Over the past 12 months, investors have been forced to acclimatise to an uncomfortable inflationary environment. In response to rising inflation, global policymakers have been responding in unity by unleashing a rapid tightening cycle in an attempt to prevent heated markets from boiling over.

Given this dynamic market, investors continue to monitor macroeconomic data points to determine the efficacy of such attempts to quell inflation. Additionally, we can at least start to make some initial observations for what some may perceive to be our new ‘base case’ for interest rates.

Income investors will also likely be aware of the narrowing equity yield premium over fixed income asset classes, which is now at its lowest in over a decade. However, in a less certain economic backdrop, equity income investors can gain exposure to defensive companies paying attractive dividends within the FTSE100.

Below, we present three compelling reasons why UK and European dividend investors should consider the UK market as a core component of any income strategy.

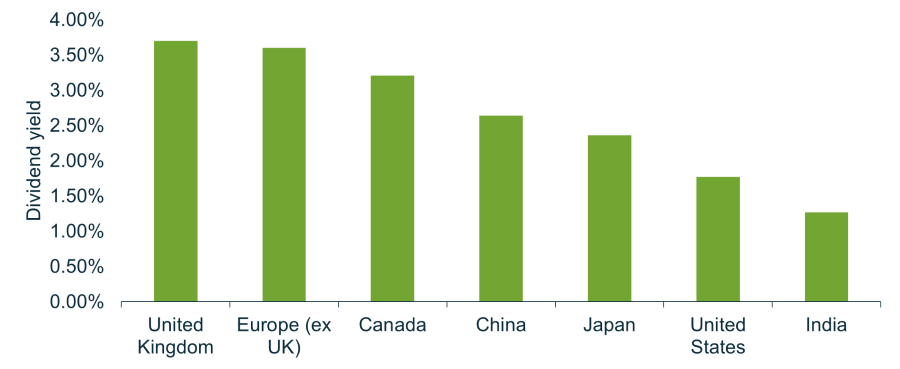

The UK offers an attractive yield premium to other regions

For some time, the UK has generated an attractive dividend yield relative to alternative regional markets. Especially worth noting is that as of today, the UK market yields more than nearly all other developed markets and over double the income generated in the US.

Source: Siblis Research, as at 31/12/2022

Even with the rapid rises in interest rates over the past year, equity investors still enjoy a healthy yield. In addition, investors could then factor in the impact of capital returns, share buybacks and the erosion of fixed income purchasing power in an inflationary environment.

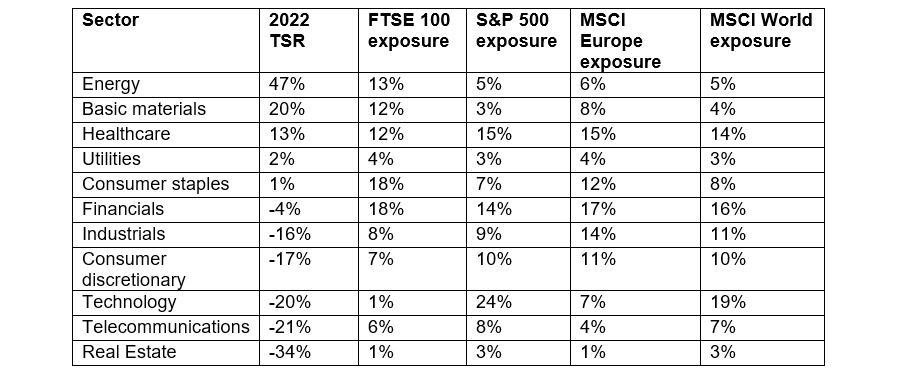

The composition of the UK market is attractive to dividend investors

Investors do not need to reflect for long to assess how certain markets respond to an extreme period of volatility. Across the globe, dividend cuts were inevitable throughout 2020 and enabled many businesses to emerge from the pandemic in a stronger, competitive position.

A significant proportion of the UK market can be found in dividend-paying sectors, such as consumer staples and commodities. In fact, each of the UK sectors generating a positive relative total shareholder return in 2022 are healthy dividend sectors, reinforcing the importance of income as a component of total return.

Source: HSBC, as at 31/12/2022

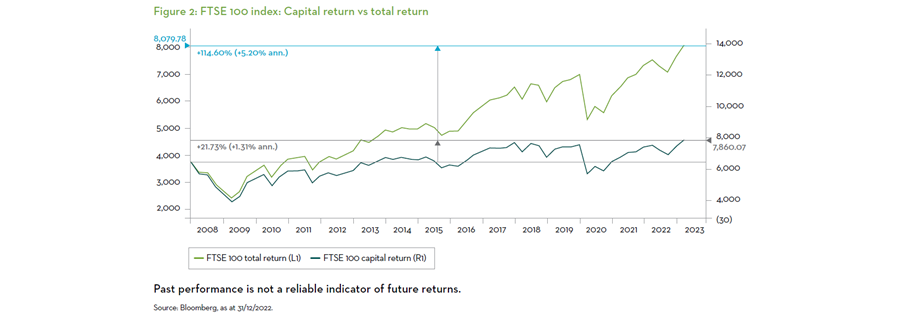

Income is the dominant source of UK equity returns

The dominance of income in UK total returns is compelling and for the reasons above, income should continue to be a material component of total return within the UK market.

This will mainly be driven by the sector exposure of the FTSE 100, which accounts for 80% of the FTSE All Share. Over the past 15 years, the FTSE 100 has generated returns of around 5.2% per annum, but around 4% of this annualised performance was generated from constituent dividend income.

This highlights the prominence of income as a component of total return in the UK. This structural preference for income within the index is certainly unique across the globe and offers a compelling opportunity for investors.

All of these factors highlight the importance of active management. By allocating passively to the UK market, investors will enjoy a healthy dividend yield but only through active management can investors target a yield premium. When income is such an important component of total return, a healthy yield premium begins to compound at a rapid rate.

Rising interest rates have enhanced the attractiveness of fixed income, however the FTSE 100 remains a natural hunting ground for active equity managers seeking income.

Jo Rands is a portfolio manager and research analyst at Martin Currie, part of Franklin Templeton. The views expressed above should not be taken as investment advice.