The invasion of Ukraine by Russia has prompted a jump in research into defensive funds and those offering exposure to soaring commodities while investors have less interest in Baillie Gifford and other growth strategies.

With around 44 million pageviews to Trustnet’s fund factsheets in 2021, analysis of this traffic data can offer a unique insight into the research behaviours of professional and private investors.

While high levels of interest in a fund’s factsheet could be a sign that investors are interested in buying – if performance has been strong or it is well-rated, for example – other funds could be getting researched because a run of poor performance or changes in market conditions mean investors are considering selling.

With this in mind, below Trustnet looks at the funds that have been getting researched more since Russia launched its invasion of Ukraine on 24 February, comparing the change in this recent traffic with the whole of 2021.

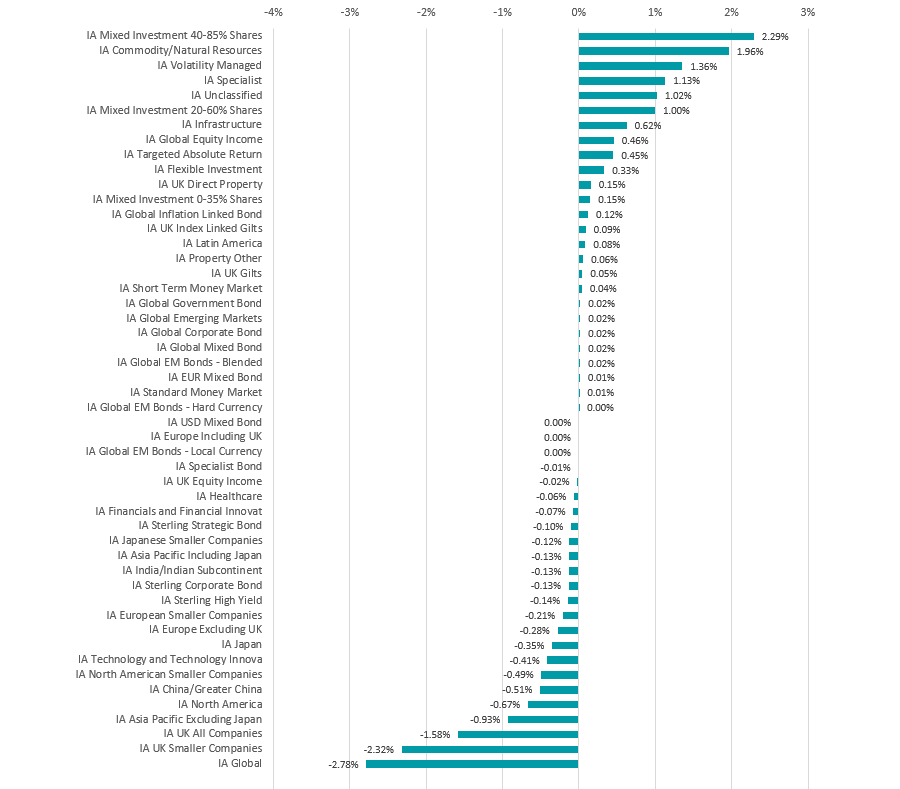

Starting with the Investment Association sectors, it’s clear that investors have been looking at more defensive areas of the market. The sector that benefitted from the biggest uptick in interest is IA Mixed Investment 40-85% Shares – in 2021, it accounted for 8.3% of Investment Association research but this has climbed to 10.6% since the conflict began.

Other more defensive areas that are being researched include IA Volatility Managed, IA Mixed Investment 20-60% Shares, IA Infrastructure, IA Targeted Absolute Return, IA Mixed Investment 0-35% Shares and some of the fixed income peer groups.

Source: Trustnet. Difference in share of fund factsheet views between 24 Feb-21 to Mar 2022 and whole of 2021

At the bottom of the chart are the sectors that are being researched much less than they used to be. IA Global has been hardest hit as investors look to safer parts of the market, with its research share falling from 17.3% in 2021 to 14.5% since the Russia/Ukraine war started (however, it remains the most-researched peer group).

IA UK Smaller Companies and IA UK All Companies funds are also being looked at less than they were in 2021 and are even being shunned more than sectors such as IA Europe Excluding UK and IA European Smaller Companies, which are closer to the conflict.

