Investing in high-octane, potentially high-risk assets is not something that comes naturally during times of market turmoil such as the one we are currently going through.

However, there are several adages that suggest now may be the right time to buy while others sell, zigging when the rest of the market is zagging.

It has been a tough year for a number of asset classes, but below fund pickers outline where they would consider putting their cash if they were unafraid of losing money and had a long-term time horizon for which to make back any short-term losses.

Emerging market growth

Chris Metcalfe, chief investment officer at IBOSS, said one area that might appeal is the emerging markets, which have suffered from a number of setbacks in 2022.

A strong US dollar has impacted overseas companies that have their debt denominated in the currency, while the zero-Covid policy in China has stymied growth with this market yet to enjoy a post-pandemic recovery.

“As we potentially roll over from peak dollar and China winds down its zero-Covid policy, this is a tremendous opportunity to invest in emerging markets,” Metcalfe said.

While some pockets, such as the commodity-rich countries in Latin America, have performed well as this year supply chain disruption has increased prices, but the former darlings in the technology and healthcare sectors have been hit hard and could be oversold.

“One of the funds we have stuck within this space is the Baillie Gifford Emerging Markets Growth fund. As is typical with Baillie Gifford funds, and as the name suggests, it focuses on growth, often tech-orientated stocks,” he noted.

Although the portfolio remains a top-quartile performer over 10 years, it has lost 21.4% over the past year, around 7 percentage points more than the IA Global Emerging Markets sector average and MSCI Emerging Markets benchmark.

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Mike Gush – the longest-tenured manager on the fund – has been with the team since 2015 and has also been co-managing the China fund since 2009, which Metcalfe said was crucial.

“The team tends to outperform their peers in rising market conditions and, as we are bullish on emerging markets from here, this is the kind of fund that should do well in this space,” said Metcalfe.

Emerging market income

Sticking with the region, Alena Kosava, head of investment research at AJ Bell, suggested investors may want to consider JPM Emerging Markets Income instead.

“While emerging market equities have suffered material underperformance over the past few years, this has largely been driven by steep losses in China,” she said, but agreed with Metcalfe that the end of zero-Covid policies could be upon us.

Additionally, while Western central banks are fighting inflation, emerging economies were swift to react and raised rates, with many regions now in a position to start easing policy.

“An equity income approach at the current juncture appears attractive, offering some cushioning in the form of regular dividends,” said Kosava, noting that the JPM Emerging Markets Income fund is currently yielding 4.2% but also aims to provide capital growth over the long term.

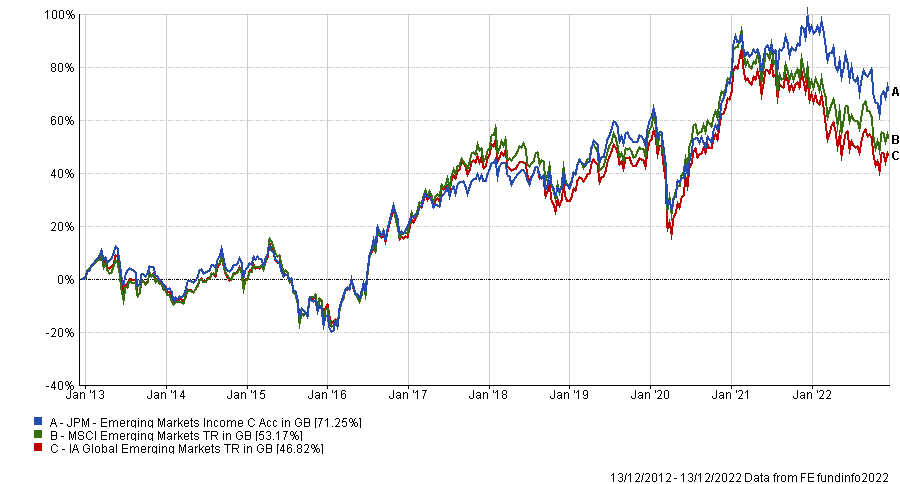

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

The fund has been a top-quartile performer over the past decade, as the above chart shows, but has also held up well over the past 12 months, down 13%, 1 percentage point less than the average peer.

“This is a credible income strategy with a breadth of analytical support combined with a dedicated portfolio management team focusing on the income consideration,” said Kosava.

UK small-caps

Turning closer to home, Kamal Warraich, head of equity fund research at Canaccord Genuity Wealth Management, said Blackrock Smaller Companies Trust, managed by the experienced the firm’s emerging companies team, may be of interest to those willing to take on more risk.

