The coming year is filled with uncertainties, from the spread of the Omicron variant to rising inflation, all of which places central banks under pressure to make monetary policy moves that could end up being wrong.

One thing is for certain, however: more of us will need to invest our cash, as savings rates are near record-lows, with nothing on the market from cash Isas to current accounts able to match inflation. This means that, in real terms, any money in these vehicles will be losing value.

Even the most cautious of investors will need to dip their toes into other assets, but this backdrop makes it more difficult than ever for individual investors to know where to put their savings. Below, five fund pickers give their top portfolio picks for people with a risk-averse mindset.

Ruffer

First up, William Heathcoat Amory, head of research at Kepler Trust Intelligence, suggested investors look towards the Ruffer Investment Company, one of two investment trust picks on the list.

The £717m trust is ‘cautious’ in the sense the managers aim to generate steady returns with minimal downside. This has meant that over the long term it can struggle when markets consistently rise, which explains it bottom-quartile performance in the IT Flexible Investment sector over the past decade. It has made 66.6% over 10 years, compared with an average of 71.7% among its peers.

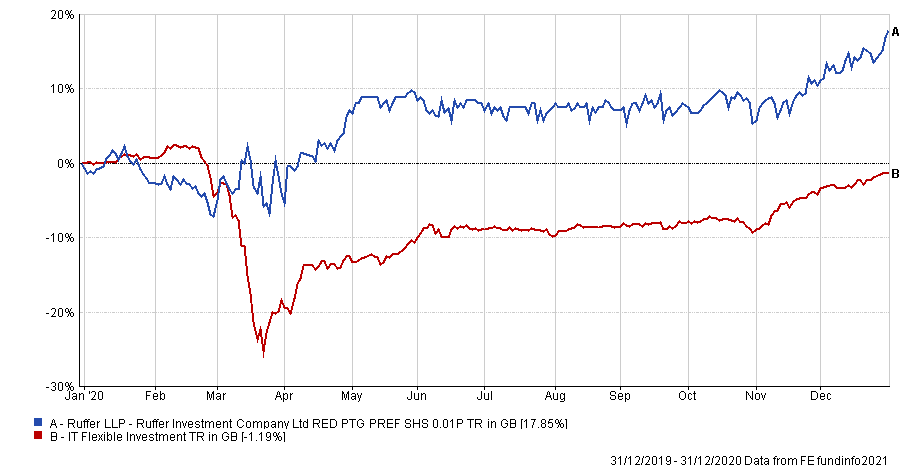

However, it has managed to generate high returns in certain crisis periods, such as in 2020, when it was the best fund over the course of the year, returning 17.9%.

Total return of trust vs sector in 2020

Source: FE Analytics

“One of the key long-term convictions of the managers has been that high inflation is coming, and their portfolio is built to protect against it. With high inflation numbers being posted in the US and UK in recent months, this is likely to be a key issue in 2022,” said Heathcoat Amory.

“Ruffer believes inflation will be persistent, but central banks will be unable to raise rates very high due to the levels of indebtedness in the economy. It will be interesting to see how this plays out in 2022, with the Bank of England already having hiked once.”

Trojan Ethical Global Income

Next is Tertius Bonnin, assistant portfolio manager at EQ Investors, who selected the Trojan Ethical Global Income fund, managed by James Harries and Tomasz Boniek.

“It uses a tried-and-tested investment strategy developed by Troy Asset Management, a house known to have an unapologetic focus on quality companies,” he said.

“This fund is a new launch and marks an evolution from the main Trojan Global Income fund whereby a new sustainability dimension has been added to the investment process.”

The fund invests in a global portfolio of high-quality companies that must stand up to “rigid” analysis of financially material environmental, social and governance (ESG) factors, as well as traditional financial analysis.

The smallest fund on the list at just £14m, it was only launched in November 2021, making performance comparisons meaningless this early on.

