Diversification is key when building a portfolio and that means the inclusion of different asset classes, such as equities, bonds, commodities, properties, etc.

Equities and bonds are often paired together due to their historically negative correlation. In other words, bonds should offer protection when equities are falling.

There are times when this does not materialise and bonds fail to protect investors’ portfolios – such as was the case last year when bonds fell alongside equities.

Yet, as central banks seem to be nearing the end of their hiking cycle, bonds could play their traditional role again.

As a result, investors who do not hold bonds in their portfolio yet, might want to start building the fixed income block.

To do that, a passive funds could work as a core holding. Dzmitry Lipski, head of funds research at interactive investor, chose the Vanguard Global Bond Index fund, which is hedged to sterling and has a low ongoing charge figure (OCF) of 0.15%.

The fund tracks the Bloomberg Global Aggregate Float Adjusted and Scaled Index. That includes more than 20,000 investment grade and government bonds from across the globe with maturities over one year.

Lipski said: “The managers of this fund use stratified sampling to build the portfolio, the index is broken down into key risk factors such as duration, currency or rating and investments are chosen to mimic the risk profile of each section of the index while avoiding illiquid bonds.”

Another passive option with the same asset manager is the Vanguard Global Credit Bond fund, with a 0.35% OCF.

Rob Morgan, chief analyst at Charles Stanley, said: “Vanguard Global Credit Bond invests in a diversified portfolio of global corporate bonds with a focus on developed market investment grade securities, but with some scope to buy high yield, investment grade, emerging market bonds and other asset classes.”

“Benefitting from Vanguard’s worldwide fixed income research capability, credit and sector selection are likely to be the primary drivers of relative performance with duration kept close to that of the benchmark.”

However, after a year where bonds failed to fulfil their task of offsetting the fall of equities, investors might prefer to hold a core bond fund with a manager trying to find ways to respond to this problem.

Alena Kosava, head of investment research at AJ Bell, said: “Fixed income markets have become increasingly volatile and have been driven my macro events as much as (if not more than) by market fundamentals over the past decade.

“It can often be tricky for clients to put a portfolio of fixed income funds together in order to achieve a dependable outcome as part of the overall fixed income allocation.”

Therefore, Kosava added that strategic bond managers can offer an opportunity to ensure investors’ fixed-income holdings evolve dynamically over time, with consideration for both macro-economic developments and the underlying credit fundamentals.

She chose Artemis Strategic Bond, which has been part of the top quartile in the IA Sterling Strategic Bond sector over 10 years, although the performance has not been as good over shorter periods.

Performance of fund vs sector over 10yrs

Source: FE Analytics

Kosava said: “The fund has a slightly long duration bias, with recent trading having been in the range of 5.25 to 5.75 years, with the largest duration contribution for the fund derived from investment grade credit and government bond exposure.

“The team is nimble and dynamic and will move the portfolio around based on market conditions as well as the prevailing technical backdrop, including supply and demand imbalances, market liquidity, sentiment and positioning, and so on.”

She added that the fund had little-to-no government bond exposure a few years ago, but the managers have been building up their allocation in sovereign bonds as value is starting to emerge.

Kosava said: “Half of the fund is currently allocated towards investment grade corporate bonds, whilst also featuring a quarter in high yield issues and a fifth of the portfolio in government bonds.”

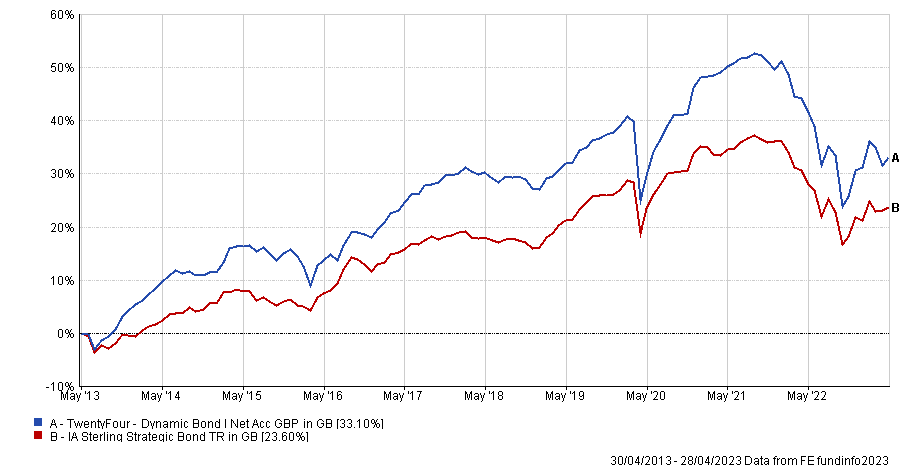

Still in the same sector, Jason Hollands, managing director at Bestinvest, picked the TwentyFour Dynamic Bond fund.

