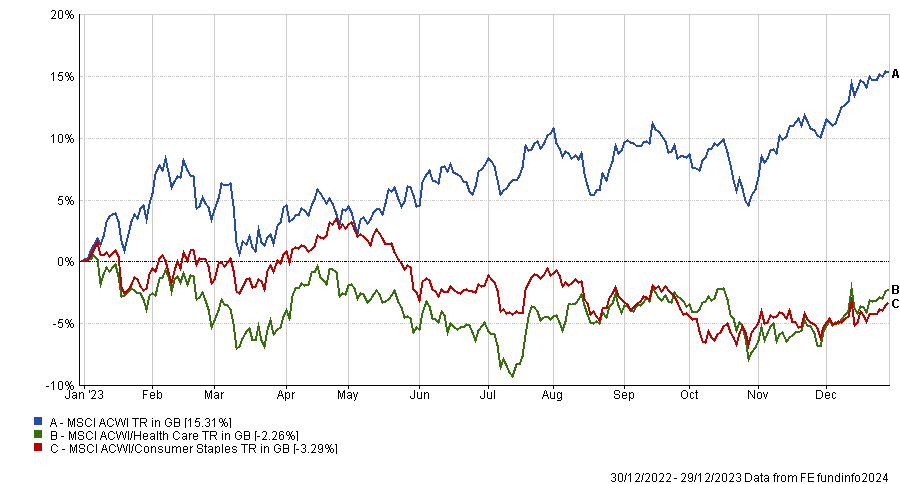

Nonetheless, certain sectors of the equity market offer opportunities for selective investors. Dufossé expects small-caps, technology and high quality healthcare and consumer staples companies to outperform broader indices.

Last year, the healthcare and consumer staples sectors were penalised by rising interest rates and fell behind higher growth sectors, so valuations now look relatively attractive.

Performance of healthcare and consumer staples vs global equities in 2023

Source: FE Analytics

At the opposite end of the spectrum, Dufossé expects tech stocks to continue to benefit from superior earnings growth driven by the surge in artificial intelligence.

US and European small-caps, meanwhile, have been the victim of “forced and undifferentiated selling” but could rebound if business activity holds up, she said.

There are three main risks to Candriam’s central scenario: a recession, rising inflation and exogenous risk (such as geopolitical risks or a threat to financial stability).

If fears of recession re-emerge, government bonds, gold, the yen and alternative investments should all perform well, compensating for a fall in equity markets.

Rising inflation would be “the worst case scenario for a diversified portfolio, putting both bonds and equities at risk of a 2022-style downturn”, Dufossé said. “In this case, liquidity and exposure to certain commodities such as gold or energy (oil) should be favoured to limit the decline.”

Finally, investors should always be prepared for unforeseen risks and shocks, especially in a year dominated by elections. If volatility spikes, then government bonds, gold, the yen and alternative investment strategies could partially protect a diversified portfolio.

Ultimately, Candriam recommends a balanced but selective portfolio to weather the challenges this year presents.

“On the bond side, we are looking for longer duration carry, exposure to investment grade credit and emerging debt; and on the equity side, more specific exposure to certain themes that have greater upside potential than the indices: consumer staples, the technology sector, and smaller caps,” Dufossé concluded.