Commodity and energy assets are on the brink of a sharp downturn, according to Felix Wintle, manager of the Tyndall North American fund, who has cut his exposure to energy from 20.7% all the way down to zero last week after oil prices began to decline.

Oil represents the canary in the coalmine however, with the manager expecting the rest of the bucket of commodities to follow.

“That is quite quick to get out of a big position, but for us, it's green light or red light. You either want to own it or you really don't want to own it,” he said. “I think other people that do own energy will probably own it for too long because it's such a tricky sector to get right.”

Oil prices have leapt over the past year and in particular more recently as countries cut ties with Russia followings its invasion of Ukraine. The country is a substantial exporter of oil and created a sizable gap in demand, with the S&P GSCI Brent Crude Spot index up 66.4% in the past 12 months.

Although it’s one of the few areas that is thriving in a declining global market, prices dropped 11% over the past month. This may be a short time frame, but Wintle said that “once it goes wrong, it tends to do so quickly”.

While some may think that the disappearance of 7.8 million oil barrels that used to be exported from Russia every day prior to its invasion of Ukraine should make western countries much more reliant on oil companies, bolstering their share prices, this is not necessarily the case.

Indeed, while it may prove lucrative for oil company profits in the short term, it also puts oil providers under much more pressure in the long run, according to Wintle.

They will be required to prop up the energy market as renewables are not yet able to pick up the slack, yet after years of underspending on new projects, these companies may not be able to plug the gap either.

Investors have a hand in this mess, the Tyndall North American fund manager said, as the rises of sustainable investing has reduce the available capital to oil giants and hamstrung their development.

Wintle said: “The whole ESG [environmental, social and governance] thing has crippled the industry”.

This production struggle could well play a significant part in the share price downturn that he predicts in the sector.

Any sign of share price weakness may therefore reflect that investors are starting to project through the short-term gains and into this long-term problem, something that Wintle noticed last month.

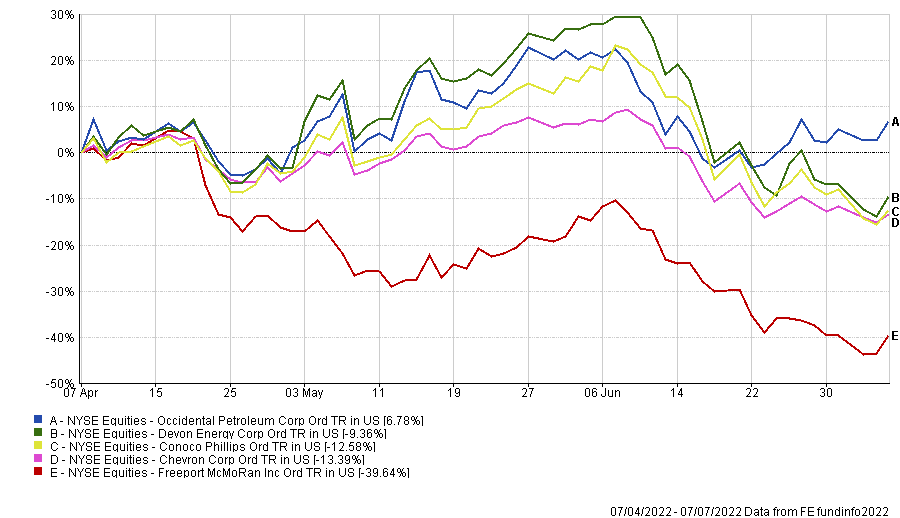

Of the fund’s five main oil holdings, all but one declined in share price over the past three months, signifying the start of a commodities drawdown, he said.

Share price of oil stocks over the past three months

Source: FE Analytics

One that stands out the most is Freeport McMoRan. Wintle bought the company back in the summer of 2020 when the first signs of inflation appeared on his radar and it climbed 156.6% in share price between July 2020 and July 2022.

Even though it grew sharply over this relatively small period, the share price has dropped almost 40% within the past three months.

Many other commodities and energy companies have performed well off the back of high inflation and heightened demand, but this period of steep rises will correct itself with sharp declines if Wintle is correct.

Looking at the IA Commodities and Natural Resources sector as a barometer, it is notoriously choppy, with the third highest volatility of all other IA sectors over the past 10 years.

It was also in the bottom quartile for having the worst downside risk, maximum drawdown and maximum loss over the same period, meaning investors in the sector saw steep rises and falls to their holdings.

Wintle said: “When we have energy exposure, we keep it on a very short leash because it's never really a buy and hold sector.

“With commodity-related assets, you always want to buy them when they're going up because they're bullish, then they’re bearish and if you catch them at the right point then you're doing quite well.”