Similar to Artemis Strategic Bond, it has been among the top quartile of the IA Sterling Strategic Bond sector over 10 years and then broadly fluctuated between the second and third quartiles over shorter periods.

Performance of fund vs sector over 10yrs

Source: FE Analytics

The fund invests in both government and corporate bonds and across the credit spectrum from investment-grade credit ratings through high-yield bonds with sub-investment grade rating.

Hollands said: “Duration is actively managed in the portfolio too. The fund can therefore be adjusted significantly depending on the outlook and where the best opportunities are at any given time, rather than narrowly focused on one part of the fixed income asset class.

“The team have very strong skills in asset-backed securities. The fund is able to use derivatives to manage interest rate and credit risk, helping it to perform in both rising and falling interest rate environments.”

A third option in the IA Sterling Strategic Bond sector is Allianz Strategic Bond, which deliberately seeks to have a negative correlation with equities.

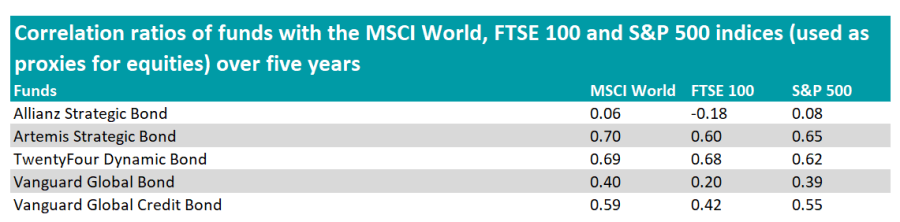

Correlation of funds to the MSCI World, FTSE 100 and S&P 500 indices over 5yrs

Source: FE Analytics

Sheridan Admans, head of fund selection at TILLIT, said: “Since Mike Riddell took over running the fund, it has achieved a correlation to equities lower than any peer in the sector.

“Riddell identifies turning points in macro conditions by focusing on inflation, changes in monetary policy, prevailing financial conditions, political trends, and the risk appetite of investors in determining positioning within the fund. He also ensures that the portfolio remains liquid.”

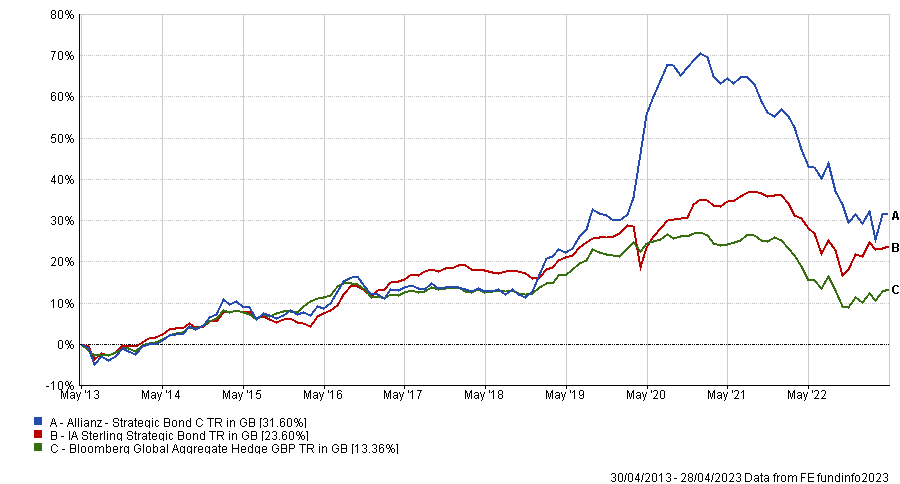

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Depending on the periods, the fund has been either in the top or bottom quartiles of the IA Sterling Strategic Bond sector. For instance, the fund has been in the first quartile over 10 and five years, but fourth quartile over one and three years.

Admans added: “The manager's macroeconomic views drive the holdings in the fund, and returns are generated from four areas: interest rate movement, foreign exchange movements, inflation, and corporate bonds.

“The fund can invest in any part of the bond market, including both high yield and investment grade bonds. While it usually buys government bonds directly, it tends to use derivatives to access the corporate bond market. Additionally, the fund can invest in emerging markets, focusing on US dollar-denominated bonds (hard currency), although it will sometimes invest in local currency ones.”