The highest inflation and tightest monetary policy in decades has left many investors in the red to end 2022 and made those with a nervous disposition turn to ever-more cautious investments.

Although many have speculated that peak inflation is behind us, this challenging environment is still far from over and some investors may want to remain defensive heading into the new year.

Here, Trustnet finds the experts’ top funds for investors who want to be cautious in 2023.

Janus Henderson Strategic Bond

Risk-averse investors would benefit from jumping into fixed income whilst yields are high, according to Rob Morgan, chief investment analyst at Charles Stanley.

He said: “There is good value in many parts of the bond universe presently, and cautious investors have an opportunity to lock in decent rates of return with relatively limited downside.”

His vehicle of choice would be Janus Henderson Strategic Bond, which climbed 28.3% over the past decade, narrowly beating the IA Sterling Strategic Bond sector average by 1.2 percentage points.

Total return of fund vs sector over the past 10 years

-1.png)

Source: FE Analytics

Investment grade corporate bonds appear particularly attractive at the moment, which the fund has a 38.6% exposure to.

Indeed, long standing managers John Pattullo (who has run the fund since launch in 1999) and Jenna Barnard (who joined in 2006) have dedicated 46.9% of the portfolio to corporate bonds overall.

Morgan said: “The flexibility of the fund combined with the depth of resource and experience of the managers affords the chance for good long-term performance in a range of scenarios.”

It had a high exposure to long-dated, high-quality bonds that were sensitive to interest rate hikes this year, which “has been painful until recently,” he added.

However, he said that it could benefit from this allocation now that inflation is on the way down, stating: “While the managers may have been too early in their call, this fund would benefit from global inflation subsiding faster than widely anticipated.”

Artemis Target Return Bond

Investors who don’t expect a rapid decline in inflation and want a higher exposure to short-dated bonds may want to consider the Artemis Target Return Bond fund, according to James Calder, chief investment officer at City Asset Management.

The fund is up 4.8% since launching in 2019, with trailing 1.7 percentage points behind the IA Target Return Bond group average.

Total return of fund vs sector since launch

.png)

Source: FE Analytics

He said that the fund can operate as an alternative to sterling short-dated corporate bonds within an investor’s portfolio.

Nevertheless, investors needn’t sacrifice any exposure to attractively priced corporate bonds, which account for a sizable 87.3% of asset allocations.

Ruffer Diversified Return

Michael Heapy, senior investment analyst at IBOSS, said that while it was “tempting to make a case for a fixed-income fund,” he would have to go for Ruffer Diversified Return as his cautious pick.

He said that most funds, regardless of region, sector or style, have fallen in 2022, so it would be unwise for investors to be overly cautious heading into next year.

“We would argue then that whilst caution is always the tool of a savvy investor, adopting a purely defensive strategy from here could be poorly timed,” Heapy added.

The fund’s broad investment universe is one of its main appeals, allowing managers Duncan MacInnes, Ian Rees and Jasmine Yeo the flexibility to allocate towards the best opportunities.

For example, the fund recently increased its treasury position to take advantage of higher yields.

It still has a high allocation towards fixed income, with the fund’s biggest exposures in index-linked gilts (27%), short-dated bonds (26.8%) and non-UK index-linked assets (13%).

Total return of fund vs sector since launch

-1.png)

Source: FE Analytics

Since launching in September last year, the £1.8bn portfolio was up 5.7% and beat its loss-making peers in the IA Targeted Absolute Return sector by 6.2 percentage points.

Personal Assets Trust

Alternatively, cautious investors may want to consider the Personal Assets Trust to see out volatility in 2023, according to Alena Kosava, head of investment research at AJ Bell.

Its defensive positioning could be ideal for an investor who is nervous about persistent inflation and continued volatility in 2023.

She said: “It tends to do particularly well amid challenging market conditions and souring economic narrative – conditions we’ve been experiencing throughout 2022.”

It has a high exposure towards inflation-resilient assets such as gold bullion, which is the fund’s top individual allocation at 8.9%. Other top holdings include quality companies such as Unilever, Visa and Nestlé, which collectively make up 9.1% of the fund’s assets.

Kosava said: “The trust is effective at providing investors with a multi-asset diversified portfolio and, given the emphasis on capital protection, should sit well with more cautious investors.”

Total return of fund vs sector over the past 10 years

-1.png)

Source: FE Analytics

Jason Hollands, managing director of Bestinvest, also chose the Personal Assets Trust as his cautious portfolio of choice heading into next year.

Its 59.3% return over the past decade wasn’t as high as you could achieve through a growth-orientated equity fund, but it did a good job of preserving investors capital – a quality that is especially important in today’s volatile markets.

Hollands said: “It won’t shoot the lights out in an equity bull market but has historically provided steady returns and proven very defensive in tougher markets.”

Gresham House UK Microcap

With the future of the UK economy looking uncertain, Ben Williams, head of fund research at Saunderson House, recommended that investors add defensive growth exposure to the region.

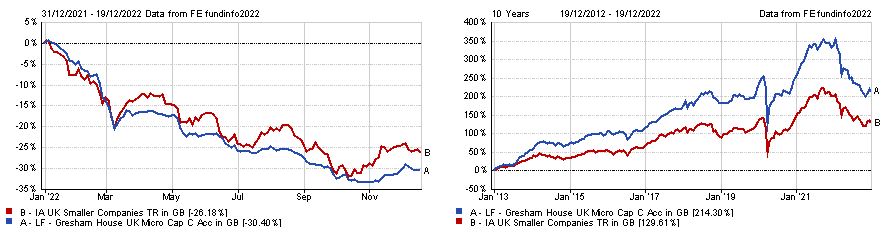

The best way of doing so would be through the Gresham House UK Microcap fund, which climbed 214.3% over the past decade and outperformed it the IA UK Smaller Companies sector by 84.7 percentage points.

Like many smaller companies funds, it dropped significantly in the challenging conditions of 2022, down 30.4% since the start of the year.

Total return of fund vs sector in 2022 and over the past 10 years

Source: FE Analytics

However, Williams said that this decline was largely sentiment driven as markets priced in more recessionary risk from smaller caps than their large-cap counterparts. This could work to the fund’s advantage, with assets in the sector undervalued.

Williams added: “It has proven to be one of the most defensive funds we recommend when markets have a tough day, given the fund manager Ken Wotton typically invests in niche, less cyclical, high-quality businesses with strong balance sheets which hold up well during market stress.”

The fund’s performance is also likely to benefit from a rally in small caps, which Williams anticipated in the second half of next year. Racier than the other picks, however, risk-averse investors may only want to put a small allocation to the asset class.