PGIM has reiterated its view that cryptocurrencies are unsuitable for retail and institutional investment portfolios, after a surge of global asset managers into the sector over the past month.

A recent article in The Financial Times noted BlackRock recently announced plans for a Bitcoin trust. This news came shortly after it said it would link its Aladdin technology platform to the Coinbase crypto exchange, allowing 82,000 investment professionals to offer these assets to their clients.

Schroders’ and abrdn’s clients will also be able to access cryptocurrencies after the groups bought significant stakes in digital asset firms this summer. Meanwhile, Charles Schwab launched a synthetic crypto ETF earlier this month.

Yet PGIM, which has more than $1.4trn of assets under management, warned that the involvement of investment behemoths does not lend cryptocurrency any legitimacy, saying it viewed them as nothing more than speculative assets.

Shehriyar Antia, head of thematic research at the group, said: “To include any asset class in our client portfolios, we need to be convinced of three factors: a clear regulatory framework, an effective store of value, and a predictable correlation with other asset classes. Cryptocurrency does not meet one of these three criteria currently.”

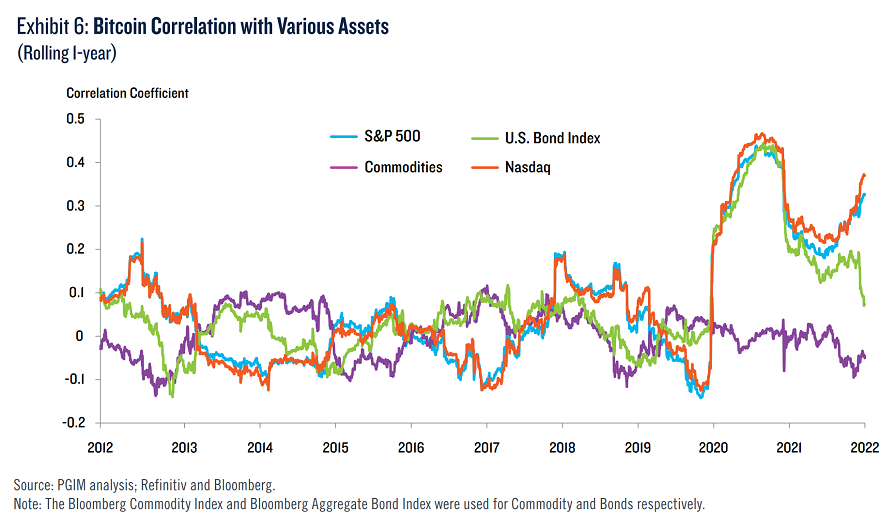

Cryptocurrency proponents claim that the low correlation with other asset classes is one of its main attributes – along with its role as an inflation hedge.

However, PGIM released a paper earlier this year titled “Cryptocurrency Investing” which debunked these claims.

Using Bitcoin as a proxy for the asset class, it said that while the cryptocurrency had a near-zero average correlation with broad US equities and commodities between 2013 and 2019, this changed in 2020 and the relationship has remained consistently positive ever since.

“Even the International Monetary Fund has noted ‘increased and sizable co-movement and spillovers between crypto and equity markets indicate a growing interconnectedness’ that is a growing source of systemic risk,” said the paper.

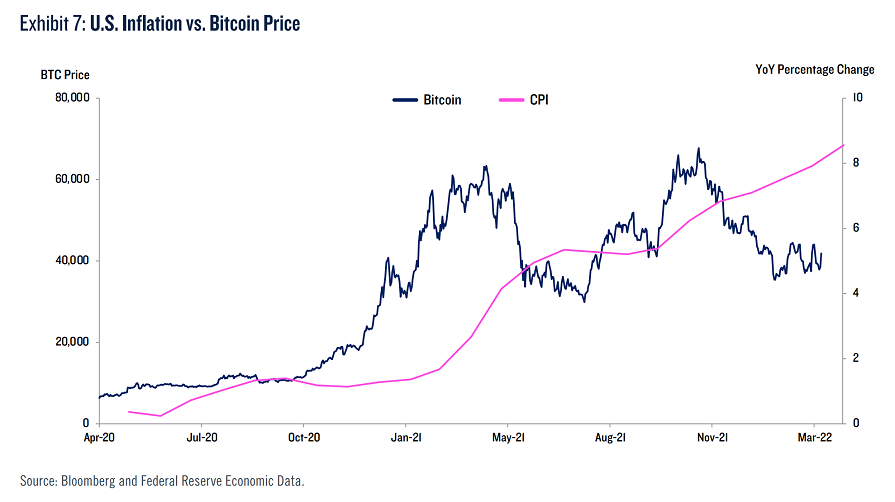

On the second point, the paper accepted that Bitcoin is scarce, with its supply limited to 21 million coins. This constraint may suggest its value, much like gold, may be resistant to fiat monetary debasement or price inflation. However, the paper said there was scant evidence to support this thesis.

“In the lone episode of elevated US inflation since the introduction of cryptocurrencies, Bitcoin provided only limited inflation protection. US prices were whipsawed during the pandemic and inflation began to soar steadily in 2021 and into 2022. The price of Bitcoin moved with inflation only for a brief time before falling sharply.

“Gold, on the other hand, has demonstrated since the 1970s that it can be a reasonably effective and reliable long-term inflation hedge.”

The paper agreed that some features of cryptocurrency markets, especially the wild price gyrations, provided opportunities for active trading.

In particular, it said hedge fund strategies could exploit inefficiencies and dislocations that arise in such “immature, retail- and momentum-driven markets”.

“Dislocations in the nascent cryptocurrency market draw comparisons to other less efficient frontier markets,” the paper explained.

“For example, futures contracts for some cryptocurrencies are not standardised and their prices do not always align with spot markets across exchanges, creating arbitrage opportunities that quant hedge funds have been successfully exploiting.

“In addition, the extraordinary volatility of cryptocurrencies presents a wide range to trade in. Liquidity and leverage can be unreliable and scarce in cryptocurrency markets. Such a backdrop provides return potential for market players who have the capability of providing leverage or liquidity to the market when it is needed most.”

Yet it warned that in the long term, while a few cryptocurrencies would endure on the fringes of the monetary system, they wouldn’t replace fiat currencies.

“Functionally, cryptocurrencies are unable to meet the basic prerequisites of either a currency or a precious-metal substitute – shortcomings exacerbated by the powerful headwinds from increasing regulatory scrutiny and the growing likelihood of central bank digital currencies, which provide almost all the functional benefits of fiat-linked cryptocurrencies, but with no liquidity or credit risk.”

Antia finished by saying that while cryptocurrencies represented “a heroic quest to build a viable, decentralised peer-to-peer payment system”, their pricing is based on speculative behaviour rather than a fundamental thesis around value or utility.

“The unsettled regulatory backdrop and the significant ESG concerns – not just around climate but also around governance – pose additional headwinds for long-term investors and further demonstrates why we see no reason for cryptocurrencies to be a part of institutional portfolios,” he added.