Although the ISA deadline has passed, it is never too early to use up the current year’s allocation, according to the experts at least.

While most of us will have scrimped and saved to put as much as we can afford into this year’s ISA allowance, others will have maxed out their limit with room to spare.

But with markets so volatile, should you drip feed your cash in, or lump it in now?

There are arguments for both, of course. Drip feeding means that investors benefit from pound-cost averaging. By buying shares over the span of 12 months, they buy at a range of different prices (sometimes more expensive and at other times cheaper), which should smooth out returns and is great for cautious investors who don’t want to lose too much in falling markets.

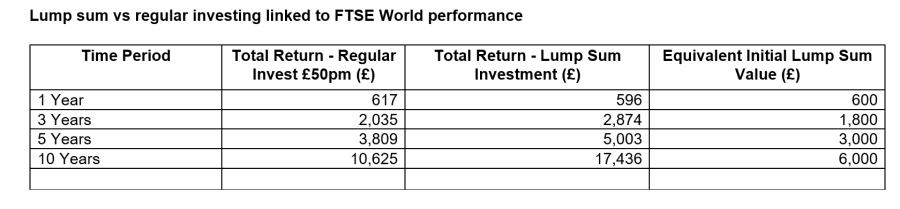

This tactic has proved particularly beneficial over the past year, according to data from interactive investor. A regular monthly investment of £50 in a fund replicating the performance of the FTSE World index over the year to 31 March 2023, excluding charges, would have generated a total return of £617 on a total contribution of £600.

In contrast, a lump sum of £600 put in at the end of March 2022 would have made a loss, with the investor left with £596 by the end of March.

Myron Jobson, senior personal finance analyst at interactive investor, said: “Our analysis shows that the regular investment strategy has trumped lump-sum investing over the past year in which stock markets have been plagued by pressures arising from runaway inflation, rising interest rates and, latterly, the Silicon Valley Bank debacle.”

However, over the longer term, the last year has been an outlier rather than the rule. Looking at the performance of the FTSE World index, the lump-sum investment of £1,800 would have turned into £2,874 over three years, compared with £2,035 had the lump sum been split equally into monthly investments (£50 per month instalments).

Source: interactive investor. Returns to 31/03/2023 of FTSE World GBP. Initial Investment of £50 on 31/03 and subsequent £50 per month invested on 1st of each month.

“This suggests that the ‘lump sum versus regular investing’ debate hinges on market conditions when you invest your money. Regular investing can ease the effects of downward share price movements, but it also limits gains in a booming market. But it does help you sleep at night and is the ultimate get rich slow strategy,” Jobson said.

There is no perfect answer, but investors can make an informed decision by looking at their own circumstances.

While it has been better over the long term to invest all at once, there are myriad other factors. Investors putting their cash away for a medium-term goal, such as to buy a house or for a rainy-day fund that may need to be dipped into at some stage, may wish to drip feed to avoid the harshest market falls, with the acceptance that this will lead to muted gains.

For those saving for retirement, putting cash away for their kids, or planning not to touch the money for at least 10 years (which implies they already have a cash buffer elsewhere for a rainy day), then getting it all in now is likely to be the most lucrative option, if history is anything to go by.