An approach to investing is to target factors such as momentum, value or quality rather than geographies, sectors or thematics.

As certain macroeconomic environments have historically favoured specific factors, it can, therefore, be tempting for style-based investors to try to time the market depending on forecasts and history.

However, Jonathan Griffiths, investment product manager at ebi Portfolios warned that it is very likely that investors will get their timing wrong.

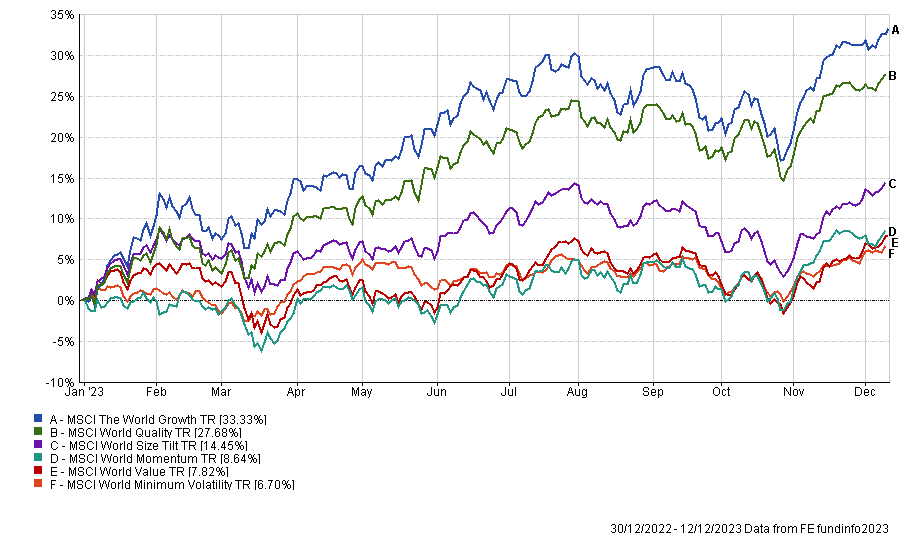

For instance, as the market was expecting a recession in 2023, factor investors might have been tempted to go all in on the minimum volatility and quality factors that have historically done well in recessionary environments.

Yet, the recession has not happened so far and growth stocks have been dominant this year, although quality has also done well.

Performance of indices YTD

Source: FE Analytics

Griffiths said: “This potential recession has been the most over-called and over-expected in modern history. However, we don't think it’s something we can time. History can be a guide, but it can also be wrong.”

Instead of trying to time allocations to factors, ebi Portfolios allocates equally across five factors in its model portfolios: value, quality, minimum volatility, size, and momentum.

Griffiths added: “While we accept that different factors will outperform at different times, we pick up the premium over the long term by having an exposure to all of them in a diversified manner.”

However, he highlighted a preference for the value stye, especially in comparison to the growth one. This involves buying shares that seem to be trading below their intrinsic value, with the expectation that fundamentals will reassert themselves, leading to a positive rerating of those stocks.

This preference is based on the Fama and French model, which suggests that the value factor outperforms growth over the long term.

The performance of the MSCI The World Growth and MSCI World Value indices shows that value outperformed growth between 1999 and 2019, but that the latter has had the upper hand in recent years.

Performance of indices since January 1999

Source: FE Analytics

To play the value style, ebi Portfolios uses passive funds such as Global Sustainable Focused Value and GSI Global Sustainable Value.

Yet, a risk with a passive approach here is that there is no way to avoid the so-called ‘value traps’ as there is no manager at the helm to separate the wheat from the chaff.

In spite of this, Jonathan Griffiths, investment product manager at ebi Portfolios, explained that a manager does not offer any guarantee either.

He said: “Value traps are also a problem for active fund managers, especially those venturing in the deep value landscape. They then fall into those traps by allocating to stocks that just continue their downward path rather than reverting back to their mean.

“Generally speaking, managers may overperform in the short term but consistently delivering that over the long run is not really possible.”

Indeed, the latest AJ Bell’s ‘Manager versus Machine’ report showed that only 36% of active equity funds have outperformed a passive alternative in 2023. The percentage of active funds to have beaten a passive equivalent over 10 years is even lower, at 32%.

Nonetheless, Laith Khalaf, head of investment analysis at AJ Bell sees merits in both approaches.

He said: “Active fund investors will typically hope to improve their chances of outperformance by selecting fund managers with established and successful track records, which is no guarantee of success, but significantly better than picking funds with a blindfold and a pin.

“Passive fund investors also need to be on their toes as some funds charge egregiously high fees, which can be easily avoided by switching to a cheaper alternative.”

He suggested that investors may pick an active managers they trust alongside their tracker holdings.

Khalaf concluded: “Ultimately active and passive funds are tools at investors’ disposal, rather than a rigid lifelong doctrine they must cleave to.”