Investors have started 2023 by paying less attention to global and US equities while spending more time looking at funds invested in Europe, Asia or dividend stocks, research activity on Trustnet suggests.

To find out which funds investors are becoming more or less interested in, we looked at the share of Trustnet pageviews each captured in January and compared with their share from 2022. The difference between the two allows to gauge their relative popularity with Trustnet users.

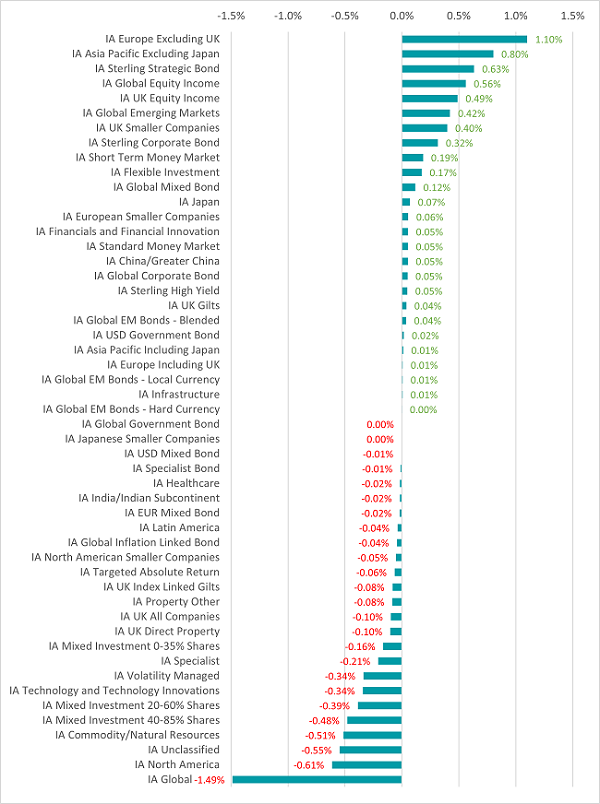

As the chart below shows, there was a big swing towards European and Asian equities while investors have been spending less time researching North America and global funds (which tend to have a high weighting to the US).

January’s change in Trustnet research by Investment Association sector

Source: Trustnet

While US stocks led the global equity bull run that followed the financial crisis, they were hit hard last year when rising interest rates soured sentiment towards growth stocks such as tech.

But although US stocks fell more than European equities in 2022, many investors still consider them to be more richly valued than companies on the continent. Asian equities, meanwhile, look attractive as China rolls back its Covid restrictions and opens up its economy from its strict lockdown.

The other theme apparent in the chart is an increase in interest in equity income strategies as both the IA UK Equity Income and IA Global Equity Income sectors were being researched more in January relative to 2022.

Income investing had fallen out of favour with investors but they are more interested now as they seek ways to make their money work harder amid soaring inflation.

