Investing in emerging markets offers an exposure to burgeoning economies such as China, India or Brazil, but the high risk, high reward strategy is not for everyone and should only be a small part of an investor’s portfolio, according to experts.

The theory goes that ‘emerging’ economies such as China, India and Brazil should grow quicker than their developed counterparts in the US and Europe, meaning that companies linked to the domestic economy should also grow quicker.

However, these companies are also in countries that come with more geopolitical risk and economic uncertainty, making them more volatile.

Over the past 10 years they have certainly been the latter, but have failed on the former, as the outperformance of the US market dwarfed the returns of emerging markets equities.

Performance of indices over 10yrs

Source: FE Analytics

Last year was particularly tough for emerging markets due to the strong US dollar and interest rate hikes from the US Federal Reserve. Higher interest rates and a stronger dollar make local currencies weak, so it is more expensive for emerging market companies to service their debt, which ois generally denominated in US dollars.

Yet, the Fed is now expected to pause on its rate hikes and inflation is likely to fall faster in emerging markets, which could prove to be a tailwind for emerging markets.

In addition, valuations are cheap compared to equities in developed markets and competition between young companies for market share across regions remains alive, which should boost growth over the long-term.

Therefore, balanced investors may wonder how much of their portfolio they should invest in emerging markets to tap into those opportunities without exposing themselves to an excessive level of risk.

Emerging market equities

Tom Kynge, deputy fund manager at Sarasin & Partners said a 60/40 portfolio of stocks and bonds should have between 5% to 10% invested in emerging market equities.

However, Ernst Knacke, head of research at Shard Capital said a balanced investor could increase this proportion up to 30%.

He added: “We see very attractive opportunities in this region, especially for long-term investors. Crucially, the opportunity set is rich with world class, alpha generating investment managers, in a region that often lacks institutional coverage and where the volatility can really be taken advantage of.”

But Gavin Haynes, co-founder of Fairview Investing, said that investors with a balanced risk profile should limit their exposure to 6% despite the fact he believes that emerging markets will be a key engine of growth on the long-term.

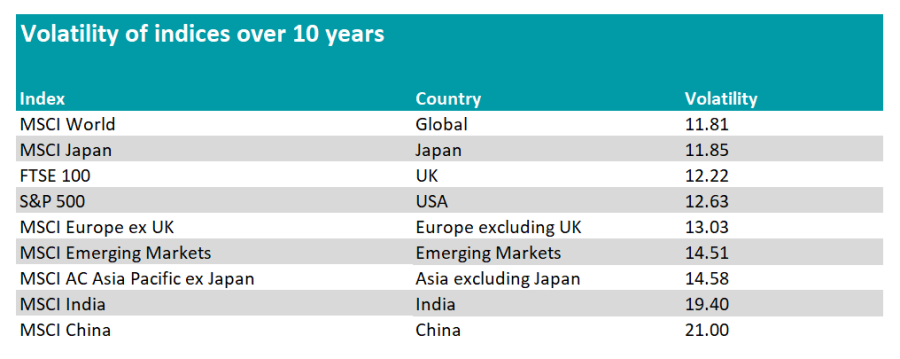

Volatility of indices

Source: FE Analytics

There is, however, a solution to benefit from the rise of emerging markets without having a direct exposure to the equities of this sector.

Tristan Dolphin, director, investment strategy & research at Stonehage Fleming said: “Our preference is to obtain the bulk of our exposure to emerging markets through high quality companies domiciled in the US and Europe – this year is testament to that approach with strong performances from consumer goods businesses, such as LVMH and L’Oreal.”

Emerging market bonds

Beyond equities, experts also consider that it might be advisable for some clients to take on fixed-income positions in emerging markets to supplement existing high quality developed market bonds in their portfolio.

Kynge added: “Typically, this may range from 0-5% depending on the opportunity in question and conviction in the idea. Emerging market bonds should always be viewed as higher risk and allocated in smaller sizes as a result.”

For Mike Stimpson, Partner at Saltus, the exposure to emerging markets equities and bonds would depend on where we are in the economic cycle. As a result, the allocation to emerging markets in Saltus’s portfolios has varied from 0% to 15% across both asset classes.

Should you have a specific exposure to China?

As the second largest economy in the world, and with the recent reopening of the country, investors could ask themselves whether they need a specific exposure to China via a country specialist fund.

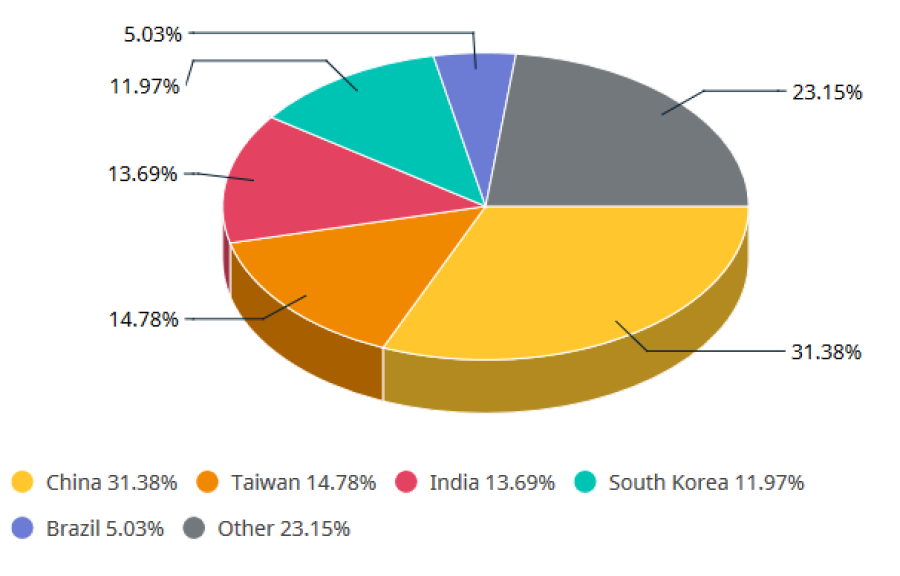

China is the largest constituent in emerging markets indices, with weightings of 31% in the MSCI Emerging Markets and 35% in the FTSE Emerging.

As a result, however, there is a limited number of IA Global Emerging Markets and Asia Pacific funds with a small allocation to China.

For instance, out of the 169 funds in the IA Global Emerging Markets sector, only 13 funds have an allocation to China below 20% and four with less than 10%.

Country weights in the MSCI Emerging Markets index

Source: MSCI

It is therefore difficult to avoid overlaps when holding both an emerging market and a China fund in a portfolio.

Knacke said it makes sense to have a specific exposure to China if the fund invests in A-shares as emerging market funds do not tend to invest in the Chinese onshore equity market.

He added: “Over time, more of this market will be included into market indices, which means the structural exposure to this market from institutional capital globally will continue to rise.

“Having the flexibility to specifically target this market through an actively managed, long term, fundamental investment approach could add significant value to client portfolios in the long run.”

However, it is becoming increasingly risky to invest in China with the rising geopolitical tensions with the US and the recent government’s crackdowns in several areas of the market.

Saltus’s Stimpson said: “For now, China is one region we are happy to forgo within our asset allocation armoury due mostly to the fact that we cannot be certain of getting our clients’ money back should the Chinese Communist Party change policy abruptly.”

Moreover, China is not always the best performing emerging market. For instance, Indian equities offered very strong returns in 2021, while China delivered negative returns.

Performance of indices in 2021

Source: FE Analytics

Dolphin said: “We prefer a more flexible Asia manager who is able to rotate capital across regions as opportunities present themselves.”