UK dividends dropped to £90.5bn in 2023, slightly behind expectations of £90.6bn and 3.7% below the £93.9bn paid out in 2022, according to a closely watched report.

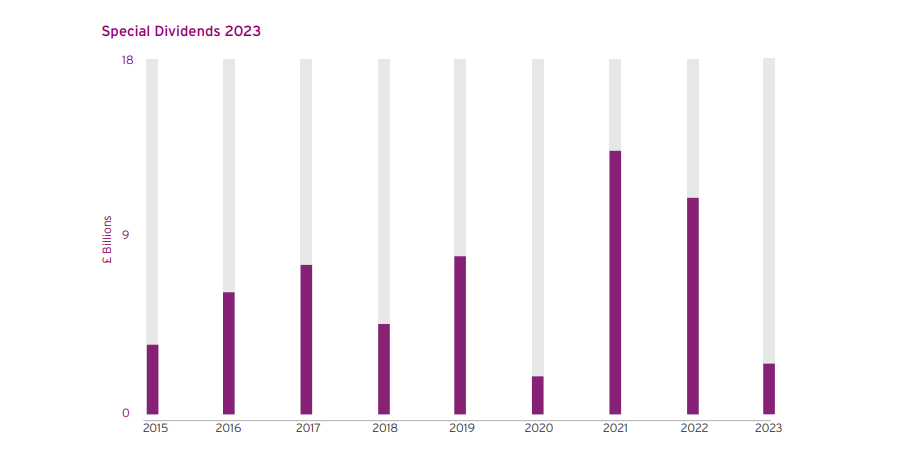

The fall was in part due to a decline in special dividends, which were £7.5bn down (79%) on the previous year, the latest UK Dividend Monitor from Computershare shows.

Mark Cleland, chief executive of issuer services for the UK, Ireland and Africa at Computershare, noted that these can be “very volatile”, adding that the figures follow two “bumpers years” in which companies played catch-up following the Covid pandemic of 2020.

Source: Computershare

Meanwhile the strength of the pound impacted more international businesses which typically pay their income out in dollars. Some two-fifths of UK payouts are declared in dollars, which would have been translated at less favourable rates.

It means total dividend payments remain some way off their pre-Covid highs. Payments from UK companies reached £104.5bn in 2019, before the pandemic.

However, regular underlying payments (excluding one-offs) were up 5.4% to £88.5bn, in line with forecasts and the landscape improved markedly in the fourth quarter of the year, with payouts up 15.6% between October and December 2023 compared with the same period in 2022. This was largely attributed to HSBC, which restored its fourth quarter dividend.

Banks were the big payers of last year, overtaking oil majors and mining giants, which had led the tables as commodities soared in 2021 and 2022.

Cleland said: “The return to prominence by the banks is really remarkable. Some 13 years of rock-bottom interest rates made it very hard for the sector to make profits, but the need to quell inflation with higher interest rates means the last two years have delivered a dramatic turnaround. Bank investors are reaping the dividends of this reversal and we expect them to see even larger payouts in 2024.”

It is the first time since the financial crisis in 2008 that banks have led the dividend-paying charts, as higher interest rates have allowed them to pass on excess profits to shareholders.

David Smith, manager of Henderson High Income Trust, noted: “Having been forced to stop dividend payments during the pandemic it’s good that banks’ dividends have been restored and grown back to pre-pandemic levels. We expect further dividend growth this year given the rise in profits from higher interest rates have yet to fully flow through to earnings.

“Interestingly despite banking dividends now being better covered by earnings and strong capital positions in the sector, dividends yields are high offering income investors an attractive opportunity given we believe those dividends should be sustainable absent a severe recession in the UK.”

In total, the companies in the sector paid £13.8bn last year, or 15% of all dividends from UK stocks. The oil sector was in second (£11.6bn) while miners were in third (£11.5bn).

HSBC overtook Rio Tinto as the biggest dividend payer in 2023, climbing from fourth to take the top spot. Oil titan Shell remained in second, with Glencore, British American Tobacco and Rio Tinto rounding out the top five respectively.

Looking ahead, Cleland said next year is likely to be one of slower growth than over the previous three years, as the upside from banking and oil companies is likely to be more muted if the Bank of England pauses rates and commodity prices even out.

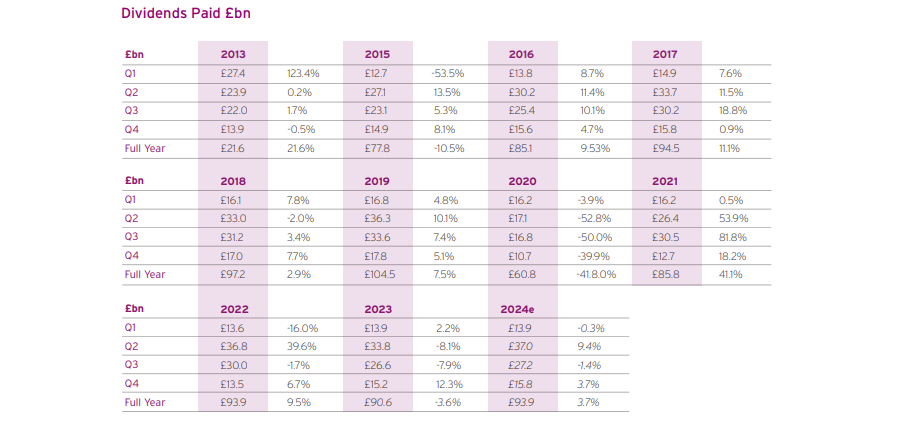

He expects headline dividends of £93.9bn, up 3.7% year-on-year, which would be in-line with the payments made in 2022, as the below chart shows.

Source: Computershare

James Lowen, senior fund manager, JOHCM UK Equity Income fund, agreed with this forecast, suggesting there will be “a flattish outturn for dividend growth this year.”

Share buybacks versus dividends

Share buybacks hampered dividend growth in 2023, the report noted, with two main reasons. This is a mechanism of buying shares to remove supply from the market to increase the share price.

Firstly, the cost of buying back shares can be taken from the dividend, as both contribute to a shareholders overall return.

However, fewer shares mean any increase in dividend per share costs less if there are fewer stocks to pay the income on, so the total amount required falls.

Lowen added: “In respect of boardroom frustrations around low UK equity valuations, a notable trend is emerging, with companies resorting to share buybacks to address the challenge. This is particularly evident in sectors such as banking, where buybacks are being extensively used.”

However, over the long term, he noted that this could be a good thing for investors, as there will be fewer shares in issue for a set dividend payment to be spread across.

“This is a powerful second derivative effect of buybacks for long-term dividend growth, which we see in numerous stocks,” he said.

“Fund dividend forecast incorporates a shift towards lower dividends and increased buybacks from 2024, signifying a short-term dip but projecting higher returns in the medium term.”