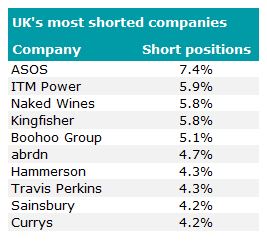

Hedge funds lowered their positions in the UK’s most shorted companies in December for the second month running, according to data from the Financial Conduct Authority.

Online fashion retailer, ASOS remained in the top spot after gaining the highest number of short positions the month prior, but bets against the company dropped by 1.4 percentage points.

Concerns around its profitability remain after revenues slowed post-pandemic, but the current 7.4% of shorted stocks has returned to October levels.

Source: Financial Conduct Authority

ASOS reported a £31.9m loss in its 2022 financial report (118% below 2021 figures) and was the worst performing stock in the FTSE All Share last year, dropping 78.6% over the period.

Things are looking more positive for fellow fashion retailer, Boohoo, as short positions in the company dropped 3.3 percentage points throughout December.

This marks the third consecutive month of declines, with short positions in the company halving to 5.1% from its peak of 10.4% in September.

Net income was down 104.4% in 2022 and its share price fell 64.9% over the past year, but investor sentiment picked up recently and Boohoo became the fifth most bought stock on interactive investor last month.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said that Boohoo offers a more affordable alternative for consumers “trading down and hunting out bargains” in the cost-of-living crisis.

She added: “With shoppers becoming impressively price sensitive as cost-of-living headwinds continue to whip up, retailers are finding it more difficult to pass on increase in input costs.”

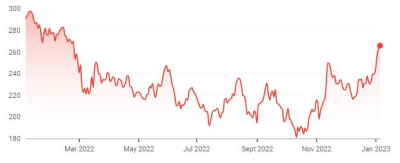

Share price of ASOS and Boohoo over the past year

Source: Google Finance

In December, property developer Hammerson returned to the top 10 most shorted group, but it is in a better position than it was when it dropped out of the shortlist in October.

The amount of shares out on loan against the company fell to 4.3% from 5% two months ago, but the overall decline in short positions among other companies boosted it back into a top 10 spot despite improved sentiment.

Likewise, building materials retailer, Travis Perkins, re-entered the top 10 list with the same number of short positions as it did when it left the month prior.

The share price of Hammerson and Travis Perkins dropped 30.7% and 39% over the past year, but hedge funds have been less inclined to short them in recent months.

Share price of Hammerson and Travis Perkins over the past year

Source: Google Finance

It is a signs of the struggles facing housebuilding sector, with many experts predicting house prices to plummet in 2023 as higher interest rates leads to more costly mortgages, which will make buying new homes unaffordable for many.

Of the companies that did have an increase in short positions last month, home improvement business, Kingfisher had the most sizable hike of 0.7 percentage points.

This modest increase is its first hike since July last year when it was at the top spot with a short position of 9.2%. Shorts in the company have since reduced to 5.8% after its share price gained 4.6% over the past six months.

Total return of Kingfisher over the past six months

Source: Google Finance

Four companies left the top 10 list throughout December after firms reduced their bets, with asset manager, Ashmore Group, having short positions drop the furthest at 2.2 percentage points.

Share price of Ashmore Group over the past year and past month

Source: Google Finance

Its share price dropped 8.4% over the past year, but the tide appeared to be turning by the end of the year and the shares have rebounded 20.7% over the past month.