Government bond ETFs dominated flows in 2022, amassing more than $28bn of net new assets – with almost three quarters captured by US Treasury ETFs. G7 government bonds now offer their highest yields since 2007, driven by aggressive interest rate hikes by central banks trying to combat inflation.

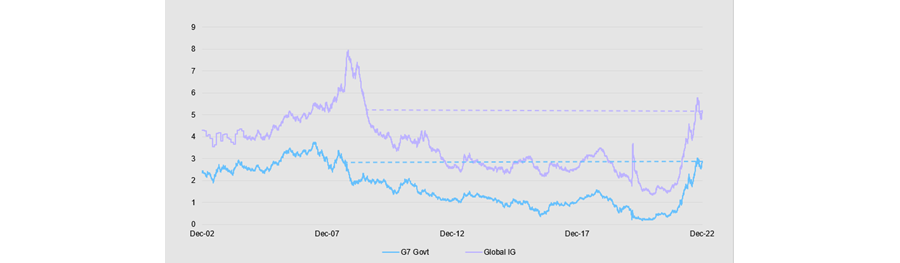

In fact, global government bond yields are higher now than global investment grade yields have been for the past decade. As yields have risen and spreads have widened, investors appear to be switching their focus towards credit, setting the scene for 2023.

20-year history of global government and investment grade yields

Source: Bloomberg, as at 30 Dec 2022 based on the Bloomberg Global G7 Index and the Bloomberg Global Aggregate Corporate Index

Despite the ongoing policy tightening increasing the probability of recession, 2023 could be the year for credit. Given the combination of strong inflows into government bond ETFs in 2022, widening credit spreads and historic investor behaviour on sector rotation, there could be higher demand for credit markets.

Central banks pivoting from trying to crush inflation to promoting growth and credit spreads widening to compensate for additional risk could be the triggers for investors to switch.

Are we nearly there yet?

Over the past year, central banks have changed their view on both the level and the stickiness of inflation, driving them to hike rates more aggressively. Inflation in the US looks to have peaked in June and has started falling, which may allow central banks to make the pivot that would be positive for credit.

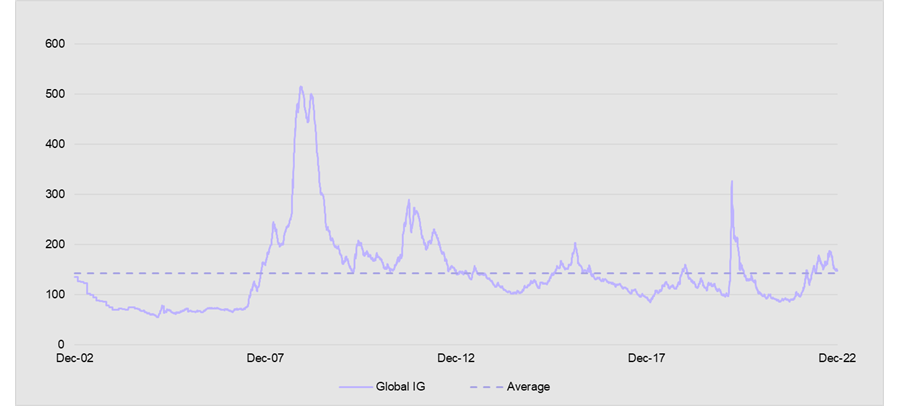

Wider credit spreads could attract investor demand

While government bond yields have been rising in response to central bank policy tightening, credit spreads have also been widening. This is partly due to reversing the tight levels driven by quantitative easing (QE) and zero-interest rate policies post Covid, and to start pricing in the possibility of a recession.

Although a deep recession could drive spreads wider, even following the rally into year end, they’re 60 basis points wider than levels seen in the middle of 2021 and remain wider than the long-term average, which appears a reasonable level to attract demand given the level of yield that credit currently offers.

Credit spreads over the past 20 years

Source: Bloomberg, as at 30 Dec 2022, based on the Bloomberg Global Aggregate Corporate Index

What can we learn from history?

While Covid and lockdowns caused a contraction in economic activity, the aggressive central bank response reduced the length of the recession but caused widespread market volatility. Although different to a normal downturn and rebound, it effectively means that there was a whole economic cycle compressed into a 12-month period that can be used to see how investors reacted.

As Covid spread in February and March, the theme was a flight-to-quality as investors sold investment grade, high yield and emerging market debt, and bought developed market government bonds. These flows, followed closely by central banks slashing rates and resuming QE, drove government bond yields to rally sharply, while credit spreads widened dramatically.

However, as the market viewed the central bank response positively, investors flooded back to investment grade credit in April. As confidence returned to markets, flows into investment grade continued over the following three months, with demand increasing for high yield.

In the last four months of the year, while investors took some profits on investment grade credit as spreads had largely normalised, they continued to add to high yield and started to switch into emerging markets (EM) – in other words taking on more credit risk as the economy rebounded.

Concerns of an imminent recession caused investors to reduce risk by selling credit and EM and buying government bonds. Once spreads widened to cheap levels, investors started to add credit risk to their portfolio, initially buying investment grade and later high yield and EM.

Outlook for 2023

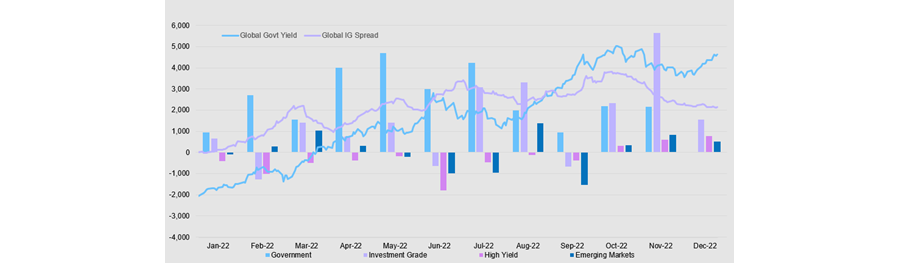

Government bonds – and US Treasuries –dominated fixed income ETF inflows in 2022, mainly due to higher rates pushing yields to their best levels in over a decade. However, it does appear that interest in government bonds is waning and credit is picking up.

The below chart shows flows, yields and spreads as per the last chart. Although yields have continued to rise, flows into government bonds have slowed since July and flows into investment grade credit have picked up.

This has been driven by spreads widening to levels that have only been seen once in the past decade outside of Covid. It is also worth noting that October was the first month of 2022 where there was positive flows into high yield and that continued in November and December, potentially signalling investor appetite to increase credit risk.

2022: Fixed income flows and bond yields

Source: Bloomberg, as at 30 Dec 2022

In addition to spreads having widened from the lows in 2021, the risk-free rate is also at decade-highs, meaning that credit is now offering a yield that provides some protection against downgrade and default risk, which has not been the case for some time.

Even if investors do expect an economic downturn in 2023, current levels of yield available on both investment-grade and high yield look attractive.

While 2020 was an economic cycle on amphetamines with extreme volatility, the 2022-2024 period could look like a more normal cycle with six-to-12 months of strong government bond inflows followed by 12-24 months of investors first favouring investment grade credit, then taking on more risk in high yield segments.

Paul Syms is ETF head of fixed income product management, EMEA, at Invesco. The views expressed above should not be taken as investment advice.