Investors who backed China over the past five years have had a tough time, but now could be a good opportunity to get in, according to Nitin Bajaj, manager of the £356m Fidelity Asian Values Trust.

Bajaj said he has found so many investment ideas in the country recently that he raised his overweight position to 38% from about 28% in May and used gearing (4.9%) to add even more Chinese names.

It is difficult to predict when the Chinese economy will turn around, the manager admitted, but he has plenty of reasons to be optimistic. China is the second largest economy in the world, consumption is expanding as a share of its GDP, household wealth is holding up and Chinese companies make up a significant part of global supply chains.

“We feel that these negative macro factors are transitory. Good businesses will not only survive but will likely be in a stronger competitive position post this downturn and by taking market share from their weaker peers,” Bajaj said. “This is probably the best time to be investing in China as we are able to buy good businesses when both expectations and valuations are low.”

Catherine Yeung, investment director at Fidelity International, thinks that China’s problems are driven by sentiment: “It’s not a financial crisis, it’s more a crisis of confidence.”

People have grown accustomed to high growth so the failure of a post-Covid rebound to materialise has disappointed markets. “The problem for China is that we need to reset expectations,” Yeung continued. “Policymakers are doing the right thing, making incremental announcements that are meaningful in aggregate. If they keep tweaking, the probability of the market doing well is high.”

Fidelity Asian Values has been overweight China for a couple of years, which has been a headwind to performance. Underweight allocations to India and Taiwan, which has benefitted from the artificial intelligence boom, also dragged on returns.

Yet investors could find comfort in Fidelity Asian Values’ results last week for the year ended 31 July 2023, showing that stock selection more than made up for the country calls. Its net asset value rose 11.4% and it made a total return of 17.3%. By comparison, the MSCI All Countries Asia ex-Japan Small Cap Index rose 7.5%.

FE fundinfo Alpha Manager Bajaj tends to take contrarian macro positions in his hunt for smaller companies with attractive valuations, good management and solid business models that offer a product or service with tangible growth or a long tail.

“It is easier to find undervalued businesses in countries which are out of favour with investors,” he explained.

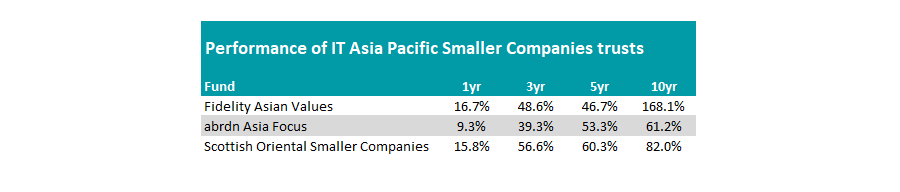

Performance of Fidelity Asian Values compared to the other two trusts in the IT Asia Pacific Smaller Companies sector

Source: FE Analytics, data to 13 Oct 2023 in GBP

Fidelity Emerging Markets managers Nick Price and Chris Tennant have taken the opposite approach to Bajaj in China and Hong Kong. They are underweight with an aggregate exposure of 22% to China and Hong Kong combined (comprising both long and short positions in individual stocks and a long position on the Hang Seng Index) compared to China’s almost 30% weight in the MSCI Emerging Markets Index.

Price said that the China recovery has been slower than he expected due to weakness in the property sector and a regulatory crackdown on the internet sector over the past few years, which has led to higher youth unemployment.

There are encouraging signs, however: savings rates in China are the highest of any major economy and Chinese companies are taking an increasingly shareholder-friendly approach.

“The days of investing in China solely for growth are likely over, and the acid test now is really whether companies are buying back shares or paying out dividends,” Price said.

“Internet platforms NetEase, Alibaba Group Holding and Tencent are all good examples of companies that have progressive buyback policies, but which are trading on very attractive valuations given weak sentiment towards the Chinese market.”