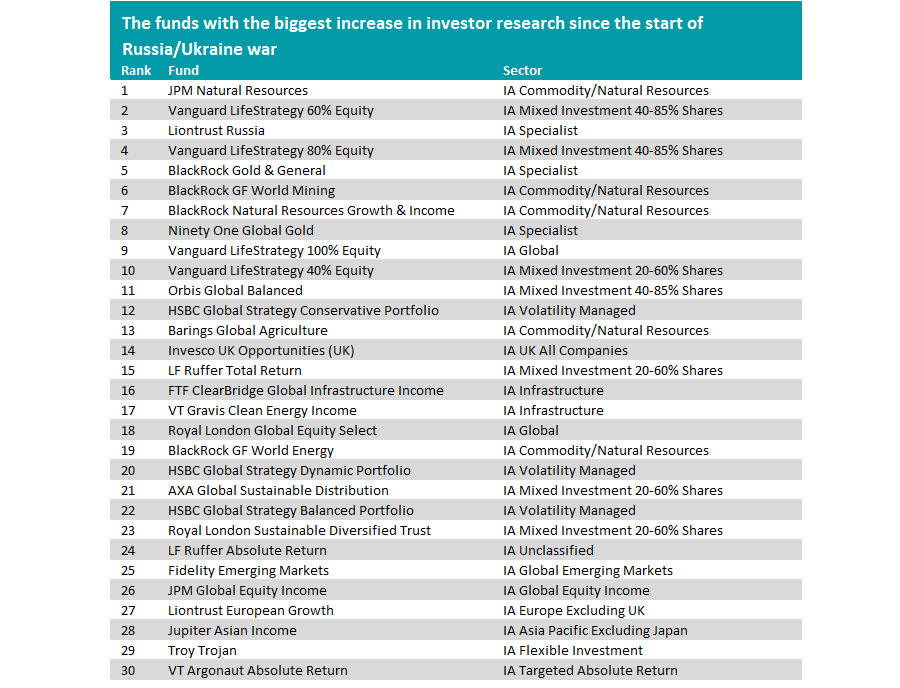

Moving on to individual funds and the table below shows the 30 funds that have witnessed the largest increase in research on Trustnet, where several clear trends can be seen.

Source: Trustnet. Difference in share of fund factsheet views between 24 Feb-21 to Mar 2022 and whole of 2021

Firstly, investors have become more interested in commodities funds. The price of many commodities has jumped in recent weeks, as Russia’s status as a key exporter of raw materials such oil, gas, wheat and industrial metals added to pre-existing supply bottlenecks.

JPM Natural Resources, for example, is the fund that has had the largest jump in interest but other funds exposed to this theme include BlackRock GF World Mining, BlackRock Natural Resources Growth & Income and Barings Global Agriculture.

The funds in the Vanguard LifeStrategy range are another theme in the above table. This reflects their popularity with advisers (they have become a mainstay of many portfolios) and will be getting researched more as the impact of the conflict is being monitored.

Investors have also been looking how the war has affected funds with Russian holdings, which have been subjected to trading bans, removed from benchmarks and written down in value by fund managers. There was a spike in research in Liontrust Russia as this and other Russian and emerging European equity funds were suspended, as well as global emerging market strategies with less exposure to the country.

Another theme is the move towards defensive funds. This appears on the list in two main ways: the increase in interest towards gold funds (BlackRock Gold & General, Ninety One Global Gold), which are a classic safe haven in times of market stress, and more research into funds that prioritise capital preservation (LF Ruffer Total Return, Troy Trojan).

Turning things on their head, below you can see the 30 funds that been less researched on Trustnet since the conflict started on 24 Feb. The most obvious trend here is the move away from Baillie Gifford’s funds – 10 of the 30 funds are run by the group.

Source: Trustnet. Difference in share of fund factsheet views between 24 Feb-21 to Mar 2022 and whole of 2021

Baillie Gifford has generated very strong returns over the past decade but has started to struggle more recently when market leadership moved from its preferred growth stocks towards value stocks as investors worry about high levels of inflation.

Its funds still remain popular with investors, despite some tailing-off in research. Baillie Gifford American was the most viewed fund on Trustnet in 2021 but has slipped into fifth place over the past month or so. Likewise, Baillie Gifford Global Discovery has fallen from 6th place to 14th while Baillie Gifford Positive Change has gone from 5th to 10th.

Other growth funds that are being researched less as the conflict adds to inflation concerns include Lindsell Train Global Equity, GAM Star Disruptive Growth, Rathbone Global Opportunities and CFP SDL UK Buffettology.