The Capital Gearing trust has been one of the most bought portfolios in recent months among DIY investors as markets have become increasingly difficult to predict.

The defensive nature of its holdings has made it an attractive option for investors’ seeking ways to hedge their portfolio against inflation, which reached 7% in the UK in March.

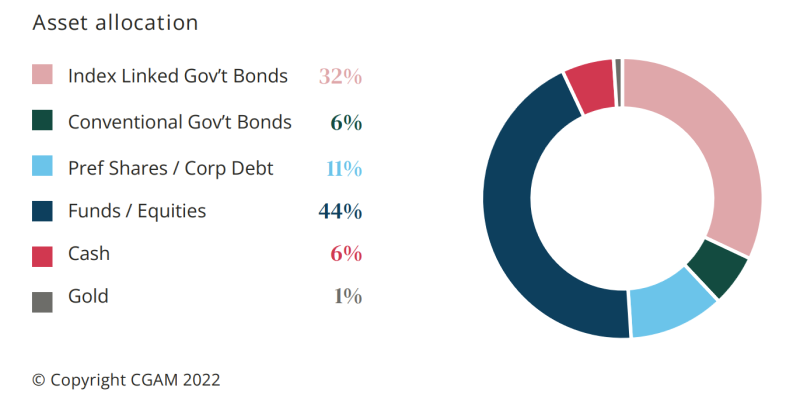

Capital Gearing has a high allocation to government bonds at 38% as they are typically considered a secure long-term investment when markets are volatile.

Equities make up the largest weighting at 44%, but top holdings are held in cautious assets such as property companies, Vonovia and Grainger.

Asset allocation of trust

Source: Capital Gearing Trust

Its defensive stance has allowed the trust to increase returns at a higher rate (7.7%) than the consumer price index (CPI) over that past year, while also beating peers in the IT Flexible Investment sector by 7.1 percentage points.

This outperformance has also occurred over a 10-year period, with Capital Gearing soaring 52.3 percentage points ahead of the rate of inflation.

Total return of trust vs sector and CPI over the past 10 years

Source: FE Analytics

Some investors may use it as a core position in their portfolios now, but owning just one fund is a high-risk strategy. As such, Trustnet asked experts what funds would fit well alongside it.

Ruffer Total Return

Although Capital Gearing succeeds in hedging portfolios against rising inflation, performance can be quite volatile, according to Tom Sparke, investment manager at GDIM.

He said that the Ruffer Total Return fund also gives investors inflation protection and diversification, but at a more consistent rate.

Its 36.1% allocation to equities is lower than Capital Gearing, which Sparke said helps increase returns when tough rotations test the market.

He added: “Despite having a similar goal and using some of the same asset classes, they do not have a high level of correlation over most periods – if held together the Ruffer fund often moves differently on a day-to-day basis, making it a good partner for Capital Gearing.

“I think, as a pair, an investor can reduce risk and still have effective inflation protection from holding this combination.”

When comparing the performance of the two funds over the past decade, Ruffer Total Return tends to outperform when Capital Gearing is below its peer group and even has a higher total return of 75.2% over the period.

Total return of funds over the past 10 years

Source: FE Analytics

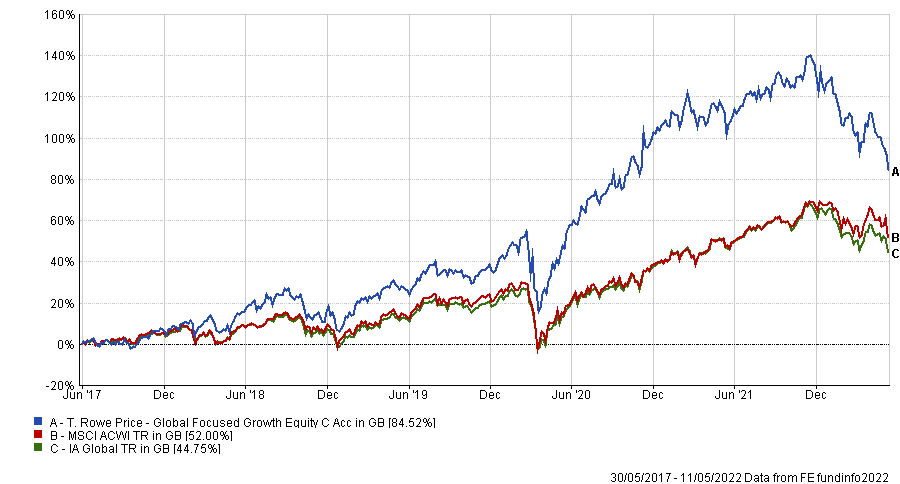

T. Rowe Price Global Focused Growth Equity

Conversely, Rob Morgan, chief analyst at Charles Stanley, recommended a fund with more volatility than the Capital Gearing trust.

The T. Rowe Price Global Focused Growth Equity fund invests in core global growth assets, which will mean sharper drops in performance but higher returns over the long-term, he said.

It has dropped 18.8% since he start of the year as many global funds struggle from the shift to value, but returns were up 84.5% since its launch in 2017, beating the IA Global sector by 39.8 percentage points and MSCI ACWI benchmark by 32.5 percentage points.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

The portfolio contains round 85 holdings, making it more concentrated than Capital Gearing’s 243 assets but Morgan said the companies it is invested have “the potential for above-average and sustainable rates of earnings growth in excess of market expectations”.

He added: “It has typically performed better in relative terms in rising markets and less well in times of market stress, essentially the opposite of Capital Gearing, which makes it worth considering for diversification.”

Montanaro UK Smaller Companies

Ben Yearsley, director of Fairview Investing Limited, said “there is no point having something doing the same or a similar thing” in your portfolio, so suggested the Montanaro UK Smaller Companies trust.

The trust is up 108.4% over the past decade but has been about half as successful as its peer group, which increased 214.9% over the same period.

Total return of trust vs sector and index over the past 10 years

Source: FE Analytics

However, Yearsley pointed out that the 1% dividend it pays out to shareholders every quarter could make it an attractive source of income, while the trust’s 12% share price discount made it a “good long-term buying opportunity”.

“Long-term returns don’t look brilliant, but I am confident in the fund over the long term,” he said, pointing to the leadership of “veteran stalwart” fund manager Charles Montanaro, who re-took over running the fund in 2016.