Barbie is making her debut on the big screen today, a new high in a career started in 1959. In her 64 years of existence, Barbie could have had over 100 different professions, from astronaut to school teacher.

In an article from 2009, Forbes revealed the annual salary for a few of Barbie’s potential jobs, with the average salary being $1,805,000 per annum (£1,381,416.32).

It means that Barbie falls into the high-net-worth individual category, exceeding the Financial Conduct Authority’s minimum salary threshold of £300,000 per year.

Mattel (Barbie’s brand owner) reported that her age is frozen at 19, meaning she has her whole life ahead of her. Other key things to note are that she is childless and has a boyfriend (Ken) but is not married.

We also know from multiple advertisements that Barbie owns multiple homes and doesn’t seem to have any debt. In summary, Barbie has a long-term horizon, no constraint for the foreseeable future and plenty of money to invest with the capacity to tolerate a high level of risk.

Below, Trustnet asked Andy Merricks, portfolio manager at IDAD, how Barbie can grow her assets as much as possible.

He suggested to use Heptagon Future Trends as a core holding, an actively managed stock-specific fund seeking out representatives of trends for the future.

Performance of the fund vs sector and benchmark since launch

Source: FE Analytics

The fund was launched in 2016 and sits in the first quartile of the IA Global sector. It has semiconductor company ASML, solar panel manufacturer First Solar and water technology provider Xylem as its top three holdings.

Merricks also included CFP SDL Free Spirit, which is the only single-country fund in the portfolio.

He said: “Like Barbie herself, the fund looks for businesses which ‘possess strong operating franchises’ and fishes in a concentrated pool of mainly UK mid- and small-cap firms.”

Performance of the fund vs sector since launch

Source: FE Analytics

The fund, managed by FE fundinfo Alpha Manager Keith Ashworth-Lord, was launched in 2017 and sits in the first quartile of the IA UK Smaller Companies sector over five years.

With a penchant for fashion, as a high-net-worth individual , Barbie can certainly afford luxury goods, but she might be more interested in investing in the brands directly.

Luxury goods have the unusual benefit of an upward-sloping demand curve, which means that, unlike in other industries, the demand increases as prices rise. As a result, luxury firms tend to be more resilient in difficult economic environments.

To gain exposure to luxury stocks, Merricks suggested the GAM Luxury Brands Equity fund.

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

While the fund has underperformed both its benchmark and sector over 10 years, it is part of the IA Global sector’s first quartile over one year. Its largest holding, LVMH Moet Henessy Vuitton, became the first European company to surpass $500bn (£404bn) in market valuation in April.

Merricks also mentioned Amundi S&P Global Luxury UCITS ETF as a passive alternative to gain exposure to the luxury sector.

He said: “The GAM Luxury Brands Equity fund or the Amundi S&P Global Luxury UCITS ETF should serve her well with LVMH, Richemont, Hermes and Ferrari all featuring in the top holdings of the respective funds. Barbie seems to be as recession-proof as some of these names.”

As somebody who has the potential to work as a surgeon or an astronaut, Barbie could be interested in something at the crossroads of technology and health. Therefore, biotechnology is another thematic included in the portfolio.

The global biotechnology market size accounted for $373bn in 2021, but market intelligence group Acumen Research and Consulting estimated that it will grow to $1.3trn by 2030.

