Today marks three years since the FTSE 100 and MSCI World indices tanked following the announcement of the UK’s first lockdown, and market conditions have shifted substantially since.

Investors face a very different environment now than they did at the start of 2020 and some companies have fared better than others in navigating this new financial world.

Here, Trustnet looks at which companies have thrived since the outbreak of Covid, and which have struggled in an abnormally volatile market.

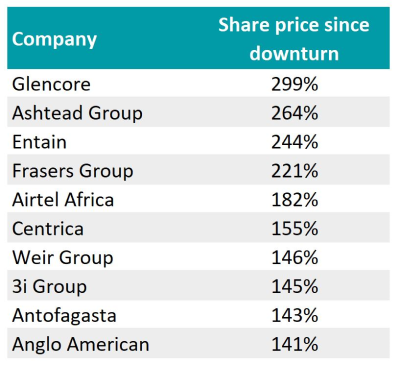

Best performing FTSE 100 companies since March 2020 low

Source: AJ Bell

Mining company Glencore was the best performing stock in the UK index thanks to surging commodity prices.

Global supply chain bottlenecks caused by lockdowns put many materials high in demand, which was exacerbated by the cutting off of supply chains from Russia last year.

Although material scarcity has eased, Glencore’s share price is up 299% since the crash of March 2020 and other mining companies have also prospered in the past three years.

Weir Group, Antofagasta and Anglo American are also among the best performing UK companies since the Covid outbreak, with their share prices climbing 146%, 143% and 141% respectively.

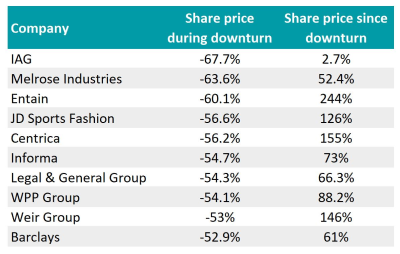

Share price of companies over the past three years

Source: FE Analytics

Energy service company and owner of British Gas, Centrica, was also among the best performers with shares soaring 155% since the downturn.

However, it was also one of the worst hit companies during the initial sell off in March 2020, with shares in the company dropping 56.2% in the downturn.

Other winners such as Weir Group and Entain were also among the worst hit during the covid downturn but came out on top over the long run.

Worst hit FTSE 100 companies in the Covid sell off

Source: AJ Bell

Laith Khalaf, head of investment analysis at AJ Bell, said: “Unsurprisingly, some of the biggest winners since the market nadir in the depths of Covid have been from the cyclical sectors that fared very poorly in the initial pandemic sell-off.

“The amount of elasticity in a share price is in part determined by the lengths it is stretched to, and in the Covid sell off share prices fell so sharply there was clearly a lot of potential energy stored within them for a rebound.”

Many of the biggest losers during the Covid sell off have recovered their share price to pre-pandemic levels, while some are still in the red three years on.

Airline company IAG is up 2.7% over the past three years following a 67.7% drop in March 2020, leaving it 65% worse off since the Covid outbreak.

Goods manufacturer Melrose Industries also has yet to recover fully from the initial Covid sell off. Its share price dropped 63.6% in the downturn and has risen a lesser 52.4% since.

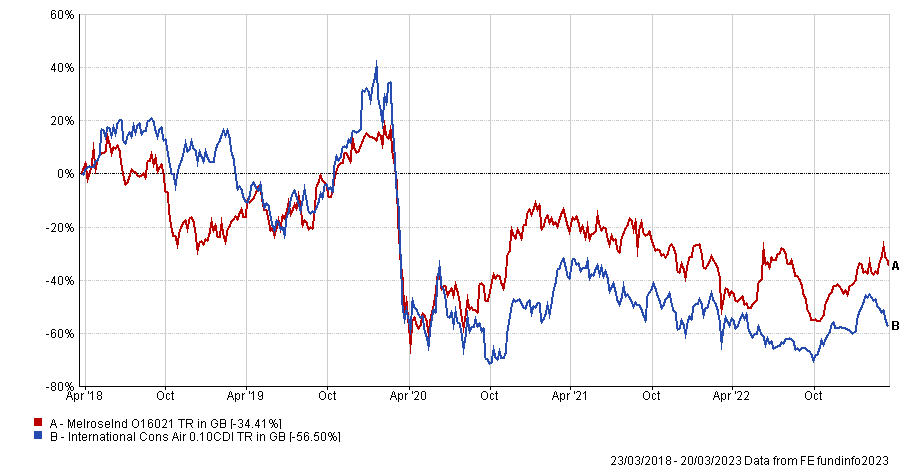

Share price of companies over the past five years

Source: FE Analytics

Khalaf said: “IAG in particular has had a torrid time as continued lockdowns crushed demand, only for the company to see that followed by a spike in fuel prices and high levels of inflation putting pressure on consumer and business purses.”

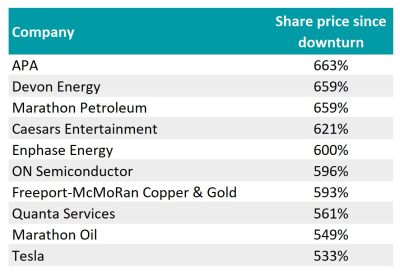

Commodities companies also topped the US market, with the likes of APA, Devon Energy and Marathon Petroleum beating the rest of the S&P 500 index.

Shares in APA were up 663% since Covid struck markets, with those in Devon Energy and Marathon Petroleum each climbing 659%.

Best performing S&P 500 companies since March 2020 low

Source: AJ Bell

Oil, mining and energy company dominated the US market in the three years since covid, but Khalaf said that he was surprised to see a technology company make it into the top 10.

Electric car manufacturer Tesla was the 10th best performing company in the S&P 500 over the period, with shares in the company rising 533%.

Many of its peers in the technology sector have been especially vulnerable to the rising inflation and monetary tightening of recent years, but Tesla still made it out on top.

Khalaf said: “It’s notable that Tesla makes an appearance, despite seeing more than a 50% share price fall since November 2021, which tells you just how much it rocketed in share price during the pandemic.”

Elon Musk’s $620bn business has suffered from the same pressures as other tech companies more recently, with shares dropping 40.4% in the past year, but the rally in investment throughout 2020 and 2021 – which saw the share price soar by over 1000% – offset this decline over the long term.

Share price of Tesla over the past five years

Source: Google Finance

Travel companies in the US have also had a hard time since Covid, with multiple lockdowns and restricted movement putting a dampener on demand.

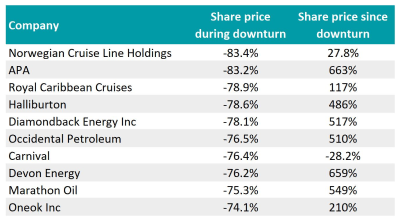

Norwegian Cruise Line, Royal Caribbean Cruises and Carnival were among the worst hit US stocks during the Covid sell off and their recovery has been slower than the commodities companies that also sunk in the drawdown.

Norwegian Cruise Line was the worst hit overall, with shares dropping 83.4% in the downturn, and its 27.8% recovery over the past three years has not been enough to reach pre-Covid levels.

Worst hit S&P 500 companies in the Covid sell off

Source: AJ Bell

However, Carnival has shrunk even further from its March 2020 low, down 28.2% over the past three years in addition to the 76.4% drop it has in the Covid sell off.

Khalaf said: “While the US travel sector is still licking its wounds, it’s notable that the energy companies have mostly made a full recovery, thanks in part to the global economic recovery, but also to the energy crisis we have witnessed over the last year.”