Last year was a challenging one for all assets but perhaps none more so than alternatives, which ended the year on an average 19% discount (excluding behemoth fund 3i) after starting on a 1% premium, according to Shonil Chande, alternatives analyst at Liberum.

It is the widest discount since the global financial crisis of 2008, which has opened up buying opportunities for investors able to look through the pending recession, he argued.

Discounts have widened despite strong growth in the underlying companies, with the net asset value of many trusts proving resilient in 2022. Every alternative sector in the Association of Investment Companies universe trades at a discount for the first time in more than a decade, suggesting there is re-rating upside potential over the coming one to three years once investor appetite returns.

Below, the analyst reveals the trusts he is particularly excited about, split into five themes: renewable energy, private equity, infrastructure, real estate and other assets.

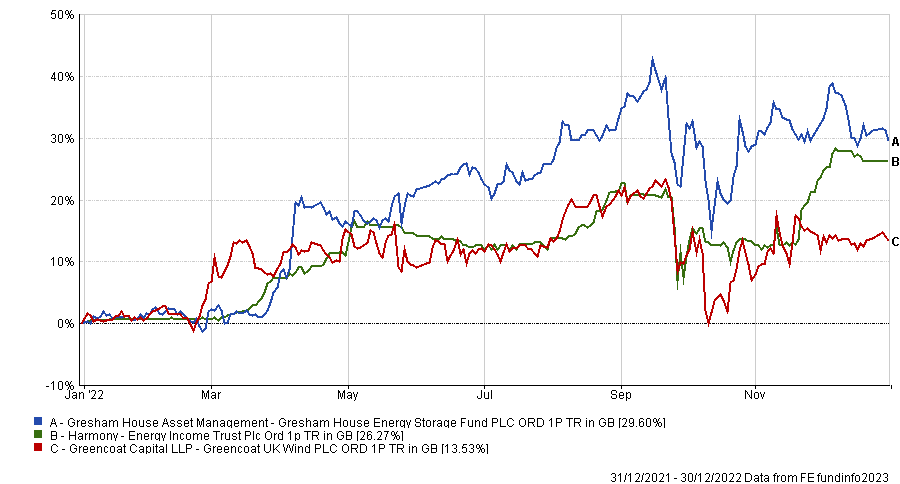

Renewables

Infrastructure, renewables and leveraged loans are the only sectors that trade close to NAV, said Chande. He is particularly keen on renewable infrastructure, which he noted “continues to have strong secular growth, with energy storage experiencing outsized growth within the sector due to a large need for investments”.

Greencoat UK Wind is expected to make “windfall” profits for the year. It has the longest track record among listed renewables trusts, good liquidity and low fees. It also pays a dividend linked to RPI, with good cover.

However, Chande noted that UK wind levels have been below average in recent years and that rising interest rates may affect the firm’s debt position.

Battery investors Gresham House Energy Storage and Harmony Energy Income are other options for investors in the space.

Total return of trusts in 2022

Source: FE Analytics

Infrastructure

Away from renewables, traditional infrastructure firms such as HICL Infrastructure may prove their worth in 2023. HICL is a diversified portfolio with low correlation to the wider market, and Chande said its inflation linkage is strong.

“NAV growth through historically accretive disposals has demonstrated the prudence of valuation,” he said, adding that there is a high terminal value for the portfolio, with 70% of the underlying holdings expected to keep their value until 2056.

Chande doesn’t expect to see any income growth in 2023, while dividend cover is low. However, he noted that “minimal reinvestment” is required to maintain the current payout.

Digital 9 Infrastructure is another option in the sector, he said. The trust has acquired eight digital infrastructure companies for a total of £1.2bn since its launch in 2021 and has “strong organic growth potential”, although the departure of the lead managers has put off some investors.

