Diversification is something that many investment professional preach, but it is not always easy to achieve, as some investors may have discovered last year when most assets fell.

One of the most popular options for investors is to buy global index funds that track the MSCI World (or another equivalent), such as the iShares Core MSCI World UCITS ETF.

The $49.1bn iShares Core MSCI World UCITS ETF is the largest fund in the IA Global sector, almost double the size of the second-largest, Fundsmith Equity. Investors who buy this exchange-traded fund (ETF) are looking to mimic the returns of the underlying benchmark, the MSCI World index.

Yet for investors that want to go elsewhere for returns as well, it is important to make sure there is low correlation, or risk both assets falling at the same time.

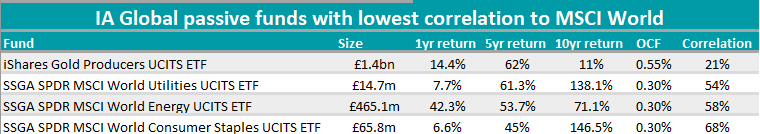

Looking at other funds in the IA Global sector, your chances of finding lowly correlated portfolios are not as bountiful as one might hope. Over the past 10 years, 522 out of 536 funds in the sector (97%) displayed a high correlation to the iShares ETF and only 14 stayed below 69%. Among these, there were four ETFs and 10 actively managed portfolios.

Source: FE Analytics

Sector-wise, gold and energy have the lowest correlation to our benchmark.

At the top of the list is the iShares Gold Producers UCITS ETF (21%), which is benchmarked against the S&P Commodity Producers Gold index. This passive fund invests in the largest publicly traded companies involved in the exploration and production of gold and gold-related products from around the world.

With the rise of technology stocks, the mining sector is not a large allocation of the benchmark index, accounting for just 4.6% of the sector split, compared with 20.7% for information technology and 14.5% for financials.

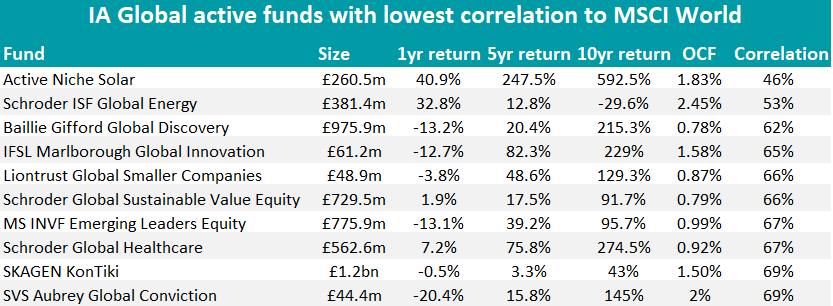

The second position, with 46% correlation, is taken up by the actively managed Active Solar, which achieved an FE fundinfo crown rating of four and invests in listed companies in the solar photovoltaic industry.

This has been the best fund in its sector over 10, five, three and one year, although it has dropped to the bottom of the fourth performance quartile over the shorter term. It is immediately followed in the correlation list by other energy-centred portfolios, Schroder ISF Global Energy (53%) and two energy ETFs. Energy makes up 5.5% of the MSCI World benchmark.

Further down the list, two more Schroders funds, Global Sustainable Value Equity and Global Healthcare, show a correlation of 66% and 67%, respectively. The latter has performed similarly to Active Solar, falling from a first-quartile performance over the long and mid-term to the bottom quartile over six months.

Source: FE Analytics

IFSL Marlborough Global Innovation, with its 50% exposure to the UK market, reports a 65% correlation to the MSCI World index. It has a five crowns FE fundinfo rating and has been co-managed by Guy Feld and FE fundinfo Alpha Manager Richard Hallett since 2020. Since then, it considerably outperformed the IA Global sector in 2021, before closing the gap with the rest of its peers last year.

Although the UK is the third largest country allocation in the MSCI World index (4.3%), the US dominates, making up 67.7% of assets.

Smaller companies funds such as Baillie Gifford Global Discovery (62% correlation) settle around the middle of the table. The £970m Baillie Gifford fund is run by FE fundinfo Alpha manager Douglas Brodie, whose strategy is to enter small positions in a large number of global smaller companies with a market cap of $5bn or below and holding them as long as they are still classified as ‘immature’. This is unlike many other smaller companies funds, which are forced to sell a stock if it reaches a certain size. Another example is Liontrust Global Smaller Companies (66%).

Lastly, MS INVF Emerging Leaders Equity, SKAGEN KonTiki and SVS Aubrey Global Conviction focus on emerging markets and have among the highest correlations in the list. The MSCI World index is one of developed markets only, so the correlation is more about the link between emerging and developed markets than between the global tracker and these particular portfolios.