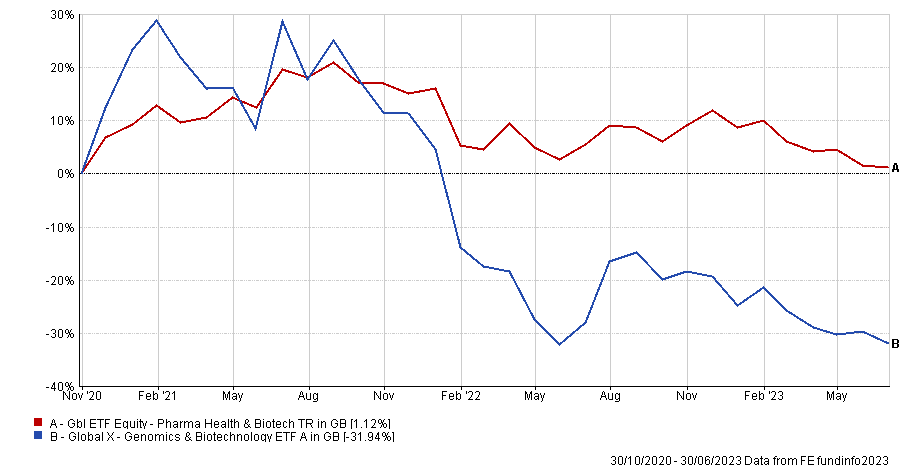

For Barbie to gain exposure to biotechnology, Merricks picked the Global X Genomics and Biotechnology ETF, which aims to provide exposure to emerging areas within the healthcare sector.

The ETF, which tracks the performance of the Solactive Genomics index, was launched in 2020. Over two years, it is a third-quartile performer in the Global ETF Equity – Pharma Health & Biotech sector.

Performance of the fund vs sector since launch

Source: FE Analytics

Nearly 80% of the fund is invested in the USA, with the Netherlands, Switzerland and Germany as the next three largest country allocations.

Moving on to another thematic area, clean energy has strong prospects as well, with the International Energy Agency projecting cumulative investment in this sector to reach $94-$131trn by 2050.

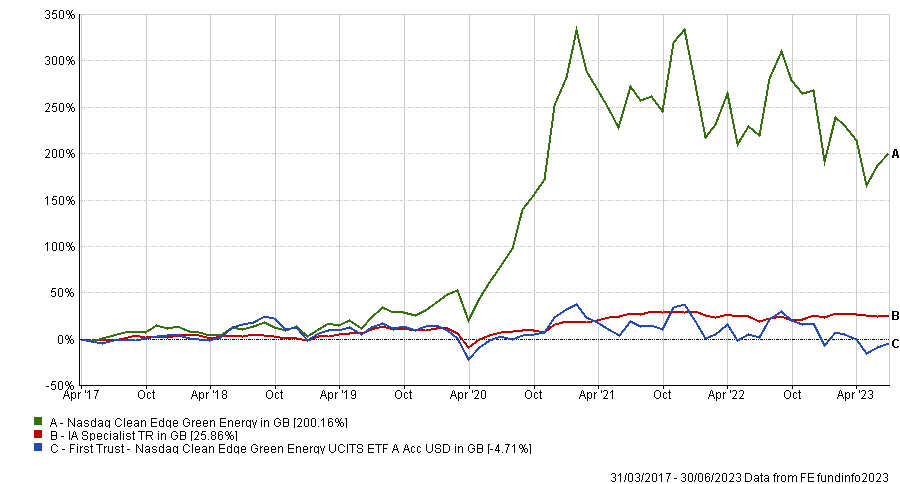

Merricks picked the First Trust Nasdaq Clean Edge Green Energy UCITS ETF, a neat basket of renewables, electric vehicles and the technologies that lay behind them.

Performance of the fund vs sector and benchmark since launch

Source: FE Analytics

The ETF was launched in March 2017 but has largely underperformed its benchmark. It has a 12.5% tracking error over five years, but has been less volatile than its benchmark, the Nasdaq Clean Edge Green Energy index.

Another option is to consider the welfare of animals. After all, she worked as a veterinarian in 1985.

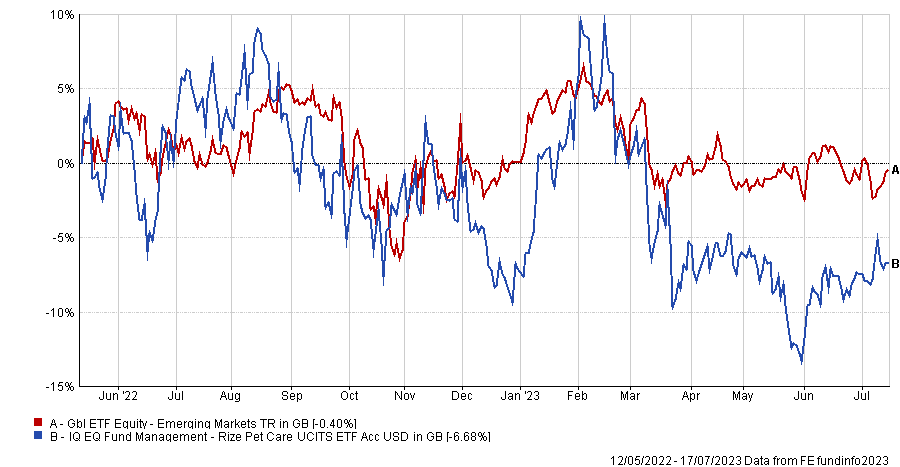

While it is not a megatrend in the same way as clean energy or biotechnology, Merricks picked the Rize Pet Care ETF, which was launched last year.