However, the managers have a good track record, as the Trojan Global Income fund has made 54.2% since its launch in 2016, around 4 percentage points higher than the average fund in the IA Global Equity Income sector, although behind the MSCI World index’s 89.2% return.

Artemis Target Return Bond

Tom Sparke, investment manager at GDIM, suggested cautious investors could look towards the IA Targeted Absolute Return sector for 2022.

“In a time of tightening monetary policy and great uncertainty around the prospects for bonds, the more cautious investor suddenly has a lot fewer options,” he said.

“Nevertheless, there are some solutions – one such comes from Artemis in their Target Return Bond strategy.”

Run by bond veteran Stephen Snowden, the fund is run on a very low level of volatility and has gained genuine real returns in its relatively short lifespan. Indeed, since December 2019, the fund has made 9.9%, beating interest rates and the average sector peer – although this comparison is difficult as the sector comprises many different strategies.

“The fund holds a high quality collection of assets that have a low sensitivity to interest rates. At a cost of just 0.40% [OCF] it is an attractive lower-risk proposition with good prospects for inflation-busting performance,” Sparke said.

TwentyFour Corporate Bond

Chris Metcalfe, investment director at IBOSS, also picked a fund that invests in bonds, choosing the TwentyFour Corporate Bond as his safe pick for 2022.

“With a large percentage of the fixed-income market producing negative returns in 2021, bond funds have increasingly become out of favour,” he said.

“The outlook for 2022 doesn’t look particularly positive either as central banks are finally bringing the era of super-loose monetary policy to an end in the face of non-transitory inflation.”

However, a cautious investors will likely need to maintain a bond exposure for diversification, to dampen down the risk of stock markets and other assets.

“Our first choice is veteran TwentyFour manager Chris Bowie who runs their Corporate Bond fund. Chris has always emphasised risk-adjusted returns and in a new period of tightening monetary policy, this is an approach we are particularly comfortable with,” he noted.

Since it launched in February 2015, the fund has made a 32.4% return, beating the IA Sterling Corporate Bond sector average

Total return of fund vs sector since launch

Source: FE Analytics

Supermarket Income REIT

Last up is the second investment trust on the list – Supermarket Income REIT – which was selected by Daniel Lockyer, senior fund manager at Hawksmoor.

“As the name suggests, this REIT owns a portfolio of high-quality, omni-channel (meeting the needs of all sources of business from in-store shopping, online delivery and click and collect) supermarket properties that are let to the major supermarkets in the UK, with Tesco and Sainsbury’s making up about 75% of the assets,” he said.

“The average leases on these supermarkets are for 15 years with 90% of rents rising each year with inflation.”

Since it launched in July 2017, the trust has made 47.3%, almost 30 percentage points more than the average IT Property – UK Commercial sector, as the below chart shows.

Total return of trust vs sector since launch

Source: FE Analytics

“The yield on the REIT today is close to 5% which compares very well with almost any other part of the bond or property market, and indeed compared to Tesco’s own corporate bond that yields just 2%,” said Lockyer.

| Fund | Sector | Fund size | Manager name(s) | Yield | OCF | Gearing | Discount/Premium |

| Artemis Target Return Bond | IA Targeted Absolute Return | £216m | Stephen Snowden, Juan Valenzuela | 2.56% | 0.40% | N/A | N/A |

| Ruffer | IT Flexible Investment | £714m | Hamish Baillie, Duncan MacInnes | 1.09% | 1.08% | 0.0% | 2.6% |

| Supermarket Income REIT | IT Property - UK Commercial | £945m | Atrato Capital | 4.02% | 1.37% | 46.9% | 13.1% |

| Trojan Ethical Global Income | IA Global Equity Income | £14m | Troy Asset Management | 0.00% | N/A | N/A | N/A |

| TwentyFour Corporate Bond | IA Sterling Corporate Bond | £1,422m | Chris Bowie, Gordon Shannon, Graeme Anderson, The Outcome Driven Team | 3.42% | 0.34% | N/A | N/A |