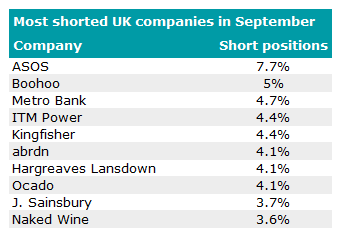

Investors increased their short positions in all but one of the UK’s top 10 most shorted stocks in September, reversing its prior downward trend.

The number of shorted stocks in the most bet-against UK companies was gradually declining for a number of months but firms added fuel to the fire again in September by upping their bets on their misfortune.

Shorting involves traders borrowing shares in a company they expect to fail, selling them on and then buying them back at a cheaper price once their valuation has dropped.

Source: Financial Conduct Authority

The company that firms increased their shorts in the most was Metro Bank, which rocketed up from the 67th spot at the start of September to the third highest spot by the end of the month.

Positions in the firm rose by a sizable 3.6 percentage points throughout the month, bringing the total percentage of shorted stocks up to 4.7%.

The Bank of England’s (BoE) rejection of Metro’s modelling application may have had a role to play in this spike – the £96m high street bank asked for permission to use its own internal models in its mortgage lending branch rather than the Prudential Regulation Authority’s (PRA) standardised model, but it was denied.

Most major banks have the authority to judge the riskiness of mortgage loans themselves without oversight, but Metro Bank has not been granted this freedom.

It said in a statement in September: “The PRA has indicated that at this stage more work is required by the company which means approval will not be attained during 2023. Whilst Metro Bank continues to engage with the PRA on its application, there is no certainty that approval will be obtained.”

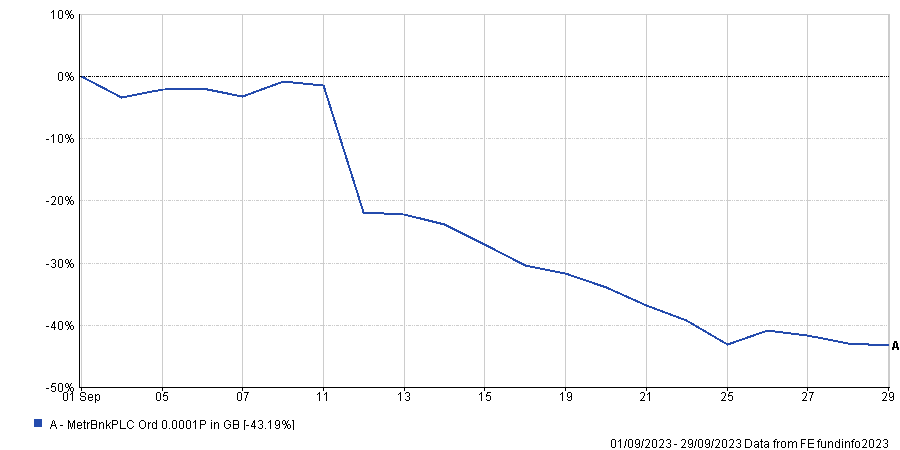

Shares in the bank fell 20.8% after the announcement, with their value falling 43.2% in total throughout the month.

Share price of Metro Bank in September

Source: FE Analytics

Traders may have upped their bets on Metro Bank, but only two firms – Caius Capital and Kite Lake Capital Management – are shorting the company.

Its spot in the top 10 could change rapidly if one of these groups lowered or exited their position, which would be easier compared to names such as ASOS, which has nine firms shorting its shares.

The online fashion retailer leapt back into the top spot yet again after short sellers had begun to ease up on it. Firms upped their stakes in the £447m company by 3.6 percentage points in September, bringing the total number of shorted stocks up to 7.7%.

Fellow online fashion vendor Boohoo also climbed back up to the second spot as short sellers increased their positions to 5%.

Like ASOS, short positions had been in decline over recent months, but eToro analyst Mark Crouch noted that “Boohoo’s turnaround will be a long, hard slog”.

Both have struggled to reach the same heights they experienced in the pandemic as consumers used their pent up savings to get clothes delivered directly to them.

