This year will see some 4 billion people – over half of the world's population – head to the polling stations. A whopping 76 countries are set to hold elections – general, regional or local – where all voters will have the opportunity to cast a ballot.

Of course, not all of these elections will matter much to the markets. Some are scheduled in countries where there is little chance of a change of government through democratic means. Others will be held in countries with minimal economic or geopolitical clout. Others still will be fair and free and in countries of global significance but with political choices that would yield relatively little difference in economic terms. Three countries whose populaces’ decision will certainly matter globally are Taiwan in January, India in the spring and the United States in November.

Taiwan is a flashpoint in the Sino-US relationship and voters face the choice between William Lai, from the pro-independence and currently ruling The Democratic Progressive Party (DPP), and Hou Yu-ih from the Kuomintang (KMT), thought to be more China (PRC)-friendly.

Emotions and rhetoric are already running high, with the election being stylized as a choice between ‘peace or war’ and ‘democracy or autocracy’, depending on who is talking. Both are likely exaggerations, at least in the short term, but it is safe to say that a Hou-win would be viewed more positively in Beijing, with the prospect of a resumption of cross-Straits talks. The KMT candidate is currently trailing in the polls but has been steadily gaining ground since the summer. There’s still all to play for.

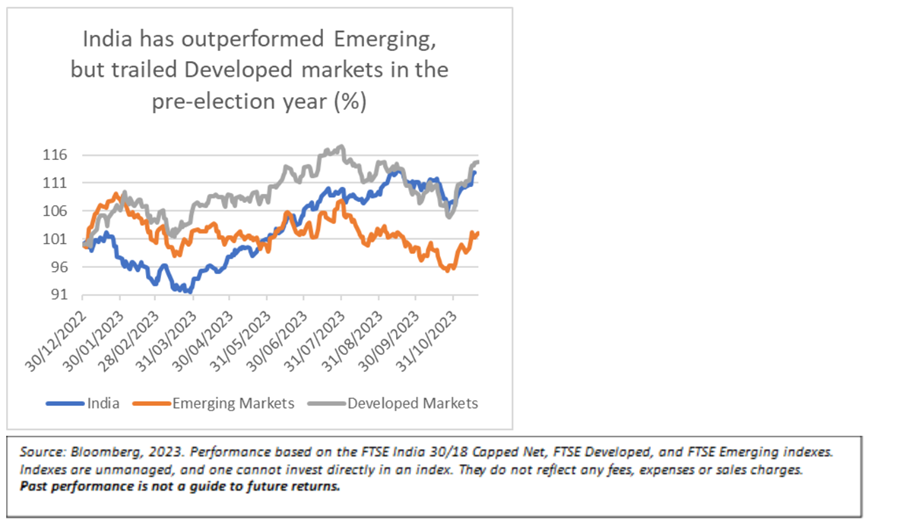

In India, a country with 1.4 billion people and one of the world’s most dynamic economies, prime minister Modi appears set for a third term with his The Bharatiya Janata Party (BJP) leading most opinion polls and a personal approval rating of 76% – making him the most popular leader globally.

Of course, there is a lot that can happen between now and election day, but the base case is that Modi will remain in office and continue his reform-oriented economic agenda. This could bode well for investors that have increasingly been gravitating towards India as a 6% GDP growth oasis in times of geopolitical turmoil, high inflation and low growth.

Finally, without a doubt, the elections in the United States have the potential to bring more far-reaching consequences than any of 75 others. While the general elections are still almost a year out, it’s worth having a look at the horse race in the US primaries.

The battle among Republicans to challenge Biden is already in full swing and the first-in-the-nation primary caucus in Iowa, is less than two months away. According to ABC News’ 538 national polling average, former president Trump clearly leads the field with almost 60% of the vote, followed by DeSantis (14%), Haley (10%) and Ramaswamy (5%). Given that this is a national average, whereas the actual total number of RNC delegates for each candidate is determined on a state-by-state basis, a Trump nomination is by no means certain just yet.

