Emerging markets and short-term debt were the themes that emerged from the additions that were made to Barclays’ Fund List in 2023.

Most platforms couldn’t ignore the public interest in short-term money market funds, which people rushed into to take advantage of the higher-interest-rates environment.

These vehicles were snubbed until central banks started to tighten monetary policy as the yields improved. However, their particular draw has been that savings accounts were largely unable to keep up with the rate increases, while money market funds achieved this. As such, experts started to worry about the consequences of their popularity.

Royal London Short Term Money Market was one of the most popular funds of 2023, but its rates fell very quickly following the expected rate cuts, as its manager recently explained to Trustnet – perhaps one of the reasons why Barclays analysts went for the less liquid Royal London Short Term Fixed Income instead.

This strategy is run by “a well-resourced and experienced management team” co-managed by Tony Cole and FE fundinfo Alpha Manager Craig Innes, who invest at least 70% in short-term fixed income securities with a duration of 0-18 months.

“They are also responsible for Royal London’s other short maturity funds, which gives them in- depth exposure to the entire short-term market ranging from overnight lending to short-term corporate credit,” Barclays analysts said.

“The fund diversifies its holdings by investing in a combination of money market instruments, including cash, time deposits, certificates of deposit and commercial paper and floating rate notes, and also in a range of other securities, including corporate bonds, supranational and agency bonds, covered bonds and/or transferable securities.”

Another strong point was the fund’s ethical criteria, whereby securities from companies that generate more than 10% of their turnover from armaments, tobacco or fossil fuels are excluded. The ongoing charges figure (OCF) is also competitive at 0.11%.

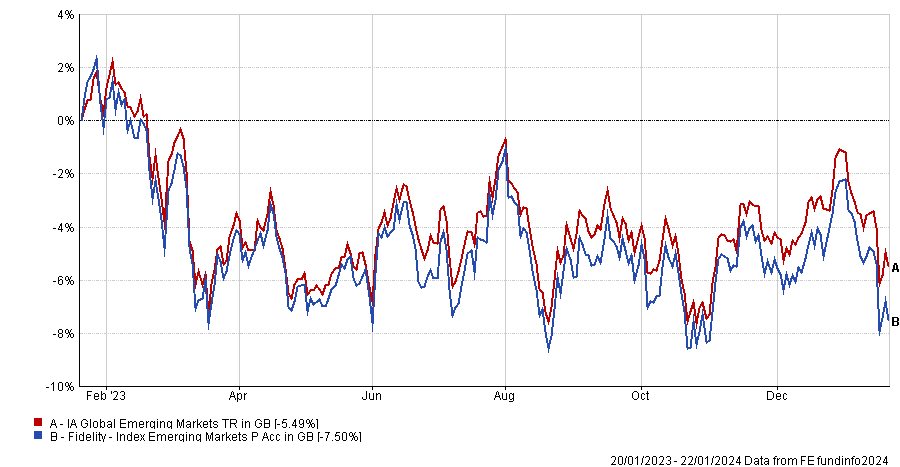

On the other hand of the popularity spectrum emerging markets didn’t have a smooth year, with the IA Global Emerging Markets sector losing 5.5% over the past 12 months. But Fidelity Index Emerging Markets still made it into the list at the end of June 2023. It has fared worse than the sector average over the past year, losing 7.5%.

Performance of fund vs sector over 1yr

Source: FE Analytics

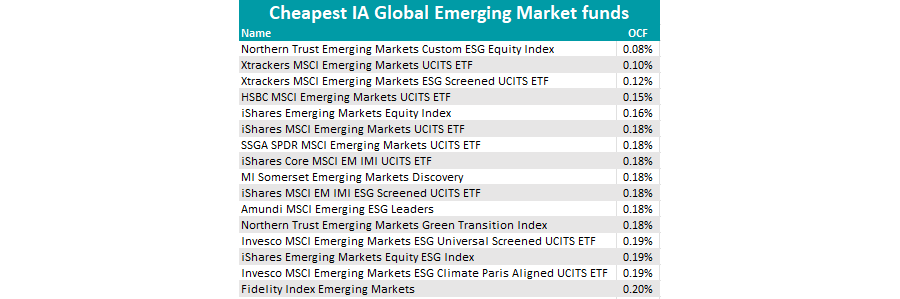

However, Barclays’ tracker funds list is purely selected on a costs basis, and this fund is one of the cheapest tracker products of its sector, as illustrated in the table below.

Source: FE Analytics

Fidelity Index Emerging Markets tracks the performance of the MSCI Emerging Markets index, resulting in a 22% exposure to financials and information technology companies mostly in China (26.5%), India (16.7%) and Taiwan (16%). The top three stocks are Taiwan Semiconductors (6.7%), Samsung (4.7%) and Tencent (3.5%).

Interactive investor recommended the same fund in its Super 60 list, as it should be “well positioned to continue its long streak of superior risk-adjusted returns” thanks to its “soundly constructed” and “reasonably representative” portfolio, which investors can snap up at a low fee.

Finally, Barclays analysts also highlighted one of Barclays’ own mixed-asset portfolios, the £49.4m Multi-Asset Sustainable fund. Over the past year, it made a 1.7% return, underperforming its average IA Mixed Investment 40-85% Shares sector peer by 2.3 percentage points. It costs 1.39%.