Index-tracking funds may only be giving investors access to one narrow part of the global market, according to data from Orbis Investments.

Passive funds, which track the performance of a set of stocks within an index, are typically viewed as a simple and cost-efficient way to access a broad range of assets, but index exposures have become heavily weighted towards one small area of the market.

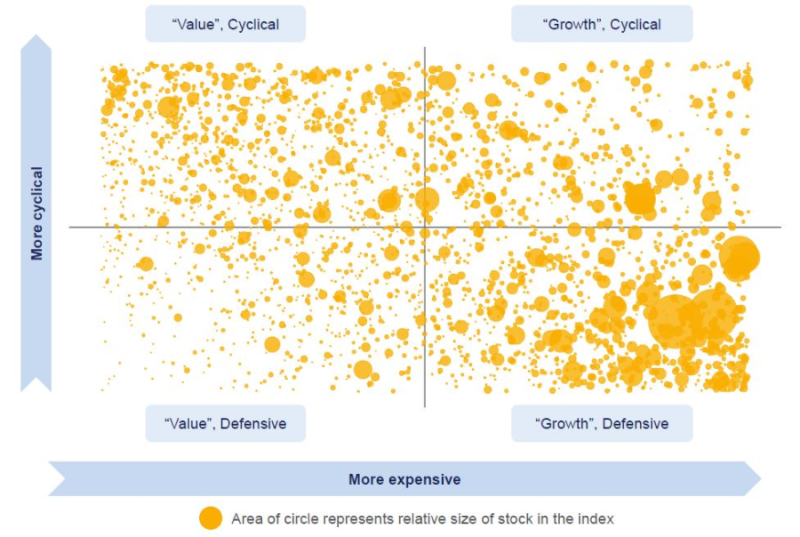

By ranking the market cap weightings of the companies within the FTSE World Index, Orbis found that growth and defensive stocks dominated the market in 2022.

FTSE World Index by market cap in March 2022

Source: Orbis

Orbis manager Dan Brocklebank warned that investors have become used to buying the index as the largest stocks have driven the market for the past decade, but this might not be the optimal approach.

He said: “If you want some specific exposure, the simplest approach is to just buy a tracker fund – it’s low cost and you just get the average. It’s a very simple approach.

“What I worry about is that passive is seen as this passive, no-brainer decision – all you have to do is buy the index and get the best companies – but if you do that today, you’re buying the index at a time when it’s massively skewed into one part of the market.”

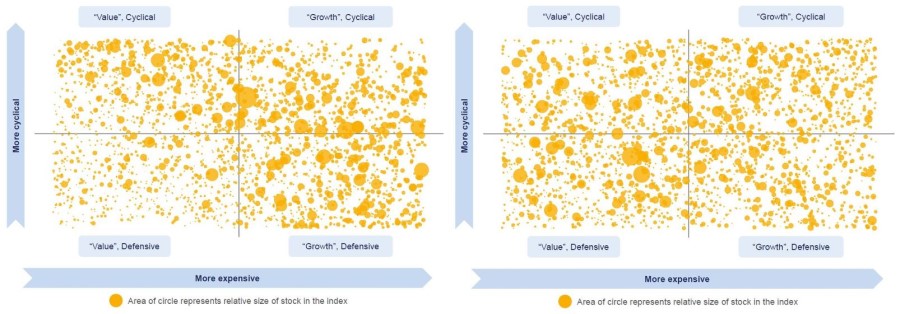

With growth stocks leading in terms of performance for much of the past decade, investors may assume that index weightings have always been very biased towards defensive growth, but Brocklebank pointed out that that is not the case.

Looking back over the past five to 10 years, the FTSE World Index was far more evenly distributed across different asset types and the move towards a defensive growth overweight was fairly recent.

FTSE World Index by market cap in 2017 and 2007

Source: Orbis

The concern here is that investors could be misled into buying a passive fund under the impression that it offers diversification and security, which is no longer the case, according to Brocklebank.

Although passives are cheaper, investors could get a broader spread of exposures and better value for money with a more expensive fund that is actively managed.

Brocklebank said: “You could see a situation here where you’re lowering your costs, but in turn, the prospects for your future returns are very low. There’s much better value in the market elsewhere in my opinion.”

However, James McManus, chief investment officer at Nutmeg, said tracker funds are still a solid way of gaining exposure to the market’s best companies, even with the large overweight.

The index FTSE World Index has naturally leant more towards defensive growth as that’s what has led the market over the past decade and investors who held a tracker over the period would have benefitted from keeping pace with those trends, according to McManus.

“This isn’t a flaw of the index, it’s a strength and it shouldn’t concern investors provided they have a portfolio that’s suitable for their needs,” he said.

“The point of investing with an index tracker is to capture the returns of the market, with a diversified fund that changes automatically to keep with the times, so it’s right that the FTSE World index has changed over time to reflect the high-growth, defensive companies that power the market.”