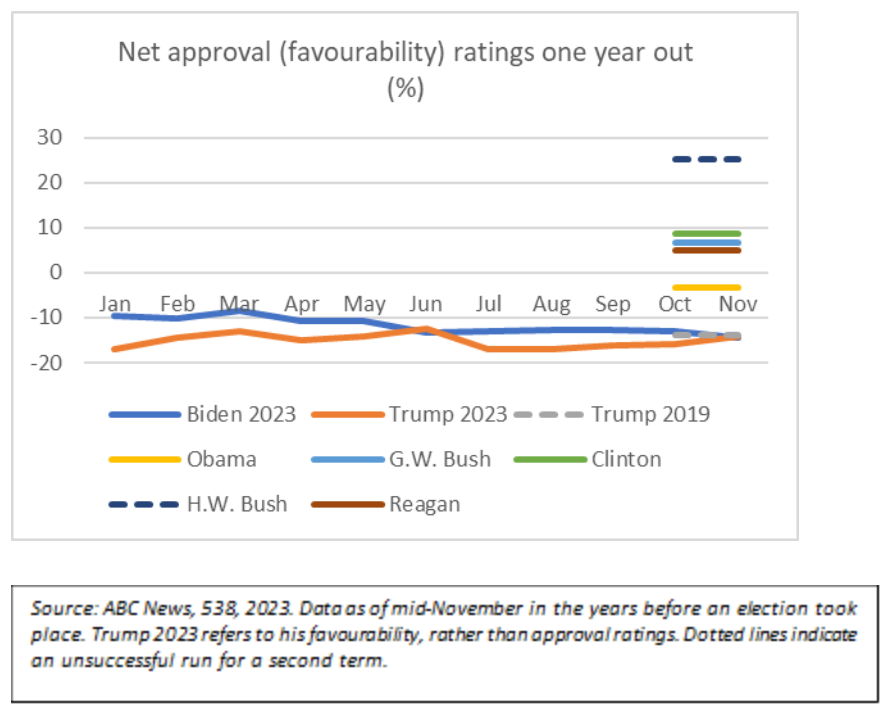

It’s safe to say, however, that the most likely matchup for November 2024 is a Biden-Trump replay. Biden’s net approval rating is close to its all-time low at -14.5%. There is simply no precedent of a successful re-election with such very low ratings; at the same time in past cycles, Obama stood at -3%, G.W. Bush at +7%, Clinton at +9%, and Reagan at +5%. However, George H.W. Bush, who was ultimately confined to one-term, stood at +25% and lost to Clinton - a reminder that it is still early in the race to gauge. Trump’s own favourability rating is around -14%. In other words, it’s likely going to be a contest of who is least disliked by the electorate.

The implication of this quagmire for investors is that there is no smooth sailing to be expected for markets in 2024.

We’ll have more certainty about the Republican nominee in a few months’ time, but US elections tend to be a close call, not least thanks to a system where relatively few voters in key states can nullify a nationwide majority in the millions. The country’s political debate is deeply divided (and divisive) and the next president will – depending on the election results in Congress – potentially be able to leave a real mark: from foreign policy and energy security, to health care and the climate transition.

