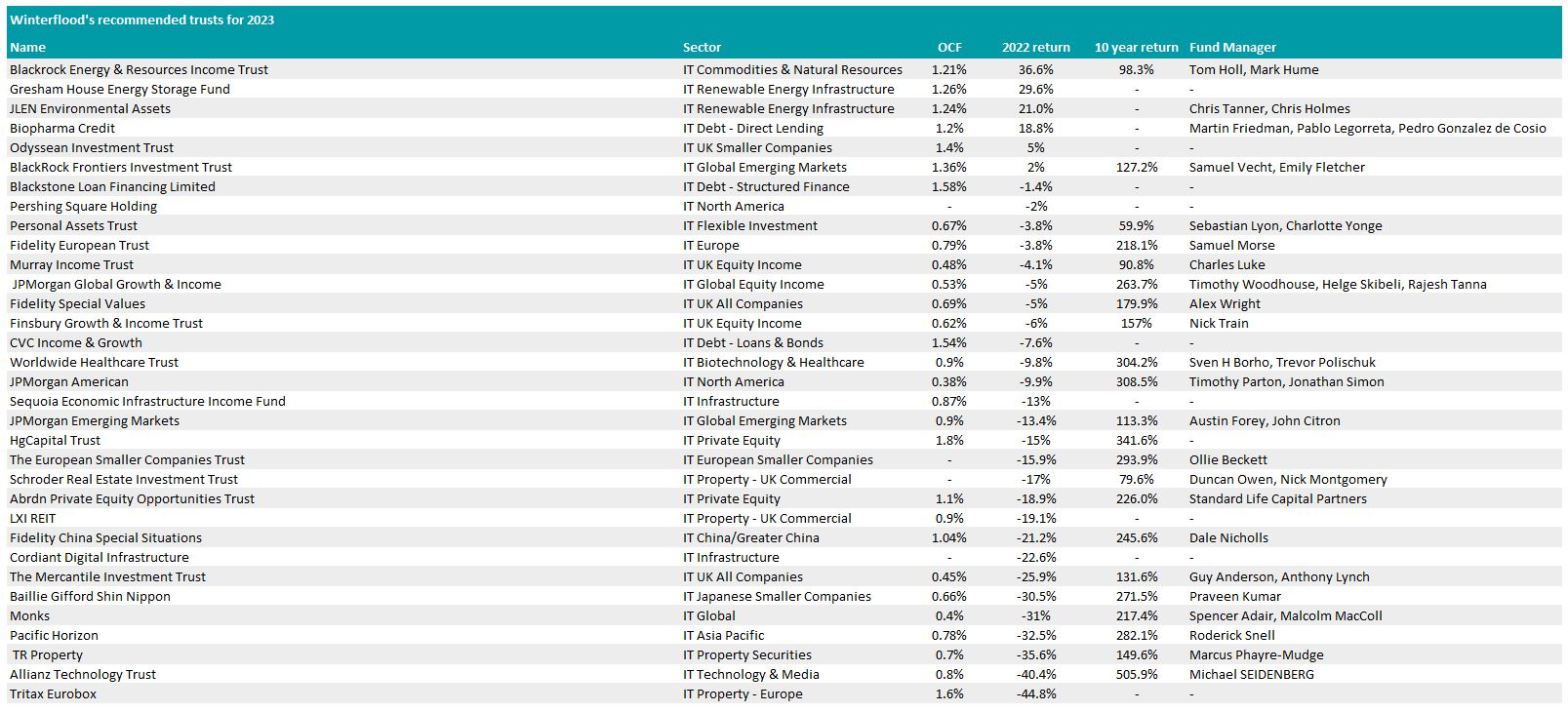

Research firm Winterflood has wrung the changes on its recommended list of investment trusts heading into 2023, removing 18 funds and adding 15 names that they expect to outperform over the next year.

This list now consists of 33 portfolios in total (19 of which are primarily invested in equities), which is two funds fewer than last year as tricky market conditions test managers’ strategies.

The report pointed out that the average trust discount stretched from 2.5% at the start of 2022 to 13.4% today, meaning that shares in investment companies are five times cheaper than they were a year ago, perhaps presenting an opportunity to invest.

Below, Trustnet looks at the changes made by head of research Emma Bird and analysts Shavar Halberstadt and Shayan Ratnasingam for the coming year among the equity trusts on the list.

Source: Winterflood

UK funds

Analysts at the firm added one name to their UK recommendations this year - the £989m Murray Income Trust.

