Building a small-cap equity portfolio is a bit like a football club: there is a first team of established players, some of whom are near the end of their careers, then an academy squad of “superstar emerging talent” that is “all hope” and “quite high risk”.

So says FE fundinfo Alpha Manager Paul Marriage, manager of the Tellworth UK Smaller Companies fund.

Toddlers are another metaphor for smaller companies, he continued. Toddlers are less risky than newborns (start-ups) and are already profitable.

“We are buying toddlers who can walk and talk and feed themselves but they’re going to grow a lot. We sell them when they become teenagers. That’s a great way to make three to five times your money,” the manager explained.

For instance, Watches of Switzerland was a toddler that grew into a “multi-bagger”; it increased in value five or six times since Marriage’s initial investment at its IPO in 2019.

Marriage attempts to find the next multi-bagger using a series of screens.

First he excludes companies below £100m and does not invest in oil, gas, mining, biotech, “blue sky” companies, gambling or “dodgy stuff”. He also rules out Tellworth Investments’ suppliers and brokers.

This narrows down the universe to about 600 companies, which Marriage and his co-managers John Warren and James Gerlis put through three more screens.

The sinners screen excludes stocks with aggressive accounting, poor corporate governance or a weak financial position.

The alpha seeker screen looks for companies that are poorly covered by other analysts and have the most potential to be mispriced.

Finally, the thermostat screen looks at how companies will be impacted by UK economic conditions for the next two quarters.

This process further whittles the universe down to about 300 companies and Marriage and his colleagues meet 200 of them every year. They have to “kiss a lot of frogs”, he said.

Marriage looks for growing companies that he can buy at a reasonable valuation. They generally fall into one of two buckets: that first team of established players known as “P3M” stocks and the academy squad of valuation opportunities that have a lot of potential.

The P in P3M stands for a differentiated ‘product’ backed by research and development. The three Ms are market leadership in a niche industry, the ability to grow profit margins and management whose interests are aligned to shareholders.

“P3Ms are the most successful investments we make. More P3Ms are multi-baggers,” Marriage said.

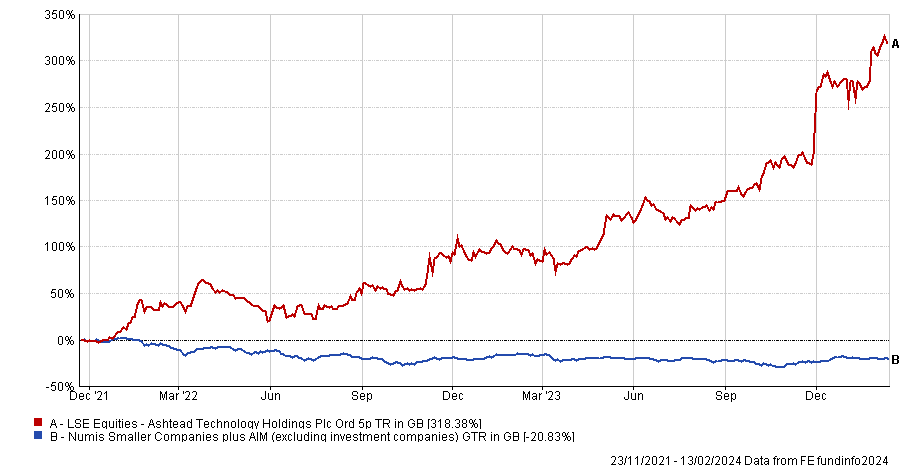

By way of example, Marriage has tripled his money in Ashtead Technology, a subsea equipment rental provider for the global offshore energy sector, which is a top 10 holding.

Oil rigs are being decommissioned, which means that thousands of kilometres of pipes in the North Sea need to be cut and Ashtead rents out the saws and robots to do the job. Ashtead also tests kit underwater.

Performance of stock since IPO vs fund’s benchmark

Source: FE Analytics

Photonics specialist G&H Group is another P3M. It produces Q-switches, which work within laser cavities by generating high intensity, pulsed light.

G&H used to be “a mishmash of businesses” but the company's new CEO has cleaned it up and done deals to improve its intellectual property (IP). G&H is now an “IP rich” star player with a defensive moat, Marriage said.

High tech businesses such as this should be making profit margins of 20% and the CEO wants to take margins into the teens at least, Marriage added.

The second type of investment, valuation opportunities, are companies that the market has misunderstood, which are available at “the wrong price on the day”.

These tend to be shorter-term opportunities with a six- to 12-month holding period and meeting the CEO is a crucial part of the research process. “We need to leave the meeting knowing the levers that management can pull to increase the valuation,” he explained.

Speciality chemicals company Elementis is an example of a valuation opportunity. A year ago, Elementis sold its Chromium business, which was a hero-to-zero business that either made huge returns or large losses.

The company is “a lot cleaner” as a result but has not been re-rated by the stock market, Marriage said. It owns the only mine in the world sourcing hectorite clay, which has become a key ingredient in makeup.

Marriage also owns Wilmington, a data and training business focussing on the legal sector. Wilmington is a crossover between a P3M stock and a valuation opportunity – so in a football club it would be in the second team. It is trading at eight times earnings and has a lot of cash on its balance sheet.

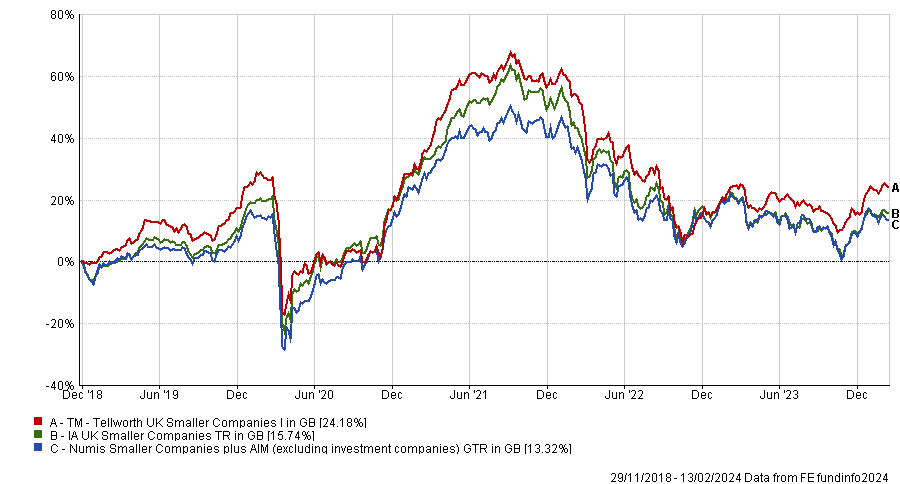

Performance of stock vs fund’s benchmark over 5yrs

Source: FE Analytics

The Tellworth UK Smaller Companies fund has beaten its benchmark and sector since inception on 29 November 2018, as the chart below shows. It has a four FE fundinfo Crown Rating, placing it amongst the top 25% of funds based on alpha, volatility and consistently strong performance.

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

Marriage co-founded Tellworth Investments in 2017 with Warren, a fellow Alpha Manager and Schroders alumnus, and they have just sold the business to Premier Miton Group. Tellworth's seven-strong investment team has all moved across to Premier Miton and the funds will keep the Tellworth brand.

Marriage is hoping that Premier Miton’s enhanced distribution capabilities will be able to grow Tellworth’s £559m in assets under management across its five funds. The sale also provides an exit strategy for minority shareholder BennBridge.