There is a lot of optimism that Japan will become more attractive in the years to come after decades of stagnation, but with so many portfolios to choose from, knowing how to play the market can be tricky.

Pictet Asset Management recently forecast that Japanese equities will deliver an annual return of more than 10% in the next five years, outperforming US equities and almost matching returns from emerging markets equities but with a lower volatility.

Year-to-date, the MSCI Japan index has outperformed the MSCI Emerging Markets but still trailed the MSCI USA.

Performance of indices year-to-date

Source: FE Analytics

Whether Japanese equities will outperform their US peers remains to be seen. However, wealth managers told Trustnet what funds they use to benefit from those positive prospects.

RBC Brewin Dolphin considers Jupiter Japan Income as a core offering for exposure to Japanese Markets.

David Cadwallader, investment manager at wealth manager RBC Brewin Dolphin, said: “Jupiter Japan Income invests in a relatively concentrated portfolio of around 40 stocks and will tend to have a bias to high-quality, large cap names.

“Historically, there has also been a bias towards growth companies, with the manager preferring firms with strong cash flows, rising earnings and strong franchises.”

Performance of fund over 10 years against sector and index

Source: FE Analytics

The fund has outperformed the TOPIX benchmark and is in the top quarter of the IA Japan sector over 10 years.

Parmenion also uses Jupiter Japan Income as a core strategy for Japan.

Jasper Thornton-Boelman, investment director at the firm, said that the dividend focus enables the fund to keep a degree of discipline across the portfolio in spite of its mix of value and growth stocks.

He added that it can be used as a single fund allocation or as a part of a blend.

When it comes to blending, Momentum Global Investment Management (MGIM) uses FSSA Japan Focus and Morant Wright Fuji Yield.

FSSA Japan Focus was launched in October 2015 and is managed by FE fundinfo Alpha Manager Martin Lau and Sophia Li. The fund is in the top quartile of the IA Japan sector over five years, but has been among the worst performing funds of the sector over three and one year.

Performance of fund since launch against sector and index

Source: FE Analytics

Morant Wright Fuji Yield is an offshore fund domiciled in Ireland. It has outperformed the Off Mt Equity – Japan sector since its launch in November 2014.

Lorenzo La Posta, fund manager at MGIM, said: “Both are fundamental, concentrated, active funds with opposite investment styles, the former a growth portfolio looking at innovators, disruptors, new-economy companies and the latter a value fund, buying discounted, unloved stocks that are cash-rich and willing to reward shareholders.

“Both teams have extensive experience in the region and a long track record to back them up.”

Performance of fund since launch against sector

Source: FE Analytics

In the value space, Canaccord Genuity Wealth Management (CGWM) uses LF Morant Wright Nippon Yield.

Kamal Warraich, head of equity fund research, said it is because of the fund’s disciplined value approach.

He added: “It also plays into the wider dividend growth theme in Japan, which is gaining more traction in recent years.”

The fund has been in the top quartile of the IA Japan sector over 10, three and one year. It has also been doing well over the past few months, ranking again in the top quartile of the sector over six, three and one months.

Performance of fund over 10 years against sector and index

.png)

Source: FE Analytics

In the growth space, CGWM prefers using SPARX Japan.

Warraich said: “Whilst the fund is focused on long-term growth, there is a valuation discipline inherent in the process which we like. Alongside the structural themes, the manager is also keen to target Japan’s manufacturing excellence which leads to an industrials sector overweight.

“This adds considerable differentiation vs peers. The manager has produced excellent risk-adjusted returns over his tenure.”

SPARX Japan is also an offshore fund domiciled in Ireland. It has outperformed both its benchmark and sector over 10 years.

Performance of fund over 10 years against sector and index

Source: FE Analytics

Finally, Brooks Macdonald uses Pictet Japanese Equity Opportunities.

Harry O’Connor, research analyst, head of Japan equities at Brooks Macdonald, said: “One of our model fund exposures is Pictet Japanese Equity Opportunities.

“The fund is a go anywhere blended-style approach which can be useful as a core holding where small allocations might not always provide scope for multiple holdings in the region.”

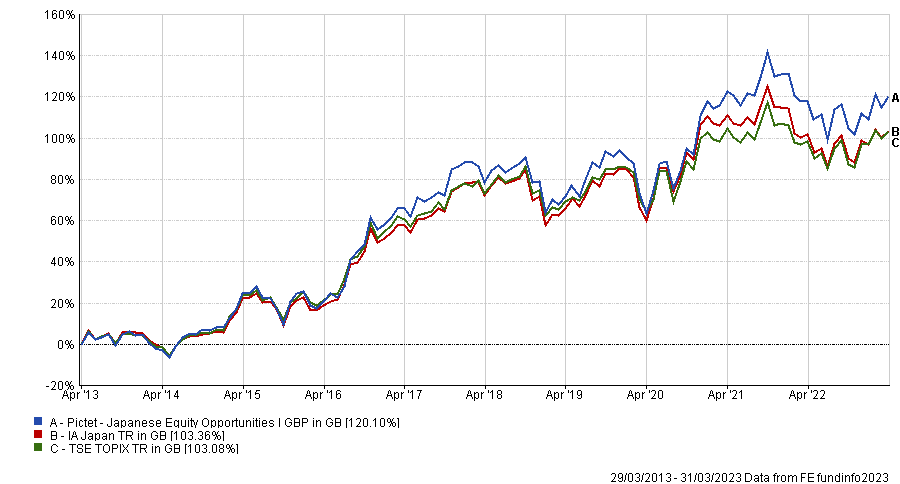

Performance of fund over 10 years against sector and index

Source: FE Analytics

The fund was launched in 1999 and has been a top quartile performer over 10 years and three years.