Environmental, social and governance (ESG) investing has become a hot topic in recent years as investors have piled into funds that can do good with their cash as well as make high returns.

This has forced new thinking among asset managers, many of whom have either relabelled their funds as ESG compliant or launched new ethical versions of existing portfolios.

Jon Mawby, bond fund manager at Pictet Asset Management, said that while he agreed with the end goal of a “fairer, more equitable and cleaner” world, too many people were “jumping on the ESG bandwagon without really thinking about what they were doing”.

He said that investors in the credit space have had to use these principles for years, particularly the governance aspect, although the environmental one had grown in popularity recently.

“Credit is a negatively asymmetric asset class [returns are fixed but losses can reach 100% of the total invested] so you have to be cognisant of these risks as they can represent a large part of the downside risk of the investment,” he said.

Governance has been a key issue in most of the major crises over the past 20 years, from the tech bubble of the early 2000s to the financial crisis in 2008 and, latterly, with companies such as European payments firm Wirecard.

“You had to use that ability to be able to identify these landmines. After all, in credit it tends to be what you don’t own that allows you to outperform rather than what you do own,” he said.

However, he warned investors have an issue when it comes to the social aspect of ESG, as plans to make the world net zero without concrete ideas of how to get there risk causing further inequality.

“If you think about the net-zero initiative, you can’t really transition from something to nothing without knowing where you are going and that is the big mistake people are making at the moment – particularly on the energy side,” he said.

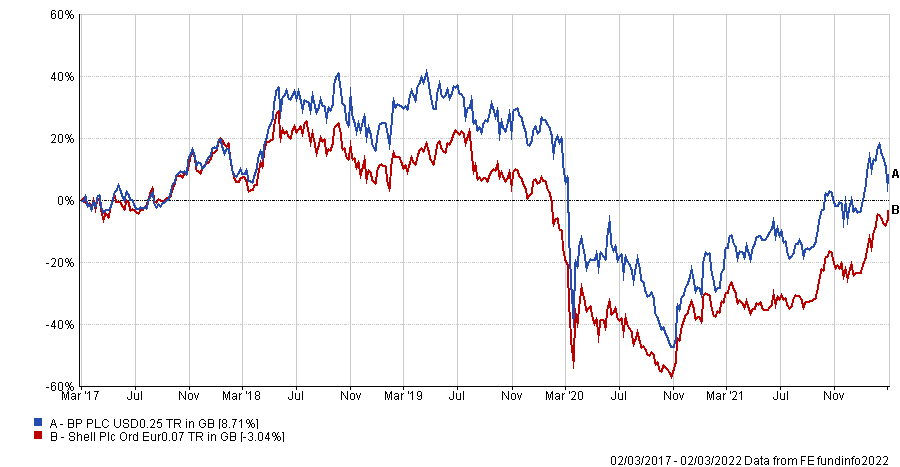

The share prices of oil majors such as BP and Shell dropped for three consecutive years in 2018, 19 and 20 as they were shunned by ESG-aligned investors.

Over the past two years these have rebounded as the price of oil has skyrocketed, yet the returns from both companies have been minimal over the entire five-year period.

Total return of Shell and BP over 5yrs

Source: FE Analytics

“People are penalising the energy companies,” said Mawby.

“Reducing energy’s access to capital – which is what you’ve seen recently as ESG has limited access –means higher energy prices, which affects the lowest-earning cohorts of society,” he said.

It also reduces the energy companies’ potential expenditure on research and development, which will stymy supply in the long run, making the energy situation worse for the lowest earners.

“Overall, it increases the socio-economic divide and the income inequality,” he said.

Mawby runs the Pictet Strategic Credit fund and several other fixed income portfolios at Pictet. He has been buying energy bonds in the funds where they are permitted – some of his portfolios adhere to Articles 8 and 9 of the EU Sustainable Finance Disclosure Regulation (SFDR), preventing them from holding these assets.

He said: “It presents one of the more attractive areas of credit at the moment because the premium has been forced on it from an ESG perspective.

“The cheapest bonds were ones under pressure from the ESG aspect. Don’t get me wrong, you do not want to invest in all of them. Some companies are not good actors, but from our perspective, to work and finance the ones that are being good actors is where we see the value-add in the long term.”

The manager added that investors should remain fluid with their definitions of ESG, as the goalposts can move at any time, using banks as an example.

“Some 14 years ago, banks were quite rightly pilloried because of the governance issues and until two years ago the banking sector was viewed as bad governance,” he said.

However, this has now moved towards the decarbonisation of the balance sheets, making them a candidate for exclusion based on their environmental impact.

Yet banks are working on this and investors that are “too ingrained about what has happened in the recent past” should instead take a “progressive view and ask how they might transition and what the issues could be”.

One area he said could be in line for a wake-up call is electric vehicles (EVs) – the current “darlings” of the ESG sector.

“EVs are all the rage because of their perceived ability to reduce emissions, but actually there are more stories coming out that they are not as clean as you think, and that is before you even get to the conversation around what you do with the batteries in five years’ time if there isn’t an adequate way to recycle them,” he said.

“At the moment they are the darlings of the ESG sector but that could flip on its head over the next five years.”