The report said that it had a long-term record of growing dividends and added that the ongoing charges figure (OCF) of 0.48% makes it “an attractively low-cost vehicle”.

Indeed, its current discount of 6.9% is “notably bigger” than its peers in the IA UK Equity Income sector, but could shrink in the coming year according to analysts.

They said: “We would expect the fund to be re-rated if relative performance improves, while any increased marketing efforts in light of its 100-year anniversary this year could also support the rating.”

Winterflood cut their recommended UK funds from seven to five this year, with abrdn UK Smaller Companies Growth, Edinburgh Investment Trust and Lowland Investment Company exiting the list.

Fidelity Special Values, Mercantile Investment Trust, Finsbury Growth & Income and Odyssean Investment Trust remained on the recommended list and round out the five UK options.

US funds

Pershing Square Holdings was added alongside JPMorgan American to make up the North American part of the recommendation list for 2023.

The $11.7bn (£9.6bn) portfolio is up 168.7% since launching in 2014, investing primarily in a combination of quality companies and private equity.

Winterflood analysts anticipate strong performance from its large-cap holdings this year, stating: “If these companies prove resilient in 2023, there undoubtedly is scope for the shares to re-rate, supported by the ongoing buyback programme.”

They compared the fund to renowned investor Warren Buffett’s Berkshire Hathaway for its fundamental analysis of stocks, noting that larger companies allow the trust to take advantage of hedging, which has $2.6bn last year for investors.

European funds

The European Smaller Companies Trust entered the recommended list this year as Winterflood analysts anticipate its balanced approach to fare well in the volatile market conditions of 2023.

They said that its portfolio was highly diversified, containing 125 holdings that span a number of countries across the continent.

Its current discount of 17% makes it the widest in the IA European Smaller Companies sector, so investors looking for a bargain may want to consider this trust.

Analysts said: “We view this as an attractive entry point and believe that the shares could be re-rated if sentiment towards Europe improves and the fund maintains its relative performance record.

“Investors should be aware that there is no discount control policy and the fund has not bought back shares since 2017.”

The trust climbed 293.9% over the past decade, striding 78.5% ahead of its peers in the IT European Smaller Companies sector.

Total return of trust vs sector over the past decade

Source: FE Analytics

It replaced the Baillie Gifford European Growth trust, which was dropped from the list this year after sinking 24.7 percentage points below the IA Europe sector average in 2022, making a negative return of 41.4%.

Indeed, the £327.8bn portfolio run by FE fundinfo Alpha manager, Stephen Paice, is now the worst performing trust in the sector over the past decade. Fidelity European Trust meanwhile was the other fund recommended, retaining its spot on the list for 2023.

Asia funds

Turning to Asia, Winterflood ditched their recommendations for Schroder Asian Total Return and abrdn Asia Focus in favour of two new trusts.

Fidelity China Special Situations entered the list due to its bias towards value assets and smaller companies, which the analysts at Winterflood said differentiated it from its peers in the IT China/Greater China sector, pointing to its allocation in unlisted companies and short positions as making good use of the freedom of the investment trust structure.

Returns were up 245.6% over the past decade, making it the best performing trust in its peer group over the period.

Total return of trust vs sector over the past decade

Source: FE Analytics

The Pacific Horizon Investment Trust also joined the recommended list for 2023, which may be of interest to investors looking for a wider exposure to Asia.

Winterflood analysts liked its contrarian stock picking approach and said that its highest exposure to metals and mining should boost returns in 2023 if commodities continue to thrive.

“It has built a successful track record of allocating capital based on analysis of fundamentals and structural trends, even when these decisions contravene prevailing sentiment,” the report said.

The report said that it has frequently been ahead of the curve in its asset allocation, moving away from China and into India in 2020 and pivoting technology to materials in 2021, both of which were seen as controversial moves at the time.

Other regions

Elsewhere, in the emerging markets the analysts retained both the JPMorgan Emerging Markets and BlackRock Frontiers Investment Trust. The former fell 13.4% last year but remains a top-quartile performer over the decade (up 108.6%), while the latter made 2%% in 2022 and has an even better 10-year return of 131.9%.

In Japan, the analysts continue to rate Baillie Gifford Shin Nippon as the only option from the country. Last year the trust made a 30.5% loss, but it remains the best performer in the IT Japanese Smaller Companies sector over the decade, up 285.2%.

“We believe that Baillie Gifford Shin Nippon’sfocus on high growth Japanese smaller companies, coupled with its high active share and the manager’s ability to select successful companies, as demonstrated by its long-term performance,is likely to deliver significant returns over the long run,” the analysts said.