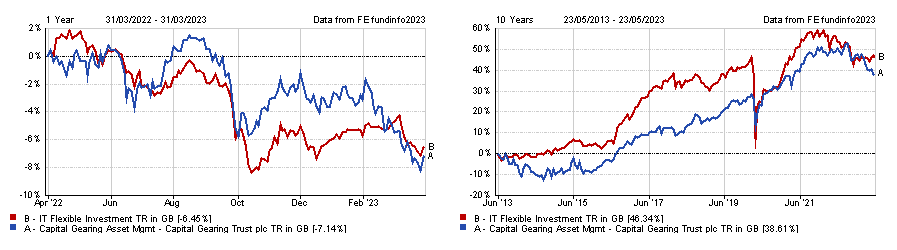

Capital Gearing Trust reported its worst results on record in today’s annual report, with returns dropping 7.1% over the past financial year.

The £1.2bn trust has climbed 38.6% over the past decade but disappointed shareholders with the second negative return in its 41 year history.

Despite priding itself on being a cautious holding for investors looking to preserve their capital, founder of CG Asset Management and manager of Capital Gearing Trust Peter Spiller said more defensiveness is needed.

Total return of trust vs sector over the past financial year vs past decade

Source: FE Analytics

Although the financial market scare in March seems to have passed, there could be more turbulence abound. Spiller said that Silicon Valley Bank and Credit Suisse are “unlikely to be the last shoes to drop”.

“Even if we are wrong, and a financial crisis is averted, it seems likely that a recession is on the horizon,” he added.

This was echoed by chairman Jean Matterson, who said markets will remain “fragile and unpredictable” for the foreseeable future, warranting additional caution.

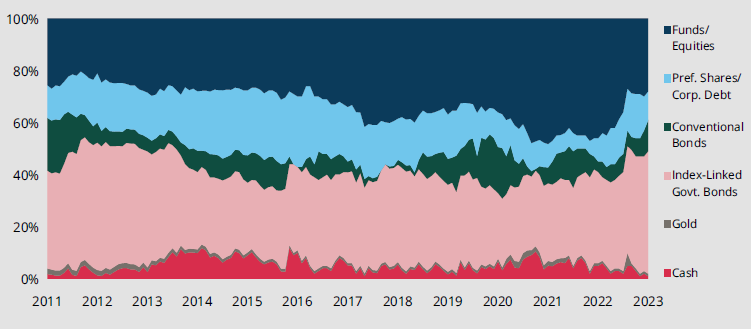

In response to these negative signs, Spiller reduced risk in the already cautious portfolio, explaining: “We are taking the opportunity to reduce our exposure to risk assets and take shelter in treasury bills. Our exposure to index-linked bonds is at record levels.

“While we sit on the side-lines of equity markets, we take great comfort from the fact that, for the first time in 15 years, we are being paid to wait.”

Spiller and co-managers Alastair Laing and Chris Clothier reduced exposure to equities and funds by 28.6% over the past year, cutting the amount of invested capital from £460m to £338m.

Equities in the property and infrastructure space were the trust’s worst performers throughout the year, accounting for most its underperformance.

The managers reduced exposure to sterling government bonds at the start of the financial year – which went on to become one of the best performers – in favour of these alternatives equities.

“We got this wrong,” Spiller said. “Losses from our property holdings were responsible for the entire loss the company experienced in the year.”

Since then, Spiller reduced property exposure from 16.5% to 4%. It was just one part of the portfolio impacted by the highest UK interest rates in decades.

“It is hard to overstate the significance of the change in interest rates,” Spiller said. “No part of our portfolio was untouched.”

However, tightening monetary conditions weren’t negative for all assets, with some areas of the portfolio benefiting from higher rates.

The “dramatic repricing” of government bonds, for example, opened the opportunity for Spiller to double his allocation to UK index-linked gilts.

This bolstered allocations to index-linked bonds in the portfolio from 35% to 46% throughout the year, while equities account for 29% of holdings.

Asset allocation since 2011

Source: CG Asset Management

Spiller said: “Rising yields means falling prices and this created a headwind for the portfolio. In that context it was satisfying that the bond portfolio delivered positive returns during the year.”