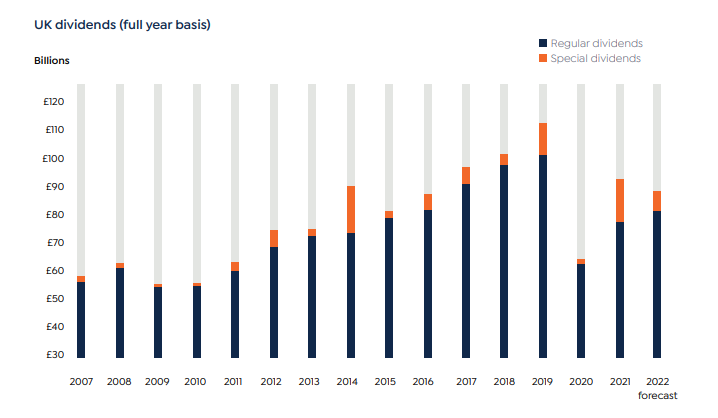

Income investors that had suffered through a disappointing year in 2020 had a much stronger 12 months in 2021, according to the latest data from the Link Dividend report, which showed UK dividends bounced back by 46% last year.

Payouts rose to £94bn as the economy sprung back into action, having tumbled down to £62bn the previous year as profits were knocked and companies conserved cash to get through the pandemic.

It is the highest total paid out by UK companies since 2016 but much of the increase was from special one-off dividends, which were three times the norm at £17bn.

However, underlying dividends rose more modestly, up 22% to £77.2bn, although this exceeded Link’s original best-case estimation (£66bn) from the final report of 2020 by £11.2bn.

The optimism may dim this year, as the firm warned that growth should slow in 2022 as profits and special dividends return to regular levels.

Ian Stokes managing director of corporate markets at Link Group, said: “High prices mean generous mining dividends can continue, but such rapid growth cannot, and we are unlikely to see the enormous special dividends repeated.”

He added that rising inflation, taxes and Covid cases will bring down the record growth of special dividends, while regular underlying pay outs will remain somewhat steady.

Early predictions from Link Group forecast a 5% growth for underlying dividends this year, raising the total to £81bn (up £3.8bn from the previous year).

Source: Link Group

Despite the slower growth, the overall positive outlook will be welcome news for many, with more than four-fifths of those that bought funds for their dividends suffering losses to their pay outs since the start of the pandemic, according to the Association of Investment Companies (AIC).

Recent Janus Henderson data revealed that the dividend cover of UK companies reached 1.1x in 2021, suggesting these payments are more secure than before.

Mining dividends grew the most last year, accounting for almost a quarter of total UK pay outs thanks to a rise in commodity value.

Mining company, Glencore was among the top-performing stocks in the FTSE 100 in 2021, up 67% following an increased demand for copper, lithium and cobalt in manufacturing electric vehicles (EVs). The company is expected to raise dividends by £1.5bn due to its strong growth.

However, the price of some metals such as copper and iron ore, though up over the year, have lowered since their highs in the summer of 2021.

Mexican precious metals miner, Fresnillo was one of the worst-performing companies in the index last year, down 19% due to low silver and gold prices.

Russ Mould, investment director at AJ Bell, warned in December that mining dividends could decline in 2022 if the price of commodities levels out.

He anticipated a slash in pay outs from several mining companies, including Anglo American and BHP Group despite their positive returns over the year.

Link Group data also found that bank dividends contributed £5.9bn to overall pay outs thanks to a strong economic recovery over the past year.

UK GDP reached its highest level since before the pandemic in November at 0.9% while higher interest rates – which were upped to 0.25% in December – is also accommodative for banks, as their profits are calculated from the base rate.

Link found that UK banks were more resilient throughout the pandemic than anticipated and the measures taken to reduce Covid’s economic impact were unnecessary.

Banks slashed dividends in 2020 in order to reduce debt, but monetary support for UK businesses and households by the government such as the furlough programme prevented this from becoming excessive.

Pay outs also increased in the industrials sector, but it was not all good news as dividends in the airlines, leisure and travel sector were down four-fifths for the second year running as traveling restrictions remained firmly in place. Overall they paid £388.5m, compared to the highs of £2.7bn in 2019.

Looking forward, Stokes said that while mining dividends will level out, bank pay-outs will continue their fast growth rate.

Similarly, Link Group data predicts that oil and gas dividends are at the start of an equally rapid rise, with Shell and BP beginning to increase pay outs at the end of last year.

Stokes said: “The banks, followed by the oil majors are likely to be the big engines of dividend growth in 2022, though neither will come very close to their former dividend power yet.

“Telecoms will get a boost from the restoration of BT’s dividend in February. These three sectors could generate up to three-fifths of UK dividend growth in 2022.”

David Smith, fund manager of Henderson High Income Trust, agreed with Link’s assessment of the dividend picture.

“There will be underlying dividend growth for the market, albeit more muted than last year, as dividends continue to recovery, while the headline yield on the market is still attractive at 3.5% especially relative to global indices, bonds or cash,” he said.