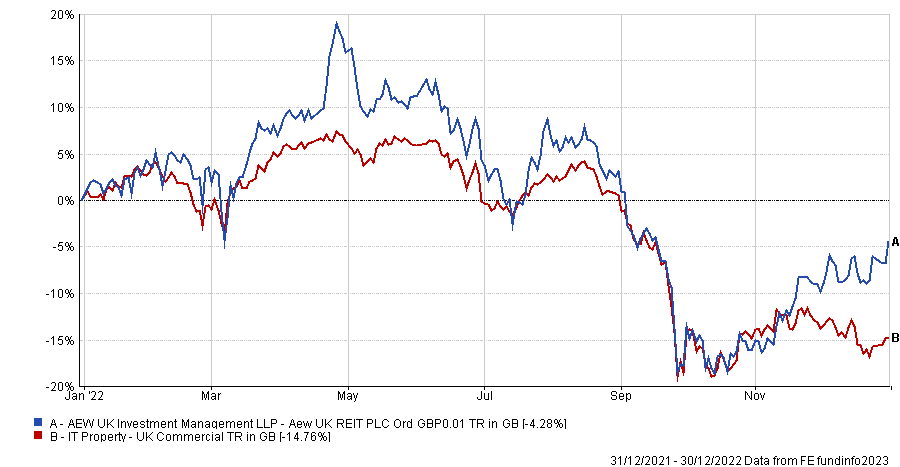

Real estate

According to Chande, “property sectors trade at particularly large discounts despite the inherent inflation protection in many subsectors,” with long-lease REITs trading at 10% below their NAV.

“Property funds could typically increase their NAV by 5 to 10% despite the difficult environment,” he argued, highlighting AEW UK REIT as the best option.

It invests in high yielding commercial property and has diversification across different areas. Its dividend should be fully covered in 2023, while the 8% yield on offer is the highest of its peer group, Chande noted.

Total return of trust vs sector in 2022

Source: FE Analytics

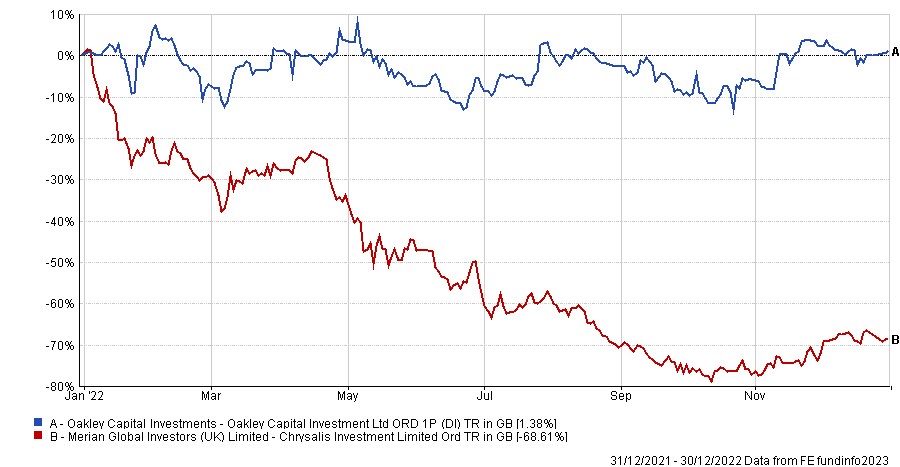

Private equity

One area that has proved popular among investors in recent years but came off the boil a bit in 2022 is private equity, and here Chande’s selections are Oakley Capital and Chrysalis Investments.

The former invests in funds managed by the parent firm and has a strong track record of picking good companies. In particular, it knows when to sell, with an “exit premium” of 60% on its holdings since 2018.

The latter buys late-stage private companies with long-term growth potential. It has had a tough year, writing down some of its more well-known holdings such as payments firm Klarna, as well as coming under fire for charging investors high performance fees.

In 2022 the trusts’ fortunes diverged, with Oakley making a small profit while Chrysalis made a huge loss, as the below chart shows.

Total return of trusts in 2022

Source: FE Analytics

However, Chrysalis’ holdings have higher expected revenue growth than the average firm on the Nasdaq (50% compared with 10%) and eight in 10 holdings have sufficient cash to last more than two years, so the trust should not need to inject more money in the future, Chande said.

Other

There was a plethora of other alternative trusts that also made the Liberum analyst’s recommended list. Venture capital trust Molten Ventures has strong revenue growth and its holdings have cash to last 18 months or more, suggesting there is also some downside protection built in.

In the fixed income space, Biopharma Credit has an “excellent track record in a specialist market” with “limited competition” thanks to high barriers to entry. It lends to life sciences companies, focusing on those with cashflows from sales of already approved drugs, giving it some downside protection.

Meanwhile, Real Estate Credit Investments holds debt taken out against commercial and residential properties in the UK, France and Germany.

It made the list thanks to its “defensive risk profile” and the fact that its loans tend to be short duration and given to “high-quality borrowers”.

Fair Oaks Income is another option here, offering investors the chance to buy collateralised loan obligations (CLOs). Its 16% dividend yield should be maintained this year, Chande said, with the portfolio well positioned to deal with any rise in default rates thanks to wide diversification.

Staying with income options, Hipgnosis Songs Fund made the list as an “uncorrelated income option led by streaming”. The firm, which buys the rights to music from well-known artists, has 146 catalogues and more than 65,000 songs under its management.