High yields on cash savings accounts could make holding onto money more attractive than investing, but investors need to look past the short term, according to Alex Funk, chief investment officer at Schroder Investment Solutions.

Cash ISAs have always been more popular than Stocks and Shares ISAs, and with some one-year cash savings accounts offering yields above 4%, that trend could well accelerate.

The gap in subscriptions between the two narrowed to its closest point in a decade in 2020, but the number of new Cash ISA subscriptions throughout the year (8,059) was still more than double that of Stocks and Shares ISAs (3,589), according to data from HMRC.

Funk said: “People are inherently risk averse and so we prefer certainty more than we prefer the allure of potential returns.”

He added that this gap in subscriptions is likely to have widened, partly due to investors getting cold feet in volatile markets, but largely due to the appeal of a fixed rate of return.

This guaranteed yield may be attractive in today’s unpredictable market, but investors with a longer time horizon could be making a mistake by chasing short-term returns.

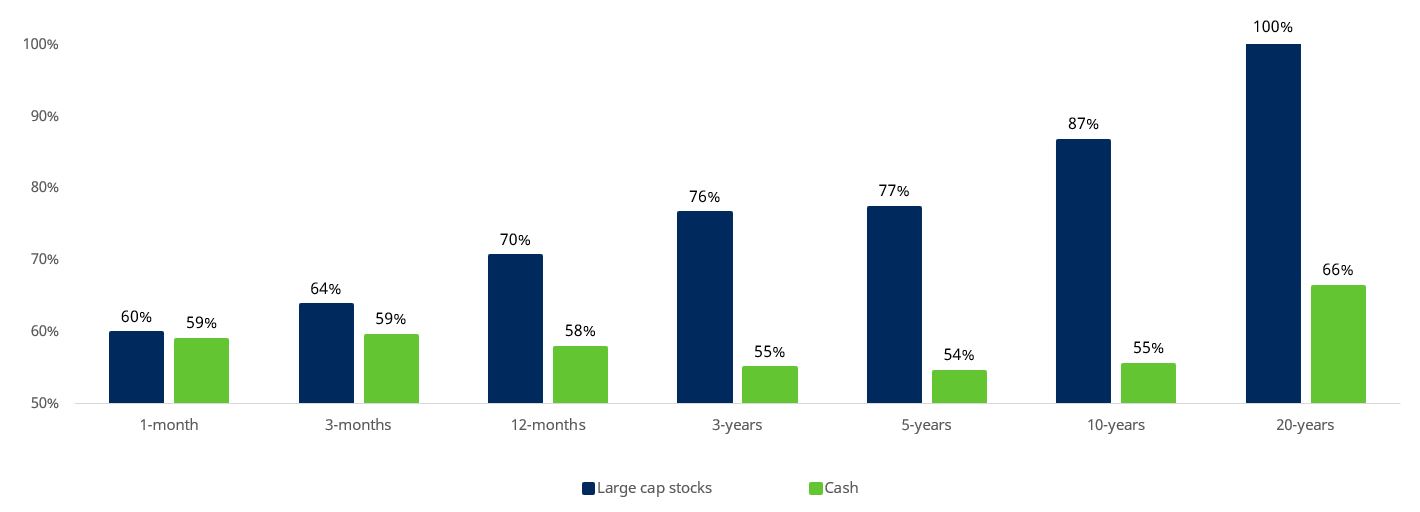

Indeed, a study by Schroders found that, although investing in equities might not deliver returns in the short term, they have historically beaten inflation 76% of the time within three years, compared to 55% with cash.

Periods where stocks and cash have beaten inflation, 1926-2022

Source: Schroders

Funk stressed that the longer investors hold onto equities for, the greater the chance they have at making returns greatly exceeding that of staying in cash.

“The world is quite simple in that the more risk you take, the more return you can generate – that's the foundation for financial markets,” he said.

Over the short term, a 4% fixed yield appears attractive, but it loses some of its appeal when you consider that inflation in the UK reached 10.4% in February.

No cash account can outpace current rates and although inflation will come down, so will cash yields, according to Funk.

Investors with a longer time horizon should instead look beyond present volatility and put money in the market, even if it means making a negative return over the short term.

Funk said: “Timing the markets is very difficult and no one has got it right. It’s more about spending time in the market rather than timing the market.”

Investors who have held off from putting money in equity markets may have shielded their capital from downside losses, but they are also lacking exposure to upside gains, which Funk said is more important.

He added that “missing a few good days [in the stock market] will be astronomical” to an investor’s overall return.

Investors can limit risk as much as possible by diversifying across different assets and styles, but having a stake in downward equity markets is better than having no exposure at all.

Stocks and Shares ISAs may give you a better return over the long term, but there is still a place for Cash ISAs in some investors’ portfolios, according to Gillian Hepburn, head of UK intermediary solutions at Schroders.

Some investors have a shorter time horizon and may need to access their savings, so a Cash ISA could be an attractive vehicle to carry savings.

Although retail investors typically favour cash out of behavioural biases, Hepburn said that many advisors she had spoken to moved into cash last year and began investing those savings heading into 2023 as the outlook for equities appeared more positive.

Indeed, having the ability to withdraw money during the cost-of-living crisis has been especially important and more than half (53%) of advisors’ clients changed their plans due to rising costs last year, according to Hepburn.

She said: “There is probably an interesting argument for having a flexible ISA in terms of being able to take money out if you suddenly have a short-term need and putting it back in the same tax year, which obviously not every ISA allows you to do.”

Ultimately, investors need to consider all the different ISA options available to them and consider which might be best in meeting their own individual needs.