He said: “It is a wonderfully niche fund that attempts to profit from the increased pet ownership and accompanying apparel and healthcare opportunities that have grown with it recently. I’m sure she would approve.”

While incorporated in the Global ETF Equity – Emerging Markets sector, the ETF predominantly invests in the USA, followed by Germany, the UK and Japan.

Performance of the fund vs sector since launch

Source: FE Analytics

The ETF tracks the Foxberry Pet Care index and sits in the fourth quartile of its sector over one year.

As previously mentioned, Barbie is not only a homeowner. Better than this, she owns multiple properties including, among others, a Malibu house, a vacation house and a three-story townhouse. As she is visibly familiar with the real estate world, Merricks added an exposure to property in the portfolio.

He said: “She’s always liked a bit of property over the years so a more 2020s version of a property fund would be the Global X Data Centre REITs & Digital Infrastructure ETF, which is a few steps away from the more familiar retail park and offices portfolio of recent years.”

This ETF was launched in 2020 and invests in around 80 businesses that are likely to benefit from the growth of digital infrastructure. It focuses on six sub-themes, which are data centres, digital connectivity, data networks, digital transmission digital processing as well as digital services and IP.

The fund benchmarks its performance against the Tematica BITA Digital Infrastructure and Connectivity Sustainability Screened index and is part of the Global ETF Equity – Other Specialist sector.

Barbie trader

With a portfolio largely made of passive funds, Barbie might want to add some alpha and throw some individual shares in the mix. Considering her averaged annual salary, the higher cost of individual shares and the broker fees are not an issue for her.

Merricks suggested buying shares in personal care brand L’Oreal, athletic apparel retailer Lululemon and premium drink mixers producer Fever-Tree.

He said: “L’Oreal should provide a steady backdrop to the ETFs while she may like to try to benefit from working out by holding some Lululemon shares or some Fever-Tree for when she wants to cool down by either sipping the premium mixers on their own or with something a little stronger.”

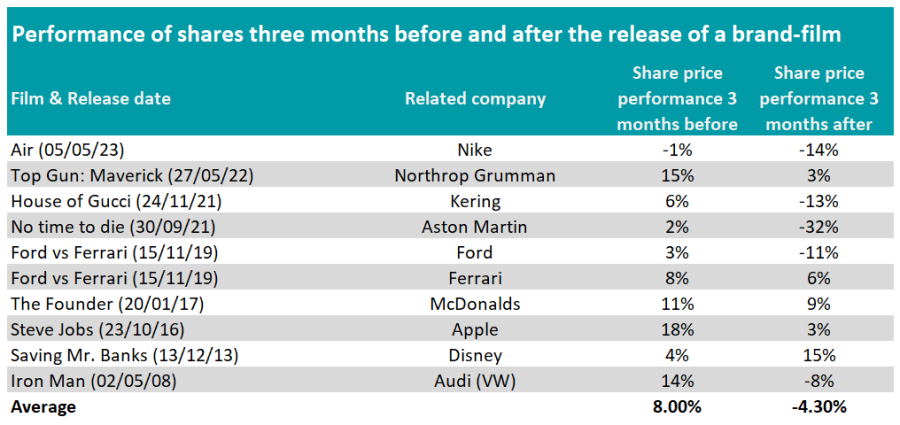

Finally, Barbie might want to hold shares in Mattel to ride the momentum her movie has created. Mattel’s share price rose 22% in the past three months, a pattern commonly observed with brand-focused films.

Performance of shares three months before and after the release of a brand-films

Source: eToro

According to investment platform eToro, a company’s share price will rise 8% on average in the three-month build up to the release of a brand-focus film but then fall 4.3% in the three months after.