Beginner investors might be overwhelmed by the vastness of the investment opportunities out there, making it hard for them to choose a good vehicle to begin with.

Once they’ve decided to start their investment journey, many people choose a passive mixed-asset vehicle for their first buy, which is usually cheap and offers a mix of various investments. The most standard blend is the so-called balanced or 60/40 portfolio, which is split between equities and bonds respectively.

But this might not be the ideal choice for young investors, who have the luxury of more time ahead of them and can therefore afford to take more equity risk. This, spread over a longer time horizon, should drive better returns.

What young people must remember, according to Nick Wood, head of fund research at Quilter Cheviot, is that “risk can be your friend”.

“Investing predominantly in equities in the early part of your life allows you to ride out the volatility and generate the greatest potential returns,” he said. “Even if you are looking five or 10 years in advance, then equities are still the place you want to be.”

As a result, he chose the Alliance Trust, an investment trust that invests globally, including emerging markets, via a number of underlying concentrated portfolios run by some of the best fund managers in the world.

It is balanced in terms of style exposures, meaning that it won’t have a bias towards growth stocks (expected to grow faster than the market) or value stocks (cheap but that can rebound), getting investors the best of both worlds.

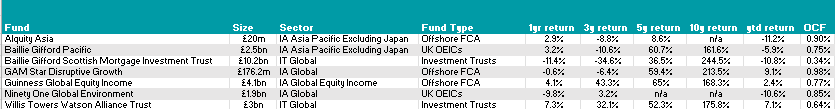

Its performance has been strong recently, as shown in the graph below, and it’s ahead of its index over 1, 3 and 5 years. Shares currently trade on a 5.6% discount.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“This gives new investors the confidence that they are buying a quality management team and that they have appropriate levels of diversification as the fund isn’t betting on just one outcome for markets,” said Wood.

“For beginner investors wanting to learn more, the Alliance Trust website is also a great source of investment insights from their underlying managers and allows its investors to really understand exactly what it is they are investing in. For a young investor, having that confidence is crucial.”

Darius McDermott, managing director of Chelsea Financial Services, suggested starting with a “reasonably high tempo” global equity product such as Scottish Mortgage, one of the largest investment trusts in the UK.

“It looks for transformational growth opportunities around the world and invests in some very interesting and exciting companies,” he said. “It is currently on a 14.4% discount, which makes it more attractive.”

For those wishing to balance it out, McDermott suggested splitting the money between Scottish Mortgage and a global equity income fund such as Guinness Global Equity Income, which in contrast invests in companies with growing dividends (prioritising income for the future).

As time goes on and the pot of money grows, the investor can add other funds into the mix, he added, for example GAM Star Disruptive Growth, which invests in companies set to benefit from the next wave of technological disruption, or a fund focused on environmental, sustainability and governance (ESG) principles such as Ninety One Global Environment, which only invests in companies helping to decarbonise the planet.

Lastly, GDIM investment manager Tom Sparke, said that for someone starting out in their twenties “it’s hard to look past Asian equities”.

“Usually, I would suggest a novice investor try a passive collective vehicle, but Asia is the highest-growth region in the world and the only one containing the world’s second-largest and the globe’s most potent growth story – India,” he said.

“Long-term, the compound growth in Asia will be more significant than in Western markets, albeit with higher volatility – but with decades ahead of you there is plenty of time for your investments to rise and fall a few times over.”

Sparke preferred actively managed funds over passives because the Asian markets will continue to be inefficient and there should be clear winners and losers, so a managed fund “might be the best option”.

For the adventurous kind, he suggested the high-growth mandate of Baillie Gifford Pacific or, for the ESG-conscious, the Alquity Asia fund.

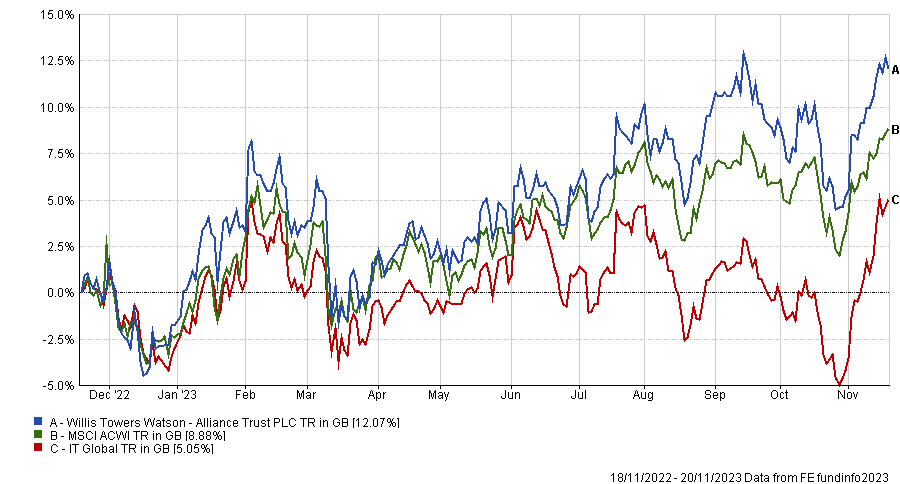

Performance of funds vs sector and index over 1yr

Source: FE Analytics

Both these funds have “concise” portfolios of only the stocks they believe will be long-term winners. The former doesn’t follow a benchmark, meaning that it will select companies not starting off from an index, but are based on fundamentals research. The latter is also unconstrained but selects stocks by themes, ESG and impact analysis.