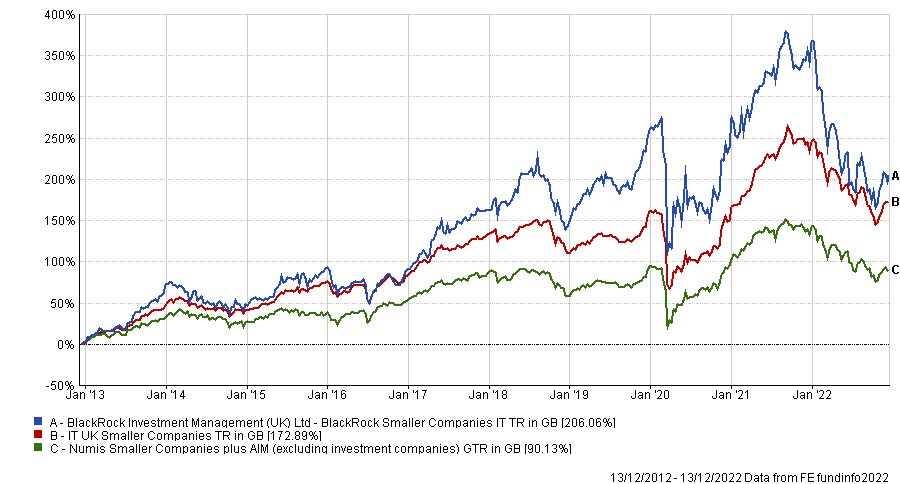

The fund has produced strong returns over the long term, more than doubling its Numis Smaller Companies ex IT benchmark’s returns over 10 years and beating its average IT UK Smaller Companies peer by 30 percentage points, as the below chart shows.

Total return of trust vs sector and benchmark over 10yrs

Source: FE Analytics

“The strategy seeks out the most exciting and innovative companies, which are typically growing very quickly and on course to becoming market leaders,” said Warraich.

“UK small-caps have been extremely unloved this year for a variety of reasons, and as a consequence the trust has been trading at a discount, while the trust can employ gearing that can amplify both the upside and downside.”

European smaller companies

Sticking with smaller companies, Simon Evan-Cook, fund manager at Downing, said investors need only look a little further to across the channel for inspiration, as European smaller companies are appealing.

He said: “About as aggressive as I get is to pick a reliable, experienced fund manager running a style and market-cap exposure that the market currently hates, and in a region that’s just been walloped by ‘the macro’.

“Doing this feels uncomfortable, but you can at least be assured it won’t be the very worst time to buy it – not something you can say when buying a fund that’s riding high in the performance tables.”

At present, European smaller companies top the list after a terrible run over the past couple of years as investors have run away from risk on the back of rising inflation and interest rates. This has been exacerbated by the war in Ukraine, which has impacted the region far more than elsewhere in the world.

“There are now some real bargains appearing in this part of the market – you can buy into a host of high-quality, growing companies at knock-down valuations,” he said.

His pick is to invest with Matthias Born, who runs the Berenberg Europe ex UK Focus fund, which launched in 2021 and has had a difficult start to life, lagging both the sector and benchmark.

Total return of fund vs sector and benchmark since launch

Source: FE Analytics

“He favours higher-quality companies, albeit those outside of the large and mega-cap parts of the market that have held up relatively well this year. At a time when the economic environment looks shaky, this feels like the right level of risk to be taking for those with an iron stomach and a long-term investing horizon,” said Evan-Cook.

Gold

Lastly, for investors that want to avoid regional bets, Gill Hutchison, research director at The Adviser Centre, suggested a thematic approach could work and highlighted the Ninety One Global Gold as her pick.

The fund is invested primarily in gold mining companies – meaning it is an equity fund, not a physical gold fund. This means that, while its performance is correlated to the price of gold, returns are based on other factors as well such as the actions of the underlying mining companies.

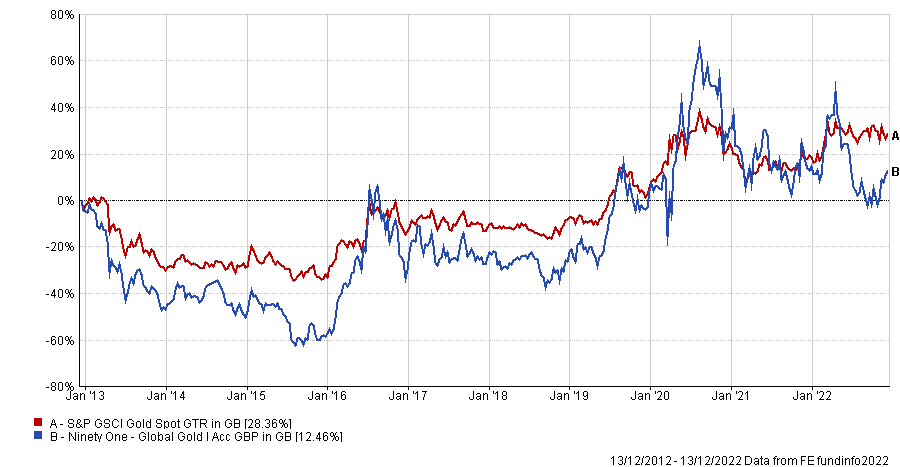

Total return of fund vs gold spot price over 10yrs

Source: FE Analytics

The price of gold has struggled to make headway in 2022 despite being recognised as a haven asset as it has been held back by the strong US and higher yields on offer from government bonds.

“Looking ahead to 2023, it is possible that the US dollar has already peaked, removing this headwind. In addition, the market is anticipating a less restrictive monetary environment, which should also be supportive,” said Hutchison.

“Further uncertainty about the economic order, such as rising default rates, would add to the metal’s appeal. Geopolitical tensions and the process of de-dollarisation by the likes of China and Russia means that central banks have increased their purchases of gold, adding a technical bid to the gold price. Investors can always expect an excitable ride in gold funds but, at present, the backdrop looks to be stacked in their favour.”