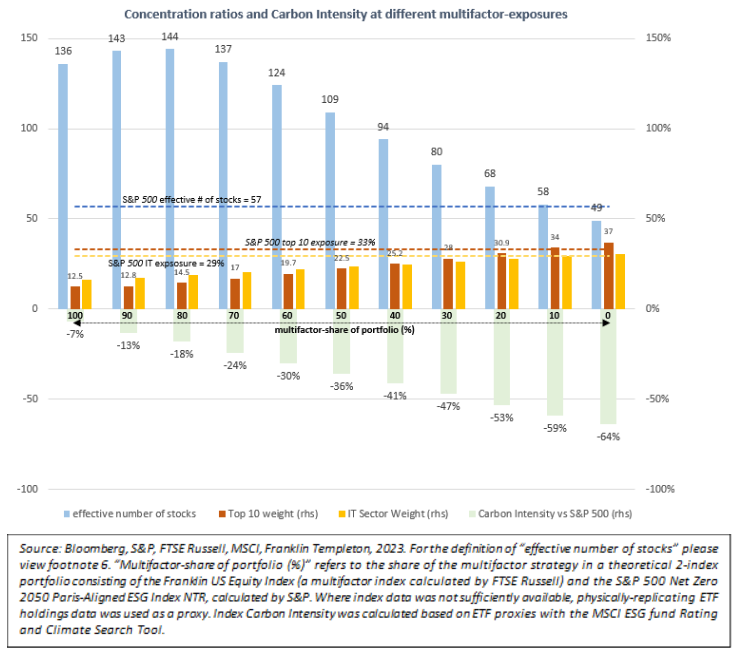

We think that a standard US exposure like the S&P 500, which makes up the bulk of most globally allocating investors, may not be the most suitable concept for a year that could bring a lot more volatility. The rationale behind our view is that the S&P 500 has rarely been more concentrated than now and therefore less diversified. The top 10 stocks make up almost one third of the index, with the Magnificent Seven contributing well over a quarter. Whether or not that will be a boon or a drag over the next year is anybody’s guess.

The Magnificent Seven, in particular, have driven the broad market, with the remaining 493 stocks mostly languishing. There are some fundamentals to back up the performance discrepancy, past sales growth and long-term growth expectations for those seven stocks outstrip those of the rest by double digits. But we argue that such high concentration may not be the best approach from a portfolio construction and diversification perspective. Think of it that way: the actual number of stocks in the S&P 500 is, of course, 500, but the effective number of stocks in the index is only around 12% of that, fewer than 60 companies. Should investors really allocate in such a way for their core US exposure?

Alternatively weighted indexes may be worth a consideration. That could be equal-weighted, the most simplistic form, or a fundamentally weighted approach, that takes into account criteria like valuations, profitability, balance sheet strength and others.

Another factor investors should have on their screens is sustainability. While the Biden administration has ushered in an era of American climate leadership, a Republican White House from 2025 onwards would most likely ramp up oil production and trim climate-related subsidies. What it would not do, however, is change the fundamental choice that companies face: prepare for climate change, or risk losing out to competitors that embrace the challenge as an opportunity for innovation. The US is the largest economy, but 85% of the world's GDP is generated elsewhere, including many countries that have an existential economic interest in combating climate change. In other words, it is our view that considering sustainability criteria is an imperative for investors, regardless of who sits in the Oval Office.

The question then arises, how to combine two goals that at first glance may appear slightly at odds with each other: increasing diversification – i. e. lowering concentration measures – and tilting towards more environmentally friendly companies that are adapting to climate change.

We believe both goals can be reconciled, depending on the specific needs of the investor. For example, it is estimated a 75% exposure to a S&P 500 Paris-aligned strategy, combined with a 25% weight of a fundamentally weighted U.S. multifactor-strategy based on the Russell 1000, would reduce carbon intensity by half, increase the number of effective holdings by 30%, and decrease the Top 10-share of the portfolio by 4 basis points vs the S&P 500 index. A 50/50 exposure would still reduce the carbon intensity by over a third and almost double the number of effective holdings (to 109 from 57). The Top 10 exposure would fall to 23% (from 33% in the S&P 500).

The bottom line: this year will bring a myriad of both challenges and opportunities – elevated by an avalanche of elections that begins in January and lasts through much of 2024. The US election in particular will keep the markets guessing for the better part of the year. Strategic investors should review their allocation to US equities with a view to reduce record-high concentration ratios and the necessity to account for climate and election-related risks. Alternatively weighted solutions like Paris-aligned strategies or multifactor exposures may together address both at the same time.

Marcus Weyerer is senior ETF investment strategist at Franklin Templeton ETFs EMEA. The views expressed above should not be taken as investment advice.