Investors would have been better off buying UK smaller companies to avoid the worst of the market falls, according to data from FE Analytics.

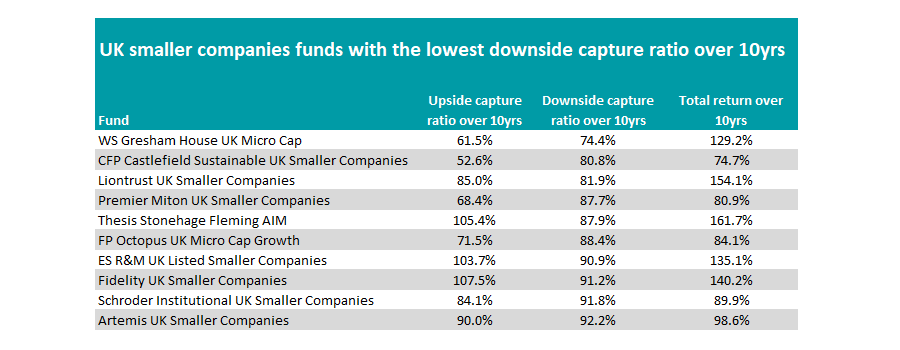

All of the five best performers in the IA UK Smaller Companies sector over the past 10 years were significantly better at protecting on the downside than shooting the lights out during the good times.

In this series, Trustnet looks at the funds with the highest upside and downside capture ratios versus a relevant benchmark. Here we chose the Numis Smaller Companies Excluding Investment Companies.

An upside score of more than 100% shows that a fund made more than the market when it rose, while a downside capture ratio of less than 100% shows they made a smaller loss during tougher times.

The best performer in the sector over the past 10 years has been the £78m Thesis Stonehage Fleming AIM fund, managed by FE fundinfo Alpha Manager Paul Mumford and Nick Burchett.

Investing exclusively in companies quoted on AIM, the fund has a technology and healthcare bias, but does not have an out-and-out growth style, with energy and miners also in the portfolio.

Over 10 years it has a downside capture ratio of 87.9% and an upside score of 105.4%, making a total return of 161.7%.

Source: FE Analytics

The second-best performer – Liontrust UK Smaller Companies – also appears on the list of funds with the best downside capture ratios.

Alpha Managers Anthony Cross and Julian Fosh, as well as co-managers Victoria Stevens, Matthew Tonge and Alex Wedge, look for companies with a competitive advantage. They also demand management own at least 3% of the company.

It is significantly larger than the Stonehage Fleming fund, with £984m in assets under management (AUM). Around a third of the portfolio is also invested in AIM, with 17% listed on the main market either in the FTSE 250 or FTSE Small Cap Index.

Analysts at Square Mile Investment Consulting & Research gave the portfolio an ‘AA’ rating and said: “The investment process applied is considered, well defined and steers the fund's management team towards relatively steady businesses that it believes have a competitive edge, that are gradually growing and generating high levels of cash.”

All of the top five funds in the sector appeared on the list above, including ES R&M UK Listed Smaller Companies and Fidelity UK Smaller Companies. WS Gresham House UK Micro Cap had the fifth-highest returns in the sector despite an upside capture ratio of just 61.5%, as it had the lowest downside of all at 74.4%.

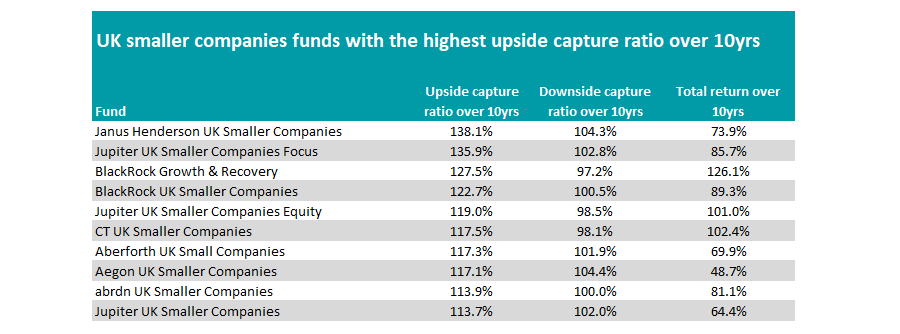

Most investors buy small-caps to add some risk to their portfolios. For those happy to experience more volatility with the promise of higher returns, BlackRock Growth & Recovery was the best option.

The £56.6m portfolio run by Matthew Betts made 126.1% over the decade, the highest of all on the list below, which shows the top 10 small-cap funds for upside capture ratio. Its return was good enough for sixth overall in the IA UK Smaller Companies sector.

Jupiter UK Smaller Companies Equity and CT UK Smaller Companies (119% and 117.5% upside scores respectively) were also among the top 10 best performers in the sector over the decade.

Source: FE Analytics

Janus Henderson UK Smaller Companies was the fund with the highest upside score, however. Neil Hermon has managed the fund since 2002 and over the past decade it’s upside score of 138.1% topped the sector, although its downside score of 104.3% meant its total return was below average.

This is part of a series looking at the best aggressive and cautious funds in different sectors over 10 years. Previously we have looked at emerging markets funds, global, US and European funds, as well as UK all companies and UK income portfolios.