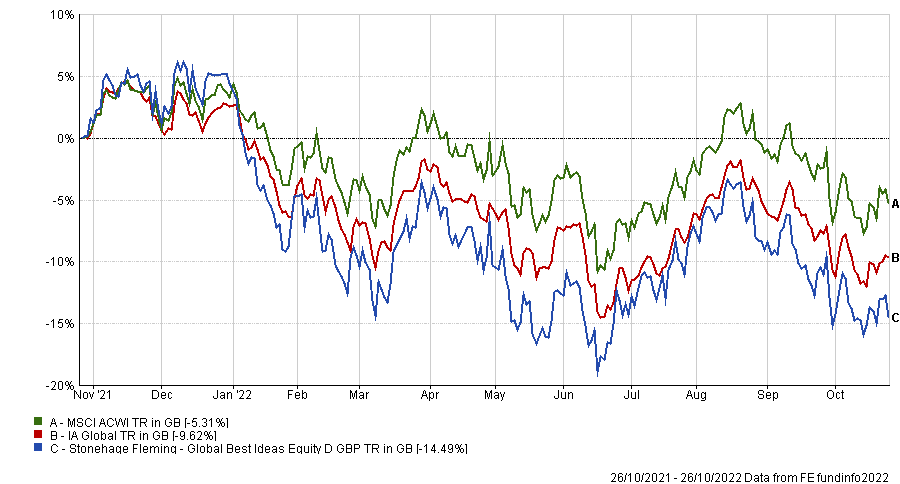

Stonehage Fleming’s $1.8bn Global Best Ideas Equity fund delivered top-quartile performance over the long term but slipped into the third quartile over 12 months as the fund has struggled to cope with an unforgiving macroeconomic picture in which US inflation and interest rates remain on the rise and cause the dollar to strengthen.

According to manager Gerrit Smit, “the currency has become a dampener on the US economy” which has also been a headwind for globally diversified American businesses.

This, in turn, has led to market volatility and a period where “any disappointment with a business’s operational performance gets severely punished, irrespective of its future potential,” he said.

Below, the FE fundinfo Alpha Manager talks about how he has been dealing with inflation, how he manages liquidity and why he would never own an auto manufacturing company.

Performance of fund over 1yr against sector and benchmark

Source: FE Analytics

Can you describe your investment process?

The philosophy is to own the world’s best businesses. We buy companies that have a strategic competitive edge and are attractively valued, with the intention to hold them indefinitely.

To identify them, we use 15 different tests, the sum of which comes down to four very basic issues. Firstly, the conviction we have in their sustainable organic growth. Secondly, we evaluate whether they implement a successful business culture to orientate them to such growth.

Thirdly, we only consider investing in businesses that are already very profitable – mainly global blue-chips. And lastly, we focus on very strong cash generators. In essence, we are looking for businesses that keep generating free cash flow.

This screening has left us with approximately 255 candidates, of which we will only own a maximum of 30.

What differentiates you from competitors?

You can call us quality growth, but at a reasonable price. There's lots of great quality companies out there, but not always at a reasonable price. Sometimes it takes us years before a stock gets to a certain price where to find a good value.

We also have a minimum market cap of $10bn, which differentiates us from other funds and spares us some liquidity challenges. Our liquidity is usually a few days, while other funds tend to have a much longer period, especially if they are investing in small and mid-cap global holdings. A lot of people in the UK retail space have taken money out of funds to cover up their rising bills and mortgages. But we are not worried as we are in a much stronger position than others.

This isn’t to say we don’t own mid-caps. Higher growth includes mega-caps but we also like the mid-cap category a lot, which are often owned by the original founder’s family, who think strategically and are not short-term orientated.

What was the best stock pick of the past years?

Despite the very negative year in terms of macro, some businesses have had an incredible operational performance. Cadence Design Systems is an example.

Performance of stock since purchase

Source: Yahoo! Finance

It is a very topical US business involved in the design of semiconductor chips – designs which are then sold to manufacturers such as Taiwan Semiconductors and Samsung Electronics. While chip manufacturing can be very cyclical, designers aren’t affected by cycles at all, which is why Cadence has done so well this year. We purchased it in December 2020 for $122 a share and is now worth $151, a 24.5% return.

Another stock that is operationally doing incredibly well is LVMH. Our initial purchase price in June 2019 was €357 per share, which are now valued at €658. That’s an 84.3% return.

It is extremely well managed and has succeeded in creating an aspirational factor in the brand, and despite more uncertain economic circumstances, people keep buying the product.

What was the worst stock pick of the past years?

Adobe has disappointed, dropping 41.5% year to date. It’s a good business, but the share is doing badly this year because it announced an acquisition. While Adobe's products are designed for desktops, for physical products, the company that it is acquiring is working online, in the cloud.

The perception is it is overpaying for that company and although it is going to provide more growth, the earnings multiples have just been marked down. We still hold it because there isn’t anything that changed strategically in the business.

Performance of stock since purchase

Source: Yahoo! Finance

Are there any sectors that you will not invest in?

The focus on sustainable organic growth eliminates by implication some sectors, such as commodity producers, mining companies and fossil fuels, as we are quite uncertain about their sustainability.

Other sectors we would avoid are those that are very capital intensive and whose free cash flow doesn’t reach shareholders. Auto manufacturers are the best example. Car models last for a maximum of five years and every time a new one comes out, a lot of money goes into it.

I cannot think of an example of why we would own an auto manufacturer. Even Ferrari, which is different, as it doesn’t think in terms of car models and the vehicles are luxury products with a scarcity value, we wouldn’t own because the share isn’t liquid enough.

How have you been navigating the present environment?

Inflation is a huge problem for companies that run on low operating margins, have high debt or cannot forward costs to their clients. We haven't had to make changes to our portfolio because of such operational issues, but I do think we are going to see huge casualties in all three of those aspects, especially with debt.

We are focused on higher growth companies, which are popular and some of their valuations have become too high, and this, on the backdrop of higher interest rates, has affected their rating and multiples.

We have trimmed for example our consumer expenditure, as consumers are increasingly facing difficulties, but otherwise we haven't felt it necessary to sell out of anything because of inflation.

What do you do outside of fund management?

I really enjoy what I do, but outside work I enjoy music. In fact, I saw Bob Dylan this week.