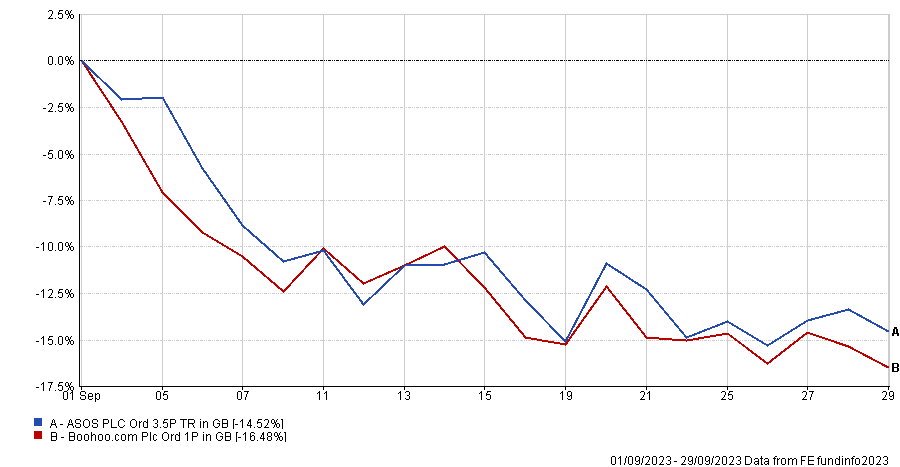

Share price of ASOS and Boohoo in 2023

Source: FE Analytics

Crouch added: “Boohoo is targeting more profits on its sales, and its cost-cutting program will help with that, but the fact is that strategy is being hampered by a lack of sales volumes.

“Prior to the pandemic, firms such as Boohoo were booming, although since lockdown shoppers have flocked back to the High Street.”

Boohoo’s share price dropped 16.5% in September with ASOS following closely behind, down 14.5%.

Alongside Metro Bank, financial services company Hargreaves Lansdown and supermarket chain Sainsbury’s joined the top 10 most shorted UK stocks in September.

They took the spots previously occupied by video game company Keywords Studios, property developer British Land and oil provider Harbour Energy.

The most notable drop came from Harbour Energy, which plummeted from the fourth most shorted UK company down to the 85th throughout September as firms lowered their bets by 3 percentage points.

It now has 0.8% of its shares held in short positions, compared to 3.8% a month prior. Neil Wilson, chief market analyst at Finalto, suggested that this turn in sentiment may be partially due to the government’s recent decision to allow drilling in the Rosebank oil field.

The area near Shetland is owned by Norwegian petroleum refinery Equinor and British oil and gas company Ithaca Energy, and could produce around 300 million barrels of oil.

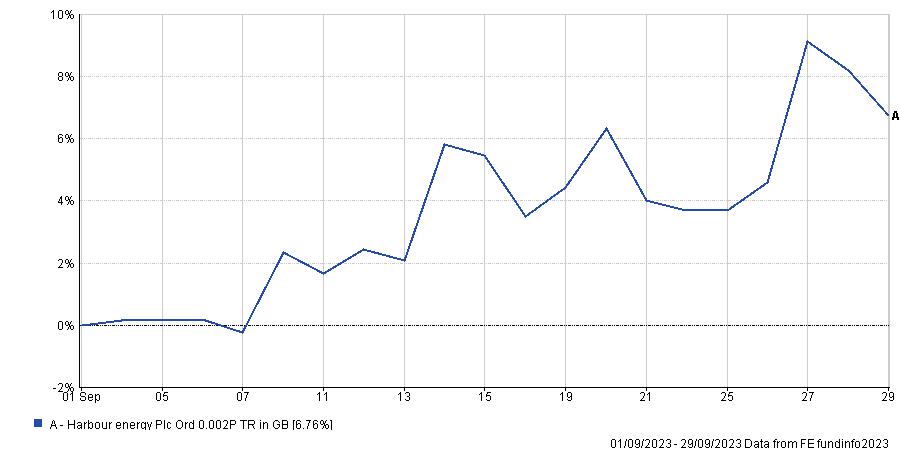

Harbour Energy’s share price was up 4.3% in the day following the government’s approval, rising a total of 6.8% throughout September.

Share price of Harbour Energy in September

Source: FE Analytics

Wilson said: “Harbour and other oil plays are catching bid as the UK approves the Rosebank field in the North Sea. Norway’s Equinor is behind the project along with Ithaca, but the signal to the rest of the industry is a positive one – some net-zero common sense being shown.”