The first monthly report on London Stock Exchange-listed exchange-traded funds (ETFs) published this week shows widespread interest in ETFs as core holdings, with the iShares Core MSCI World UCITS and iShares MSCI ACWI UCITS ETFs the most bought in June this year.

But another common way of using these vehicles is to get exposure to specific themes that wouldn’t be as accessible otherwise – from uranium miners, to the future of defence and sustainable gold.

Specialised platforms compete with each other by bringing new, more niche and more diverse products to the market, but this doesn’t always go well, explained Hector McNeil, co-chief executive officer and founder of HANetf.

“We try to provide value-added solutions to investors. You don't get it right every time, but more times than not we have,” he said.

“Funnily enough, we launched a full range of thematic ETFs around securities in 2007 – coal, shipping, nuclear, clean energy, water, wind – and nobody cared back in those days, even though they would have been superstars today. Sometimes it’s not the right time and things don’t immediately resonate with people.”

Below, McNeil shares the most and least successful ETFs in the platform’s range and anticipates what’s in the pipeline.

Among the success stories is HANetf Sprott Uranium Miners UCITS ETF, which has jumped following the Russian invasion of Ukraine last year.

Performance of fund over 1yr against sector

Source: FE Analytics

“The Russia war changed the paradigm, with people now realising that nuclear needs to be part of the long-term solution to get away from fossil fuels – particularly as the industry has got a lot safer and technically robust. There’s even Rolls-Royce now looking at making mini prefabricated reactors as well.” said McNeil.

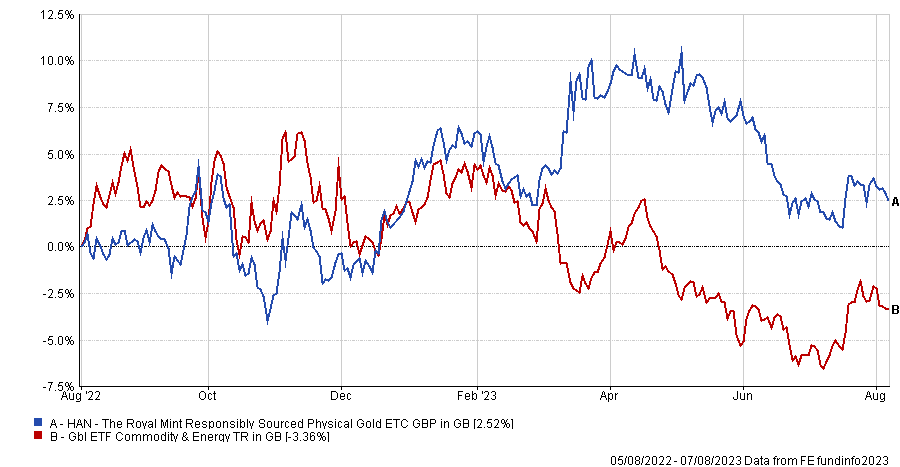

The Royal Mint Responsibly Sourced Physical Gold ETC has also been very popular, he said, continuing a theme of investors seeking commodity exposure over the past few years.

Performance of fund over 1yr against sector

Source: FE Analytics

“The main reason for its success is that it uses 100% responsibly sourced gold, with the top level of responsible sourcing from the LBMA [the London Independent Precious Metals Authority]. We tried to make sure that at least 50% of gold bars are sourced from recycled gold, which is 95% less carbon intensive than mined gold,” said McNeil.

“Most sustainable investors wouldn't buy gold simply because it's not seen as a sustainable investment, but some sustainable investors will buy the recycled products. That's an example of how we reached $863.1m of assets under management (AUM) despite being almost the last-to-market exchange-traded commodity (ETC).”

Also attracting a lot of interest were ETC Group Physical Bitcoin (demand rose when iShares tried to launch a Bitcoin ETF in the US), EMQQ Emerging Markets & Ecommerce UCITS ETF and the article nine iClima Global Decarbonisation Enablers UCITS ETF, focusing on companies whose business model is facilitating the transition story.

Turning to the less successful products, the Purpose Enterprise Software ESG-S UCITS ETF had to be run down in January this year.

“It’s one I really liked, but it just didn't get off the ground. It just didn't resonate with people and didn't get enough assets, so that's closed down,” said McNeil.

The Global Online Retail UCITS ETF, launched in March 2021, also closed earlier this year.

“It did very well in the US, but we launched that in Europe and it had a massive drawdown. It got particularly killed by the war and the inflation story, so unfortunately that's another one that didn't work out,” he said.

“Even if you think a product has good potential, if the market conditions aren't right, you can’t keep it on the platform when it’s going to take another three or five years for it to become profitable. That's a lot of money to burn over that time period to wait for success, so it’s best to take it off.”

McNeil anticipated there’s more environmental, sustainability and governance (ESG)-focused products coming along, with the latest launch – the European Green Deal UCITS ETF came to the London Stock Exchange last month –in this space.

Active ETFs will also undergo substantial growth, McNeil predicted. Speaking to Trustnet recently, he called mutual fund managers ‘dinosaurs’ who will be made extinct by the active ETF structure.

“Investors might be familiar with the success of Cathie Wood in the US, the first solid superstar active ETF manager. So more of that will come as well.”