The UK market has been unloved for years but the situation is reaching dire levels, according to Anthony Cross, FE fundinfo Alpha Manager of the Liontrust UK Smaller Companies fund.

Despite very low valuations, investors are shunning domestic companies, but going forward there are a few considerations that could turn things around.

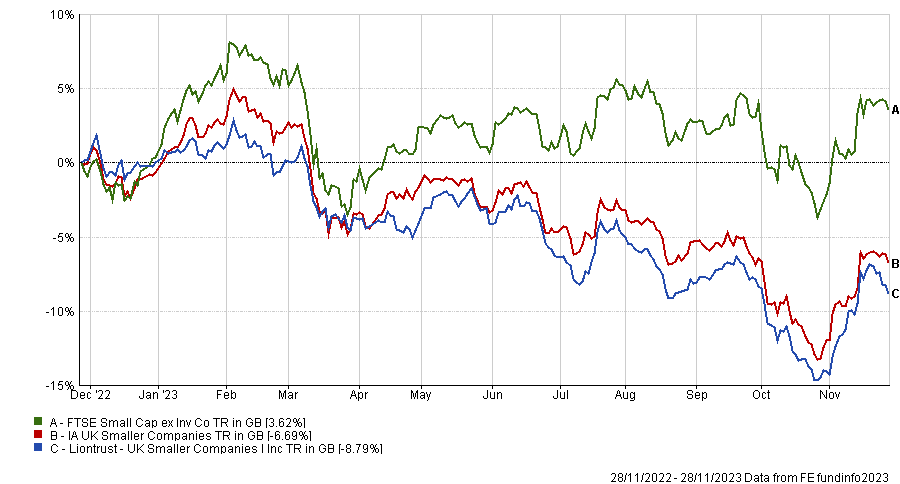

Performance of fund vs sector and index over 1yr

Source: FE Analytics

The first is one that could happen organically. With everyone rushing into global funds and therefore buying “quite expensive businesses”, a shift to a valuation-aware market should happen at some point.

“Our data points out that the UK market's value tracks pretty close to where it should do on a discounted cash flow, but now it's saying it's over 30% cheap. UK small-caps are nearly 50% cheap. In contrast, the US is 40% too expensive and Europe is a little expensive,” said Cross.

“So what could well happen is that somebody at some point might find that they are starting to underperform as the businesses they own have got too expensive, and their share prices have started to come down. At that point, they’ll be looking around to find where to get some performance from, and they well might come back to the UK.”

The other thing that could help is better support for UK equities from the government, although there has been less impact here than the manager would have liked.

“We were disappointed that there wasn't more government action in the chancellor’s Autumn Statement, with the Great British ISA that didn't come about. There could be more government action to encourage UK retail investors to come back to the UK market,” Cross said.

“It's a bit mad that the government in many ways introduced big tax breaks for people to go out and buy global funds. If you give tax breaks, please make sure they are invested in domestically to stimulate jobs within the UK.”

Meanwhile, Alpha Manager Paul Marriage, who co-runs the Tellworth UK Smaller Companies fund, advocated for more investment in the alternative investment market (AIM) through defined-contribution (DC) schemes, noting that “a tiny amount” of DC schemes buying AIM would have “a massive impact” on the bottom end of the market.

So how did we get here?

The reasons for the widespread disinterest in UK stocks are several, according to Cross, who cited the normalisation of interest rates as a key factor.

“It is healthy for economies and business overall, but at the moment what it meant is that all the money has come out of equities and bonds and gone either into cash deposits or gilts,” he said.

“The good news is that that’s a cyclical headwind and at some point, it will sort itself out. It will probably start to reverse when people remember about the value that comes from long-term compounding factors.”

Another problem has been the way that wealth managers have been reconstructing portfolios over the past 5-10 years. Previously, they used to have “a great chunk in equities”, most of which would be in the UK, but now they tend to follow the MSCI index and to draw the UK portion down to 4% or 5% of client portfolios.

This, said Cross, has been “a powerful detriment” that has created selling pressure on UK equities, particularly in the small- and mid-cap section.

Marriage, had similar concerns, with the domestic mood being: “no one likes us, we don’t care”.

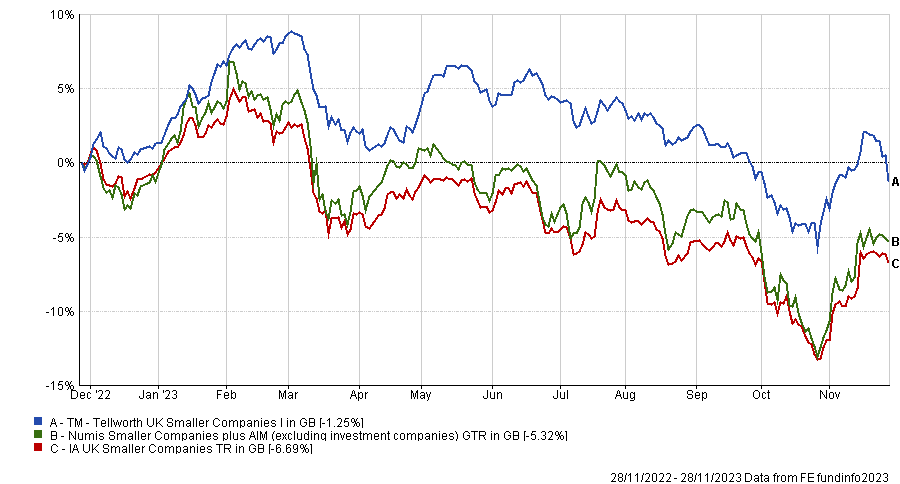

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“The UK has been a go-from market, with portfolios going from double to single-digits allocations,” he said. “It’s no secret that the UK and in particular small-caps, have more sellers than buyers.”

But not all buyers have abandoned the market.

“Post the dot-com bubble, the usual buyers of UK smaller companies were UK large funds and we don’t see them anymore. Post financial crisis, it was global value funds, and we nearly see them now,” he said.

“Today, there are still a whole lot of people who think UK small-caps are cheap and are acting on it, but they're just not equity investors, they're no-equity actually investors who take those companies private.”

Passive funds have also slowed things down, with overseas buying mainly being directed towards large-cap and passive vehicles.