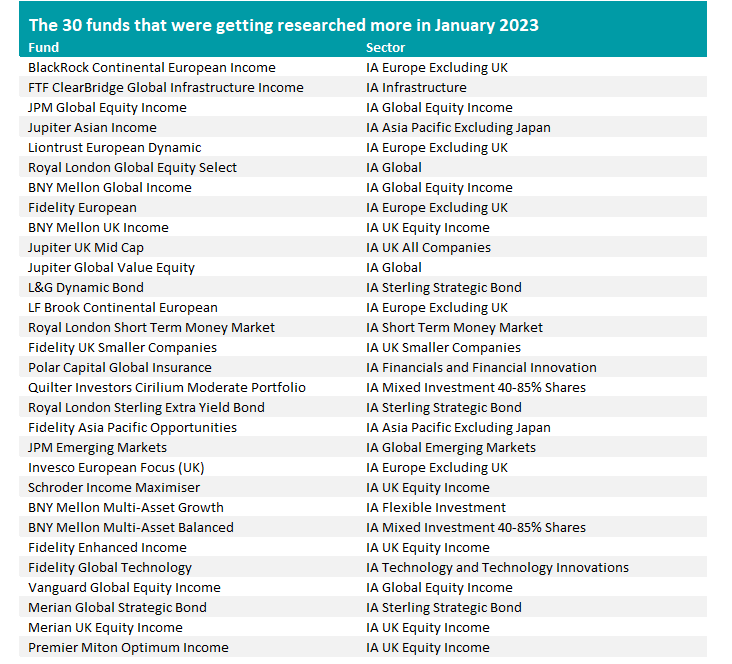

Both of these research trends are shown in the list of the individual funds that attracted a greater share of research activity on Trustnet when compared with 2022.

Source: Trustnet

The fund that has benefitted from the biggest increase in interest neatly combines both of these themes: BlackRock Continental European Income. Managed by Andreas Zoellinger and Brian Hall, the £1.5bn fund aims to generate an above-average income from European companies; it has made a second-quartile return over five years but slipped into the third quartile over one and three years.

As a recent Trustnet article revealed, BlackRock Continental European Income is the only fund that appears on the recommended funds lists of Hargreaves Lansdown, AJ Bell, interactive investor and Barclays Smart Investor.

Analysts at Barclays said: “This is a dynamic approach to income investing in European shares managed by one of the most experienced and talented European teams. The flexibility of the strategy means that the managers go beyond the obvious income sectors and are very reactive when trading around positions.”

Other than European, Asian and equity income funds, the list of those being researched more on Trustnet includes Royal London Global Equity Select. As we recently noted, this fund has enjoyed a strong run over recent years, making some of the highest returns in the IA Global sector while being among the funds with the lowest volatility and maximum drawdown.

Bond funds have also climbed up the research rankings as high yields and the risk of an economic slowdown make the asset class appear more attractive to investors. Those with a flexible approach – such as L&G Dynamic Bond and Royal London Sterling Extra Yield Bond in the IA Sterling Strategic Bond sector – have been getting more attention.

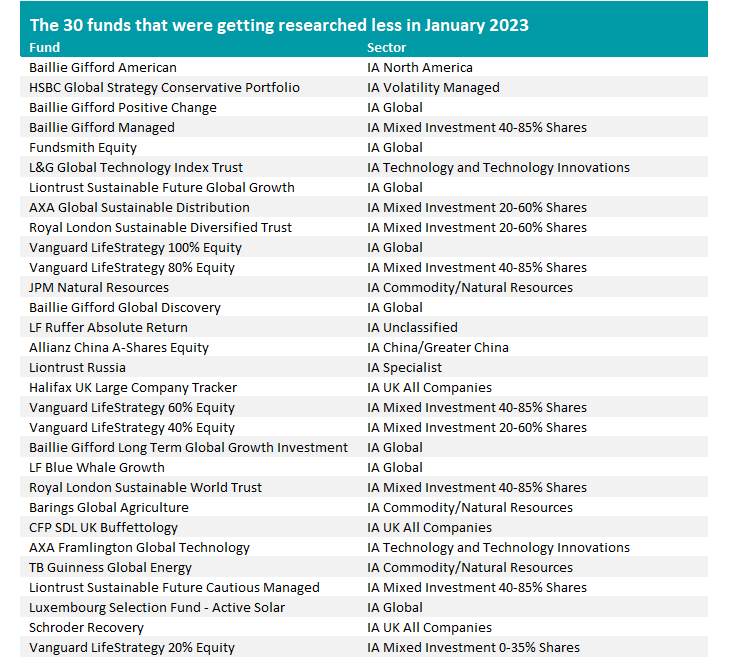

Source: Trustnet

As rising interest rates caused previously top-performing growth funds to tank, many of these have been getting researched less on Trustnet. This is reflected in the table above, although research into growth funds has been falling for several months now.

The strong performance of growth funds over the past decade means many of the funds in the list are familiar names: Baillie Gifford American and its stablemates, Fundsmith Equity, LF Blue Whale Growth and CFP SDL UK Buffettology have high profiles but are losing research share.