‘The early bird catches the worm’ is a phrase that is perhaps best suited to investing yet after the rush of the most recent ISA season it can be easy to forget.

Many investors rush to get any spare pennies saved throughout the year into their ISA before the deadline, but just because we have started a new tax year does not mean they should stop thinking about their ISA allowance.

In fact, now is the best time to put money into an ISA. According to data from AJ Bell, a £3,000 annual investment in a global equity fund on the first day of each tax year since 1999 would now be worth £200,373. The same £3,000 invested on the last day of each tax year would be worth £191,102, more than £9,000 less.

This is largely because of time. The more time money can sit in the market, the more likely an investor is to reap the rewards.

In 2021, research from Schroders explained this. Looking at returns from investors that put their cash in the FTSE 250 index, squirrelling £1,000 per year away every year since the beginning of 1986 and leaving it alone for 35 years would have netted £43,595 by January 2021.

Timing the market however could have been disastrous. Leaving the cash invested, savers would have made roughly 11.4% per year. This falls to 9.5% per year if they missed the 10 best days, 8.1% per year if you missed the 20 best days and 7% per year if they missed the 30 best days.

During the same period, if they missed out on the FTSE250 index’s 30 best days the same investment might now be worth £10,627, or £32,968 less, not adjusted for the effect of charges or inflation.

This shows how crucial it is to stay invested and the earlier you can do so, the more time your money has to grow and the lower the risk that you miss out on some of these ‘best days’.

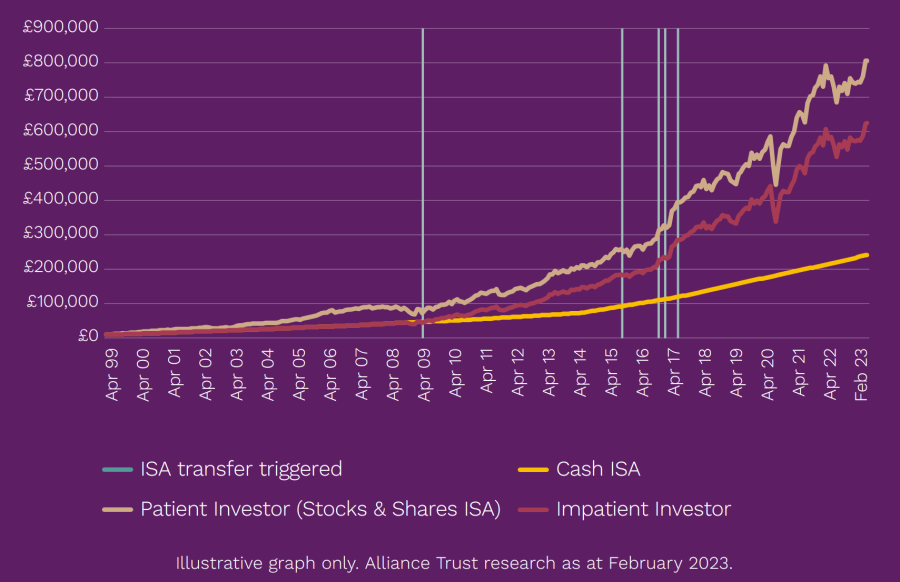

It was also highlighted by the managers of Alliance Trust earlier this year, who took three examples: a cash ISA investor, a stocks and shares investor, and someone that tries to mix both who moves their money in and out of cash when interest rates rise above inflation. Each put in the full ISA allowance in a year.

The former would make an 8% return overall over the next 24 years, while the impatient latter would made around £400,000 more than this. The investor that stayed in stocks throughout added another £190,000 to their pot, as the above chart shows.

Of course, it is not always possible to simply max out an ISA allowance at the start of the new tax year. There is no way I have that money hiding down the back of the sofa.

Laith Khalaf, head of investment analysis at AJ Bell, addressed this: “Of course, you may not have the capital available to make two subscriptions at once. A halfway house might be to set up a regular ISA saving plan for next year, which automatically takes cash from your bank account each month by direct debit and invests it according to your instructions. That way at least some of your money gets into the market sooner, and the regular nature of your investment also makes for a smoother ride.”