Sometimes there are opportunities too good to miss out on. For IBOSS chief investment officer Chris Metcalfe, one of these golden moments came earlier this year in the form of the Chinese stock market.

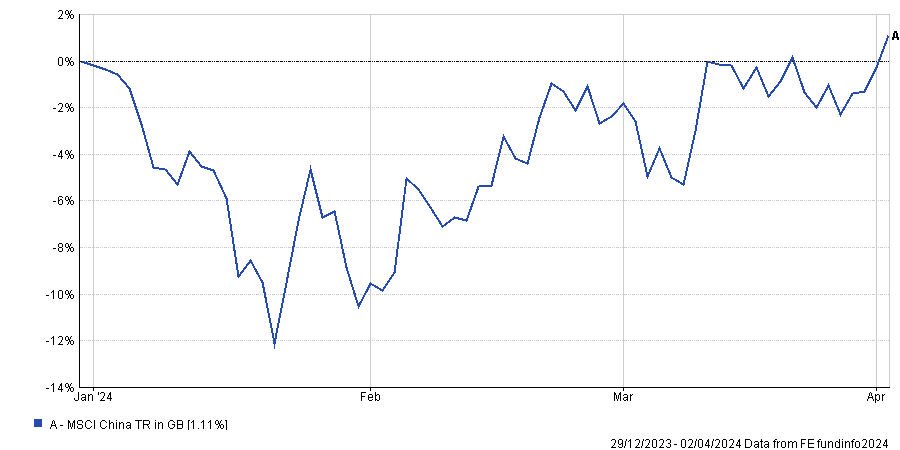

Although the year-to-date return of 1.1% may seem uninspiring, since the market's lows on 22 January it has gained 15% in what he called a “stealth rally”.

“Generally with China everybody is looking for the big bazooka – is [president] Xi [Jinping] going to come out with something absolutely amazing that’s going to completely re-energise the Chinese stock market? The answer to that has been no. But actually the Chinese market has stabilised and has been outperforming over the past couple of months,” said Metcalfe.

Performance of index over YTD

Source: FE Analytics

This move has come at a good time for IBOSS, which upped its exposure to China towards the end of January by making a rare intra-quarter move.

Typically, the firm’s model portfolios are reviewed once a quarter in February, May, August and November but such was the scale of the opportunity that he decided to make a move in the interim.

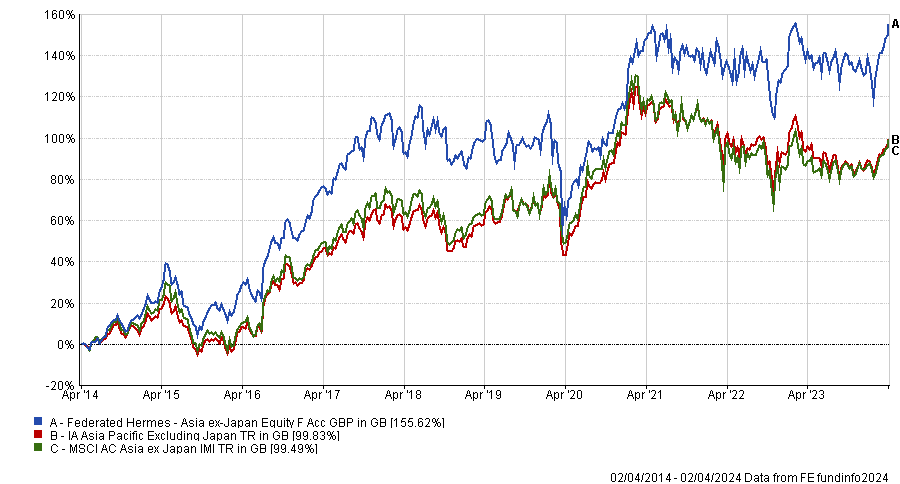

He added the £2.5bn Federated Hermes Asia ex-Japan Equity fund managed by FE fundinfo Alpha Manager Jonathan Pines to gain exposure to the rebounding Chinese market.

At present, the fund is 42% invested in the world’s second-largest economy, some 15 percentage points more than its MSCI AC Asia ex Japan benchmark.

Metcalfe noted that many managers in Asia and emerging markets have been put off China – partly for career risk – and were unwilling to invest heavily unless well-known issues, such as the country’s property sector and government intervention on technology stocks, were sorted.

“A lot of Asia and emerging market managers have been frightened off China. Obviously it comes with a shedload of baggage – we know that – but it is the world’s second largest economy and we think it’s attractively priced on a relative and absolute basis,” he said.

Metcalfe spoke to managers, asking what it would take for them to plough in to China and whether they required these issues to be fixed before they would invest – something he noted was “basically not going to happen”.

“The Hermes guys were prepared to act. They are reactive and when we are paying active fees we want to see active effort. They’ve got the expertise on the markets and can move much faster than us, where it is a big deal to do an intra-quarter change, compared to those guys who can change their geographical weighting on a daily basis,” he said.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

It is the first time IBOSS has made an intra-quarter move in almost two years, when it acted swiftly following the disastrous Liz Truss/Kwasi Kwarteng mini-Budget in 2022.

At that time, it bought sovereign bonds as Truss had “had changed the relative price of sovereigns all over the world, which was quite a thing for a UK Budget”.

“We couldn’t get confidence in the UK at the time so we bought the next best thing – Treasuries, which were hedged because she also put a floor in the pound when it was at parity with the dollar,” said Metcalfe.

“This position here is similar. Chinese equities are so unloved for all the reasons everyone knows. But there is always a reason. There was a reason people didn’t want sovereigns back in 2022 and in particular gilts. You want to be buying stuff where the risk-return profile is compelling and from a China point of view it is.”

Metcalfe had previously used two dedicated China funds in his portfolios, but was forced to remove them as they took up too much of his time, instead moving to broader Asia and emerging markets funds with higher exposure to the country.

“There was too much emphasis being put on the fact that we had two China funds at 1% each. It was absorbing a ridiculous amount of time defending the fact that we had them,” he said.

“Clients don’t ask about how much China you have through Asia and emerging market funds. If they see the word China in a fund title then they are all over it.”

However, he admits that there is the potential for the trade to “fail” and as such has paired the Federated Hermes fund with others in the sector.

L&G Pacific Index Trust is his preferred passive option here. The £1.5bn fund excludes China, which makes it imperative that his active funds are willing to invest in the market.

“What we didn’t want was our passive to be excluding China and our actives scared to invest there too,” he said.

The other fund in this space is FE fundinfo Alpha Manager Anthony Srom’s £1.5bn Fidelity Asia Pacific Opportunities fund, which has around 26% invested in China.

“One manager can fail but we use multiple funds in a sector to mitigate the risk one of them gets it catastrophically wrong,” Metcalfe concluded.